Missouri Department of Revenue My Tax Portal 2022

Understanding the Missouri Department of Revenue My Tax Portal

The Missouri Department of Revenue My Tax Portal is a centralized online platform designed to streamline tax-related processes for residents and businesses in Missouri. It allows users to access various services, including filing tax returns, checking the status of their applications, and making payments. This portal is especially useful for individuals who want to manage their tax obligations efficiently from the comfort of their own homes.

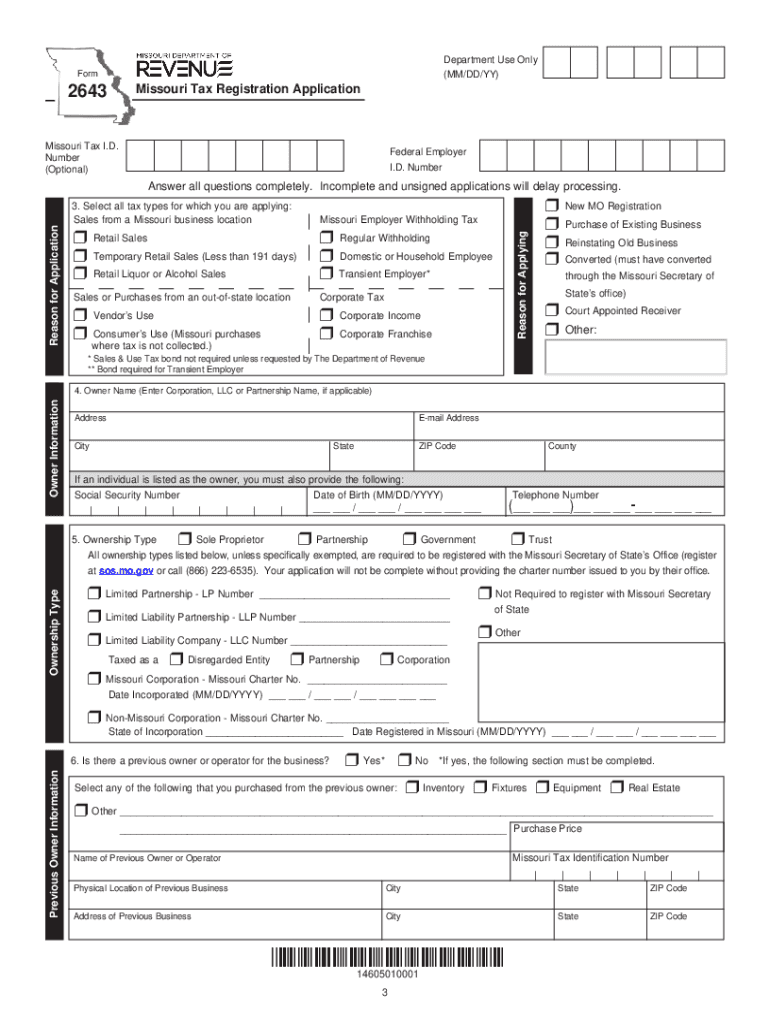

Steps to Complete the 2643 Form Online

Completing the 2643 form online through the Missouri Department of Revenue My Tax Portal is a straightforward process. Follow these steps for a smooth experience:

- Log in to the My Tax Portal using your credentials or create an account if you are a new user.

- Select the option to fill out the 2643 form from the available forms list.

- Carefully enter the required information, ensuring accuracy to avoid delays.

- Review your entries for any errors before submitting the form.

- Submit the form electronically and save a copy for your records.

Legal Use of the 2643 Form

The 2643 form is legally binding when completed and submitted according to the regulations set forth by the Missouri Department of Revenue. To ensure its validity, users must comply with all relevant laws, including eSignature regulations. Utilizing a trusted platform like signNow can help maintain compliance and provide an electronic certificate, confirming the legitimacy of the submission.

Required Documents for the 2643 Registration

When filling out the 2643 registration, certain documents may be necessary to support your application. Commonly required documents include:

- Identification proof, such as a driver's license or state ID.

- Previous tax returns or financial statements, if applicable.

- Any relevant business documentation for entities applying on behalf of a business.

Having these documents ready can facilitate a smoother application process.

Form Submission Methods

The 2643 form can be submitted through multiple methods, providing flexibility for users. The primary submission methods include:

- Online submission via the Missouri Department of Revenue My Tax Portal.

- Mailing a printed version of the form to the appropriate department.

- In-person submission at designated revenue offices.

Choosing the online method is often the most efficient, allowing for immediate processing and confirmation.

Penalties for Non-Compliance

Failing to submit the 2643 form or submitting it incorrectly can result in penalties. These may include fines, interest on unpaid taxes, or delays in processing your application. It is crucial to adhere to filing deadlines and ensure all information is accurate to avoid these repercussions.

Quick guide on how to complete missouri department of revenue my tax portal

Complete Missouri Department Of Revenue My Tax Portal effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Missouri Department Of Revenue My Tax Portal on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Missouri Department Of Revenue My Tax Portal with ease

- Locate Missouri Department Of Revenue My Tax Portal and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Mark pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to missing or lost documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from your chosen device. Modify and eSign Missouri Department Of Revenue My Tax Portal and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct missouri department of revenue my tax portal

Create this form in 5 minutes!

People also ask

-

What is the 2643 form create process in airSlate SignNow?

The 2643 form create process in airSlate SignNow allows users to design and customize their documents easily. This user-friendly feature helps streamline the process of creating forms that meet specific business needs. With airSlate SignNow, users can quickly drag and drop fields to ensure their 2643 forms are perfectly tailored for any transaction.

-

How much does it cost to use the 2643 form create feature?

The 2643 form create feature is included in airSlate SignNow's competitive pricing plans, which cater to various business needs. Users can choose from different subscription tiers, ensuring there is a suitable option for every budget. With this feature, businesses can save on traditional document management costs while enjoying the flexibility of electronic signature capabilities.

-

What are the key features of the 2643 form create functionality?

The 2643 form create functionality includes drag-and-drop design tools, reusable templates, and integration with popular document formats. Additionally, it allows for real-time collaboration among team members, ensuring inputs are efficiently gathered. This robust feature set ensures your 2643 forms are not only professional but also compliant with legal standards.

-

How can the 2643 form create feature benefit my business?

The 2643 form create feature enhances efficiency by automating the document creation process, saving valuable time and resources. By utilizing this tool, businesses can reduce errors and improve turnaround times for important documents. It streamlines workflows and ensures that every 2643 form aligns with industry standards, enhancing overall productivity.

-

Can I integrate the 2643 form create functionality with other tools?

Yes, the 2643 form create function seamlessly integrates with various applications like CRM systems, cloud storage, and payment processors. This capability enhances your document workflows and helps keep all your business tools synchronized. By integrating with other tools, you can manage your 2643 forms and related data more effectively.

-

Is the 2643 form create feature user-friendly for non-technical users?

Absolutely! The 2643 form create feature in airSlate SignNow is designed for users with all levels of technical expertise. With its intuitive interface and helpful tutorials, even non-technical users can create, customize, and send forms effortlessly. This ease of use ensures that businesses can adopt the tool without extensive training.

-

What types of documents can I create using the 2643 form create feature?

The 2643 form create feature can be used to create a variety of documents, including contracts, agreements, and compliance forms. This versatility means you can tailor your documents to suit different business scenarios and industries. With airSlate SignNow, the possibilities for creating effective and professional 2643 forms are nearly limitless.

Get more for Missouri Department Of Revenue My Tax Portal

- Revocation of premarital or prenuptial agreement new jersey form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children based on grounds of form

- Nj dissolution marriage form

- Nj no fault divorce form

- New jersey marriage form

- New jersey corporation 497319074 form

- New jersey pre incorporation agreement shareholders agreement and confidentiality agreement new jersey form

- Bylaws 497319076 form

Find out other Missouri Department Of Revenue My Tax Portal

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe