Instrucciones Para El Formulario 940 PR Internal Revenue Service 2022

Understanding the 2020 Instrucciones 941PR

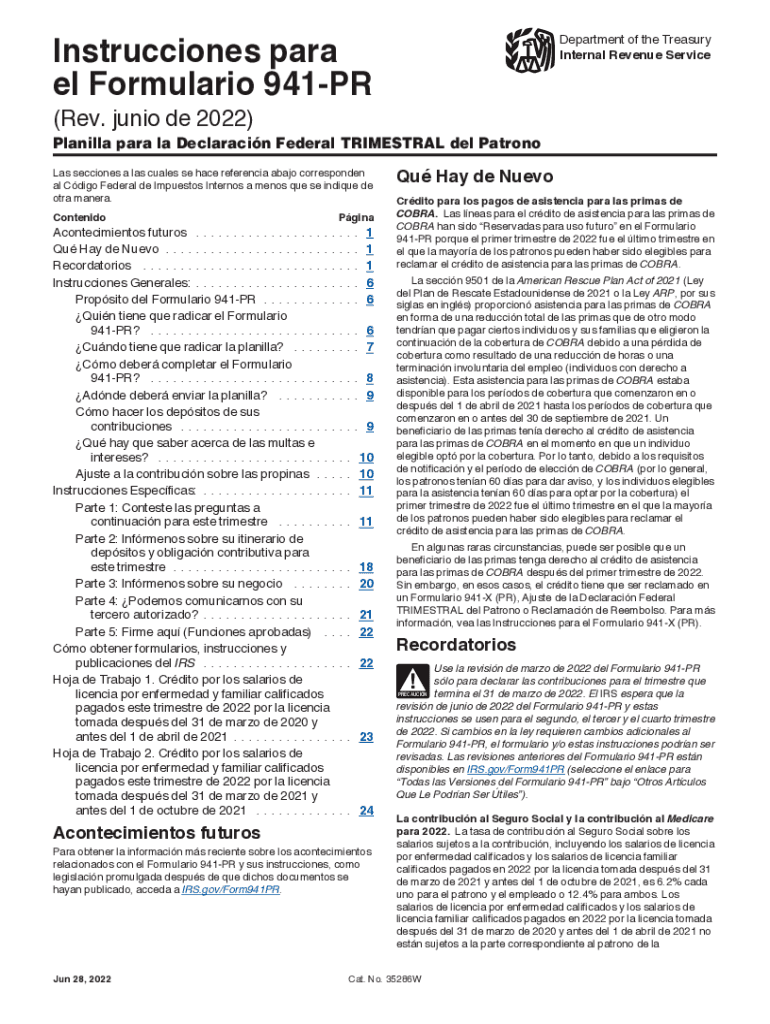

The 2020 Instrucciones 941PR provides essential guidance for employers in Puerto Rico regarding the quarterly federal tax return. This form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It is crucial for employers to accurately complete this form to ensure compliance with federal tax regulations. The instructions detail the necessary information that must be included, such as the number of employees, total wages paid, and the amounts withheld for federal taxes.

Steps to Complete the 2020 Instrucciones 941PR

Completing the 2020 Instrucciones 941PR involves several key steps:

- Gather all relevant payroll information for the quarter, including total wages and taxes withheld.

- Fill out the form accurately, ensuring that all required fields are completed.

- Double-check calculations for accuracy, particularly for tax amounts withheld.

- Sign and date the form to certify that the information provided is correct.

- Submit the completed form by the specified deadline to avoid penalties.

Legal Use of the 2020 Instrucciones 941PR

The 2020 Instrucciones 941PR is legally binding when completed and filed according to IRS regulations. Employers must adhere to the guidelines set forth in the instructions to ensure that their submissions are accepted. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is important to maintain accurate records and documentation to support the information reported on the form.

Filing Deadlines for the 2020 Instrucciones 941PR

Employers must be aware of the filing deadlines for the 2020 Instrucciones 941PR to avoid late penalties. The form is typically due on the last day of the month following the end of each quarter. For example, the deadlines for the 2020 tax year are:

- First Quarter: April 30, 2020

- Second Quarter: July 31, 2020

- Third Quarter: October 31, 2020

- Fourth Quarter: January 31, 2021

Required Documents for the 2020 Instrucciones 941PR

To complete the 2020 Instrucciones 941PR, employers need to gather specific documents, including:

- Payroll records detailing employee wages and hours worked.

- Records of taxes withheld from employee paychecks.

- Any previous quarterly tax returns for reference.

Form Submission Methods for the 2020 Instrucciones 941PR

The 2020 Instrucciones 941PR can be submitted in various ways to ensure compliance with IRS requirements. Employers can choose to file online through the IRS e-file system, which is a secure and efficient method. Alternatively, the form can be mailed to the appropriate IRS address based on the employer's location. In-person submission is also an option at designated IRS offices.

Quick guide on how to complete instrucciones para el formulario 940 pr 2021internal revenue service

Prepare Instrucciones Para El Formulario 940 PR Internal Revenue Service seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Instrucciones Para El Formulario 940 PR Internal Revenue Service on any platform with airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign Instrucciones Para El Formulario 940 PR Internal Revenue Service effortlessly

- Obtain Instrucciones Para El Formulario 940 PR Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive data with features that airSlate SignNow gives specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Instrucciones Para El Formulario 940 PR Internal Revenue Service and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instrucciones para el formulario 940 pr 2021internal revenue service

Create this form in 5 minutes!

People also ask

-

What are the 2020 instrucciones 941pr and why are they important?

The 2020 instrucciones 941pr provide detailed guidance on how to fill out Form 941-PR for employers in Puerto Rico. They outline essential tax requirements and deadlines, making them vital for compliance. Understanding these instructions helps ensure accurate reporting and reduces the risk of penalties.

-

How can airSlate SignNow assist with the 2020 instrucciones 941pr?

airSlate SignNow simplifies the process of completing your 2020 instrucciones 941pr by providing an intuitive eSigning platform. Users can easily fill out, sign, and send their documents electronically. This streamlines the workflow, ensuring that you meet all necessary deadlines without hassle.

-

What features does airSlate SignNow offer for handling the 2020 instrucciones 941pr?

With airSlate SignNow, you get features like customizable templates, real-time tracking, and secure cloud storage for your 2020 instrucciones 941pr. These capabilities allow for efficient document management and ensure your important tax filings are organized and accessible at all times.

-

Is airSlate SignNow cost-effective for managing the 2020 instrucciones 941pr?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our cost-effective solution allows you to manage your 2020 instrucciones 941pr without incurring high administrative costs. You can choose a plan that fits your budget and needs.

-

Can I integrate airSlate SignNow with other software for the 2020 instrucciones 941pr?

Absolutely! airSlate SignNow seamlessly integrates with various software applications to enhance your workflow related to the 2020 instrucciones 941pr. This means you can sync with your existing tools for payroll, accounting, and document management effectively.

-

What are the benefits of using airSlate SignNow for the 2020 instrucciones 941pr?

Using airSlate SignNow for the 2020 instrucciones 941pr offers numerous benefits, including increased efficiency, reduced paperwork, and secure storage. Our platform enhances collaboration among team members, ensuring that all aspects of document handling are smooth and reliable.

-

Is it easy to use airSlate SignNow for first-time users dealing with the 2020 instrucciones 941pr?

Yes, airSlate SignNow is designed with user-friendliness in mind. Even if you are new to eSigning and handling the 2020 instrucciones 941pr, our platform provides easy-to-follow instructions and supportive resources. You'll be up and running in no time!

Get more for Instrucciones Para El Formulario 940 PR Internal Revenue Service

- Nj subcontractor form

- Notice of unpaid balance and right to file lien mechanic liens individual new jersey form

- Quitclaim deed by two individuals to llc new jersey form

- Warranty deed from two individuals to llc new jersey form

- Notice of unpaid balance and right to file lien mechanic liens corporation or llc new jersey form

- Nj file lien form

- Llc limited liability company 497319168 form

- Nj certificate form

Find out other Instrucciones Para El Formulario 940 PR Internal Revenue Service

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe