Taxes Illinois 2022-2026

What is the 2015 Illinois Power of Attorney?

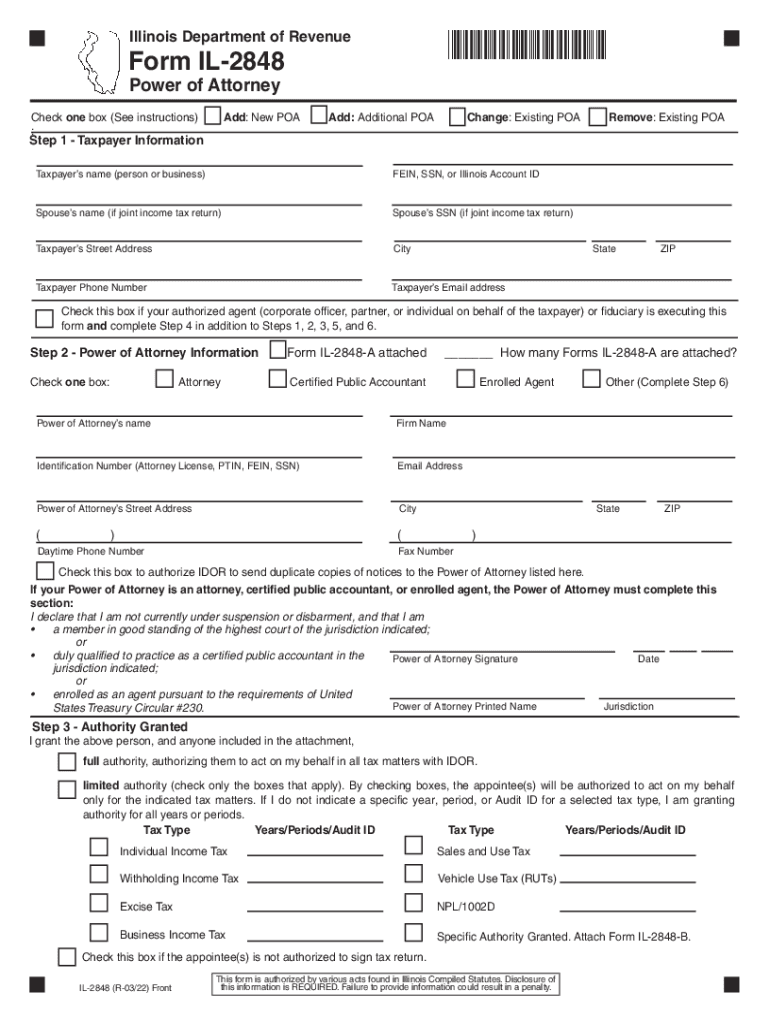

The 2015 Illinois Power of Attorney (POA) is a legal document that allows an individual, known as the principal, to designate another person, called the agent or attorney-in-fact, to make decisions on their behalf. This document is crucial for managing financial, legal, and health-related matters when the principal is unable to do so themselves. The Illinois Power of Attorney is governed by state law, ensuring that it meets specific legal standards to be considered valid and enforceable.

Key elements of the 2015 Illinois Power of Attorney

Several key elements must be included in a valid Illinois Power of Attorney. These elements include:

- Principal's Information: Full name and address of the individual granting authority.

- Agent's Information: Full name and address of the appointed agent.

- Scope of Authority: A clear description of the powers granted to the agent, which can include financial decisions, property management, and healthcare decisions.

- Signatures: The document must be signed by the principal, and it may require witnesses or notarization to enhance its validity.

Steps to complete the 2015 Illinois Power of Attorney

Completing the 2015 Illinois Power of Attorney involves several steps to ensure that the document is legally binding. These steps include:

- Download the Form: Obtain the official Illinois Power of Attorney form from a reliable source.

- Fill Out the Form: Provide all required information, including details about the principal and agent, and specify the powers granted.

- Sign the Document: The principal must sign the form in the presence of a notary public or witnesses, as required by Illinois law.

- Distribute Copies: Provide copies of the signed document to the agent and any relevant institutions or parties.

Legal use of the 2015 Illinois Power of Attorney

The 2015 Illinois Power of Attorney is legally binding when executed according to state regulations. It is essential to ensure that the document complies with the Illinois Power of Attorney Act to avoid any disputes or challenges regarding its validity. The agent must act in the best interest of the principal and adhere to the powers granted within the document.

Form Submission Methods for the 2015 Illinois Power of Attorney

Once the 2015 Illinois Power of Attorney is completed and signed, it can be submitted in several ways:

- Online: Some institutions may allow the submission of electronic copies of the POA.

- Mail: Send a physical copy to relevant parties, such as banks or healthcare providers.

- In-Person: Present the document directly to institutions that require it for verification.

Examples of using the 2015 Illinois Power of Attorney

The 2015 Illinois Power of Attorney can be utilized in various scenarios, including:

- Financial Management: The agent can handle banking transactions, pay bills, and manage investments on behalf of the principal.

- Healthcare Decisions: If the principal becomes incapacitated, the agent can make medical decisions based on the principal's wishes.

- Real Estate Transactions: The agent can buy, sell, or manage real estate properties in the principal's name.

Quick guide on how to complete taxes illinois

Execute Taxes Illinois effortlessly on any device

Online document administration has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely archive it online. airSlate SignNow equips you with all the features necessary to create, edit, and eSign your documents quickly without hindrances. Manage Taxes Illinois on any device with airSlate SignNow Android or iOS applications and streamline any document-driven process today.

The easiest way to modify and eSign Taxes Illinois without effort

- Find Taxes Illinois and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as an old-fashioned wet ink signature.

- Review the details and click on the Done button to secure your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to the frustration of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Taxes Illinois and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxes illinois

Create this form in 5 minutes!

People also ask

-

What is an IL power of attorney template?

An IL power of attorney template is a legal document that allows you to appoint someone to make decisions on your behalf in Illinois. This template simplifies the process of establishing your preferences regarding medical, financial, and legal matters. With airSlate SignNow, you can easily customize this template to suit your needs.

-

How can I create an IL power of attorney template using airSlate SignNow?

Creating an IL power of attorney template with airSlate SignNow is straightforward. Simply select the template option, follow the guided steps to input relevant information, and utilize our intuitive editing tools to customize your document. Once completed, you can save it securely or send it for signatures.

-

Is there a cost associated with using the IL power of attorney template?

airSlate SignNow offers a range of pricing plans to accommodate varying needs, including a free trial. The cost associated with using the IL power of attorney template includes the benefits of our platform, such as secure document storage and electronic signatures. Explore our pricing options to find the best fit for your requirements.

-

What features does the IL power of attorney template offer?

The IL power of attorney template on airSlate SignNow includes features such as easy customization, electronic signing, and secure document storage. You can also collaborate with others in real time and track the status of your document. These features enhance the user experience and streamline the process.

-

What are the benefits of using an IL power of attorney template?

Using an IL power of attorney template saves time and ensures that all legal requirements are met for appointing an agent. With airSlate SignNow, you gain access to a user-friendly interface, allowing for quick modifications and immediate electronic signing. This efficiency can provide peace of mind in managing your important decisions.

-

Can I integrate the IL power of attorney template with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications. This includes CRM systems, document management tools, and cloud storage services. By integrating your IL power of attorney template, you enhance your workflow and ensure that your documents are easily accessible.

-

Is the IL power of attorney template legally binding?

Yes, the IL power of attorney template provided by airSlate SignNow is legally binding when executed properly. This includes having the document signed by the principal and signNowd, if required by Illinois law. Ensure you follow all legal guidelines to guarantee the validity of your document.

Get more for Taxes Illinois

- Aging parent package hawaii form

- Sale of a business package hawaii form

- Legal documents for the guardian of a minor package hawaii form

- New state resident package hawaii form

- Hawaii statutory form

- Commercial property sales package hawaii form

- Revocation of advance health care directive four parts hawaii form

- General partnership package hawaii form

Find out other Taxes Illinois

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document