Ct 706 Nt Form

What is the Ct 706 Nt Form

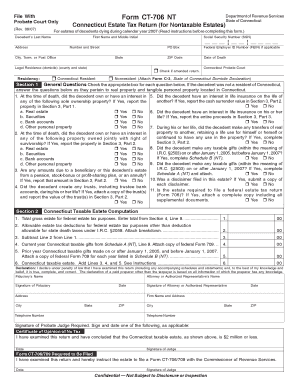

The Ct 706 Nt Form is a specific tax form used in the state of Connecticut. It is primarily utilized for estate tax purposes, allowing executors or administrators to report the value of an estate to the state. This form is essential for determining the estate tax liability based on the total value of the deceased's assets at the time of death. Understanding the purpose and requirements of the Ct 706 Nt Form is crucial for compliance with state tax laws.

How to use the Ct 706 Nt Form

Using the Ct 706 Nt Form involves several steps to ensure accurate reporting of estate values. First, gather all necessary financial documents, including property appraisals, bank statements, and investment valuations. Next, complete the form by entering the required information, such as the decedent's details and the total value of the estate. After filling out the form, review it for accuracy before submitting it to the Connecticut Department of Revenue Services. Utilizing digital tools can streamline this process, making it easier to fill out and submit the form.

Steps to complete the Ct 706 Nt Form

Completing the Ct 706 Nt Form requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant documentation regarding the estate's assets.

- Fill in the decedent's name, date of death, and other identifying information.

- List all assets, including real estate, bank accounts, and personal property, along with their fair market values.

- Calculate any debts or liabilities that may affect the estate's value.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate state agency, either online or by mail.

Legal use of the Ct 706 Nt Form

The Ct 706 Nt Form must be used in accordance with Connecticut tax laws. It serves as a legal document that reports the estate's value and is subject to review by state authorities. Accurate completion of the form is essential to avoid potential penalties or legal issues. Additionally, the form must be submitted within the specified time frame to ensure compliance with state regulations regarding estate taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 706 Nt Form are critical for compliance. Typically, the form must be filed within six months of the decedent's date of death. Extensions may be available under certain circumstances, but it is essential to request these extensions before the original deadline. Staying informed about important dates can help prevent late fees and ensure that the estate is settled in a timely manner.

Required Documents

When preparing to complete the Ct 706 Nt Form, several documents are necessary to provide accurate information. Required documents include:

- Death certificate of the decedent.

- Appraisals of real estate and personal property.

- Bank statements and investment account statements.

- Records of any debts or liabilities associated with the estate.

Having these documents readily available will facilitate the completion of the form and ensure compliance with state requirements.

Quick guide on how to complete ct 706 nt form

Effortlessly Prepare Ct 706 Nt Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Handle Ct 706 Nt Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The Easiest Way to Edit and Electronically Sign Ct 706 Nt Form Without Stress

- Find Ct 706 Nt Form and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred delivery method for the form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device. Edit and electronically sign Ct 706 Nt Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 706 nt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ct 706 Nt Form?

The Ct 706 Nt Form is a tax document filed in Connecticut for estate tax purposes. It serves as a declaration of the estate's total value and is essential for proper tax compliance. Understanding how to complete the Ct 706 Nt Form is crucial for executors managing estates.

-

How can airSlate SignNow help with the Ct 706 Nt Form?

airSlate SignNow offers an easy-to-use platform that allows users to effortlessly eSign and send the Ct 706 Nt Form. This not only speeds up the submission process but also ensures that all documents are securely stored and easily accessible. Utilizing airSlate SignNow for the Ct 706 Nt Form helps streamline your estate management tasks.

-

Is airSlate SignNow cost-effective for managing the Ct 706 Nt Form?

Yes, airSlate SignNow provides a cost-effective solution for managing the Ct 706 Nt Form compared to traditional methods. Our pricing plans are designed to meet the needs of various business sizes, ensuring affordability without compromising on features. By choosing airSlate SignNow, you can save both time and money on document management.

-

What features does airSlate SignNow offer for the Ct 706 Nt Form?

airSlate SignNow includes robust features such as customizable templates, secure storage, and real-time tracking for the Ct 706 Nt Form. Additionally, our platform supports electronic signatures, which makes it quick and simple to finalize important documents. These features work together to enhance efficiency for estate management.

-

Can I integrate airSlate SignNow with other tools for the Ct 706 Nt Form?

Absolutely! airSlate SignNow easily integrates with various tools and software, making it perfect for handling the Ct 706 Nt Form alongside your existing workflows. Integrations with CRM systems and cloud storage solutions ensure seamless document management. This flexibility makes it a great choice for professionals managing estate documentation.

-

What are the benefits of using airSlate SignNow for the Ct 706 Nt Form?

Using airSlate SignNow for the Ct 706 Nt Form provides numerous benefits, including improved efficiency, secure document handling, and easy accessibility. The streamlined signing process reduces turnaround time and ensures you meet deadlines. Furthermore, security features guarantee that your important documents remain private and protected.

-

Is it easy to learn how to use airSlate SignNow for the Ct 706 Nt Form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy to learn how to use it for the Ct 706 Nt Form. Our intuitive interface and helpful resources ensure that users can quickly get started without requiring extensive training. You'll be able to navigate and utilize the platform with confidence in no time.

Get more for Ct 706 Nt Form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair texas form

- Texas letter notice form

- Texas repair form

- Letter with demand 497327485 form

- Texas landlord notice form

- Letter landlord demand template form

- Texas letter demand form

- Tx criminal records form

Find out other Ct 706 Nt Form

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter