Form 2210 Underpayment of Estimated Tax by Individuals

What is the Form 2210 Underpayment Of Estimated Tax By Individuals

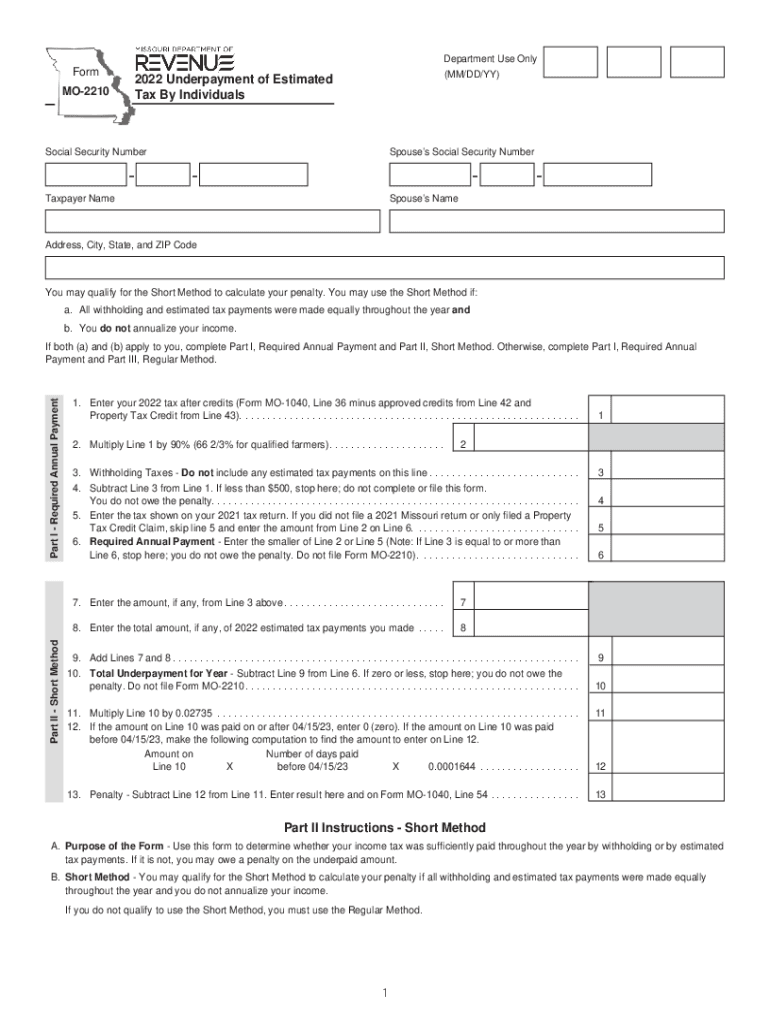

The Missouri MO2210 form is used by individuals to calculate and report any underpayment of estimated tax. This form is essential for taxpayers who may not have paid enough tax throughout the year, either through withholding or estimated payments. The purpose of the form is to determine if an individual owes a penalty for underpayment and to calculate the amount owed. Understanding this form is crucial for ensuring compliance with state tax laws and avoiding unnecessary penalties.

How to use the Form 2210 Underpayment Of Estimated Tax By Individuals

Using the Missouri MO2210 form involves several steps. First, gather your financial information, including total income, tax withheld, and previous estimated payments. Next, follow the instructions on the form to calculate your total tax liability and determine if you have underpaid. If underpayment is identified, the form guides you through calculating the penalty based on the amount owed and the time period of underpayment. It is important to ensure accuracy in your calculations to avoid further issues with the Missouri Department of Revenue.

Steps to complete the Form 2210 Underpayment Of Estimated Tax By Individuals

Completing the Missouri MO2210 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including income statements and previous tax returns.

- Complete the income section to report your total income for the year.

- Calculate your total tax liability using the appropriate tax rates.

- Document any tax withheld and estimated payments made throughout the year.

- Determine if your total payments are less than the required amount.

- If underpayment is identified, calculate the penalty using the provided tables and instructions.

- Review the form for accuracy before submission.

Legal use of the Form 2210 Underpayment Of Estimated Tax By Individuals

The Missouri MO2210 form is legally binding when completed accurately and submitted to the Missouri Department of Revenue. It is important to ensure that all information provided is truthful and reflects your actual financial situation. Filing this form correctly can prevent potential legal issues, including penalties for underreporting income or underpayment of taxes. Compliance with state tax laws is essential for maintaining good standing as a taxpayer.

Filing Deadlines / Important Dates

Timely filing of the Missouri MO2210 form is crucial to avoid penalties. The deadline for submitting this form typically aligns with the annual tax return filing deadline, which is usually April 15. If you are unable to meet this deadline, you may be eligible for an extension, but it is important to check specific state guidelines for any changes or additional requirements. Keeping track of these dates can help ensure compliance and avoid unnecessary penalties.

Penalties for Non-Compliance

Failing to file the Missouri MO2210 form or underreporting your estimated tax can result in significant penalties. The Missouri Department of Revenue may impose fines based on the amount of underpayment and the duration of the underpayment period. Additionally, interest may accrue on any unpaid taxes. Understanding these penalties can motivate timely and accurate filing, helping to maintain compliance with state tax regulations.

Quick guide on how to complete form 2210 2022 underpayment of estimated tax by individuals

Complete Form 2210 Underpayment Of Estimated Tax By Individuals easily on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers a great eco-friendly substitute for conventional printed and signed papers, enabling you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Manage Form 2210 Underpayment Of Estimated Tax By Individuals across any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The simplest way to modify and eSign Form 2210 Underpayment Of Estimated Tax By Individuals with ease

- Locate Form 2210 Underpayment Of Estimated Tax By Individuals and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 2210 Underpayment Of Estimated Tax By Individuals and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Missouri MO2210 tax form?

The Missouri MO2210 tax form is used to calculate underpayment penalties for state income tax when not enough tax is withheld throughout the year. Understanding your obligations can help ensure accurate tax submissions. Utilizing airSlate SignNow simplifies the signing process for this critical document.

-

How can airSlate SignNow help with completing the Missouri MO2210 tax form?

airSlate SignNow allows you to easily fill out, sign, and send the Missouri MO2210 tax form electronically. Our platform streamlines this process, ensuring compliance and security for your sensitive information. You can access your documents anytime and from anywhere.

-

Is there a cost associated with filing the Missouri MO2210 tax using airSlate SignNow?

Yes, airSlate SignNow operates on a subscription model, offering various plans to meet the needs of individuals and businesses. The pricing is competitive, especially considering the time saved in managing tax documents like the Missouri MO2210 tax form. Evaluate our plans to find one that best fits your needs.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as document templates, electronic signatures, and real-time tracking for tax documents like the Missouri MO2210 tax form. Our platform enhances collaboration and ensures that all parties can easily manage and review documents. Plus, secure cloud storage keeps your sensitive tax information safe.

-

Can I integrate airSlate SignNow with other financial software for managing the Missouri MO2210 tax?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and financial software, making it easier to manage your Missouri MO2210 tax documents. This integration ensures that all relevant financial information is readily accessible, simplifying the tax filing process.

-

What are the benefits of using airSlate SignNow for the Missouri MO2210 tax form?

Using airSlate SignNow for your Missouri MO2210 tax form streamlines the entire process, from signing to submission. You benefit from reduced paperwork and improved efficiency while ensuring compliance with state tax regulations. Our user-friendly platform helps you focus more on your business and less on administrative tasks.

-

How secure is the information shared via airSlate SignNow when dealing with the Missouri MO2210 tax?

Security is a top priority at airSlate SignNow. When handling sensitive information associated with the Missouri MO2210 tax form, we use advanced encryption and secure protocols to protect your data. Trust us to keep your tax documents confidential and secure during the entire signing process.

Get more for Form 2210 Underpayment Of Estimated Tax By Individuals

- Mutual wills or last will and testaments for unmarried persons living together with minor children new jersey form

- Nj cohabitation form

- Paternity law and procedure handbook new jersey form

- Bill of sale in connection with sale of business by individual or corporate seller new jersey form

- Nj complaint divorce form

- Nj divorce form

- Office lease agreement new jersey form

- New jersey domestic form

Find out other Form 2210 Underpayment Of Estimated Tax By Individuals

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word