2643 Applicaition for Registration 2025-2026

Understanding the Missouri Tax Registration Application

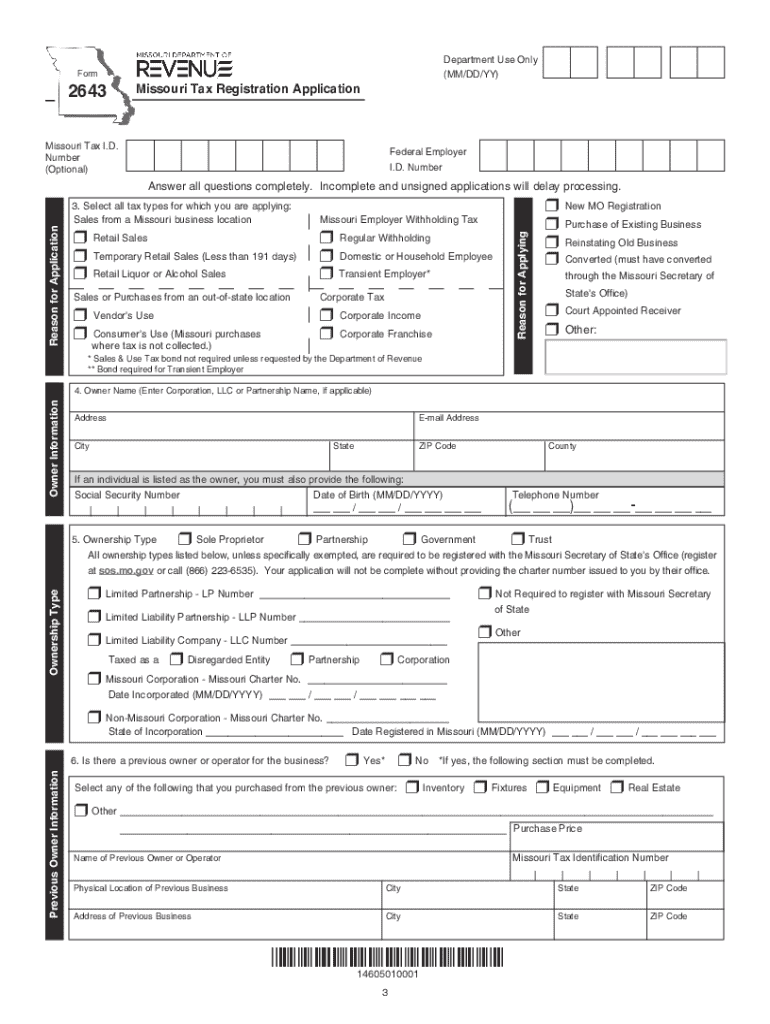

The Missouri Tax Registration Application, also known as Form 2643, is essential for businesses operating in Missouri. This application serves as a formal request to register for various state taxes. It is crucial for ensuring compliance with state tax laws and regulations. Completing this form accurately helps businesses avoid potential penalties and ensures they can collect and remit the appropriate taxes. The application is necessary for various business entities, including sole proprietorships, partnerships, corporations, and limited liability companies (LLCs).

Steps to Complete the Missouri Tax Registration Application

Filling out the Missouri Tax Registration Application involves several key steps:

- Gather necessary information, including your business name, address, and federal Employer Identification Number (EIN).

- Identify the specific taxes for which you are registering, such as sales tax, withholding tax, or corporate income tax.

- Complete the application form, ensuring all sections are filled out accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed application either online or by mail, depending on your preference.

Required Documents for the Missouri Tax Registration Application

When submitting the Missouri Tax Registration Application, certain documents may be required to support your application. These typically include:

- Your federal Employer Identification Number (EIN) or Social Security Number (SSN) if applicable.

- Business formation documents, such as articles of incorporation or partnership agreements.

- Identification for the business owner or authorized representative.

- Any additional documentation specific to the type of tax for which you are registering.

Form Submission Methods for the Missouri Tax Registration Application

Businesses can submit the Missouri Tax Registration Application through various methods. The options include:

- Online Submission: The application can be completed and submitted electronically through the Missouri Department of Revenue's website.

- Mail Submission: You can print the completed form and send it via postal mail to the appropriate address listed on the form.

- In-Person Submission: Businesses may also choose to deliver the application in person at their local Department of Revenue office.

Eligibility Criteria for the Missouri Tax Registration Application

To be eligible to submit the Missouri Tax Registration Application, businesses must meet certain criteria. These include:

- Operating a business or engaging in activities that require tax registration in Missouri.

- Having a physical presence in the state, such as a storefront or office.

- Complying with local, state, and federal regulations applicable to your business type.

Application Process and Approval Time for the Missouri Tax Registration Application

The application process for the Missouri Tax Registration Application typically involves the following:

- Submission of the completed application form along with any required documents.

- Review of the application by the Missouri Department of Revenue.

- Approval time may vary, but businesses can generally expect a response within a few weeks. Delays may occur if additional information is needed.

Create this form in 5 minutes or less

Find and fill out the correct 2643 applicaition for registration

Create this form in 5 minutes!

How to create an eSignature for the 2643 applicaition for registration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri tax registration application process?

The Missouri tax registration application process involves completing the necessary forms to register your business for state taxes. This can be done online through the Missouri Department of Revenue's website. airSlate SignNow simplifies this process by allowing you to eSign and send your application securely and efficiently.

-

How much does the Missouri tax registration application cost?

The cost of the Missouri tax registration application can vary depending on your business type and the specific taxes you need to register for. However, using airSlate SignNow can help reduce costs associated with printing and mailing documents, making it a cost-effective solution for your registration needs.

-

What features does airSlate SignNow offer for the Missouri tax registration application?

airSlate SignNow offers features such as eSigning, document templates, and secure cloud storage, which are essential for completing your Missouri tax registration application. These features streamline the process, ensuring that your application is completed accurately and submitted on time.

-

How can airSlate SignNow benefit my Missouri tax registration application?

Using airSlate SignNow for your Missouri tax registration application can save you time and reduce errors. The platform allows for easy collaboration with team members and ensures that all documents are securely signed and stored, making the registration process smoother and more efficient.

-

Can I integrate airSlate SignNow with other software for my Missouri tax registration application?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow for the Missouri tax registration application. This allows you to connect with accounting software, CRM systems, and more, ensuring a seamless experience from document creation to submission.

-

Is airSlate SignNow secure for handling my Missouri tax registration application?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Missouri tax registration application and all related documents are protected. The platform uses advanced encryption and secure storage solutions to keep your sensitive information safe.

-

How long does it take to complete the Missouri tax registration application with airSlate SignNow?

The time it takes to complete the Missouri tax registration application using airSlate SignNow can vary based on your preparedness and the complexity of your application. However, with our user-friendly interface and eSigning capabilities, many users find they can complete their applications much faster than traditional methods.

Get more for 2643 Applicaition For Registration

Find out other 2643 Applicaition For Registration

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation