1120 REIT U S Income Tax Return for Real EstateAbout Form 1120 REIT, U S Income Tax Return for Real Estate Investm1120 REIT U S

Understanding the 1120 REIT U.S. Income Tax Return for Real Estate

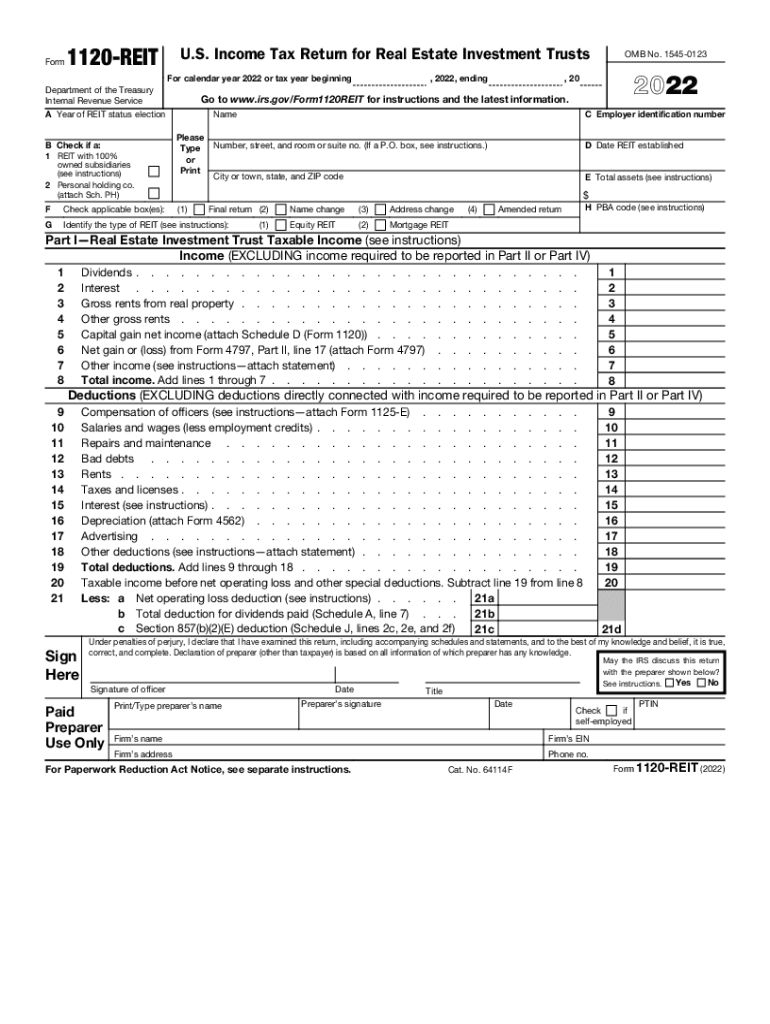

The 1120 REIT form is a crucial document for real estate investment trusts (REITs) operating in the United States. This form is designed to report the income, deductions, gains, losses, and tax liability of a REIT. It is essential for compliance with IRS regulations and ensures that the REIT is taxed appropriately. The form must be filed annually, and it plays a significant role in maintaining the tax-exempt status of the REIT, provided certain conditions are met.

Steps to Complete the 1120 REIT U.S. Income Tax Return

Filling out the 1120 REIT form involves several key steps. First, gather all necessary financial records, including income statements and balance sheets. Next, accurately report the REIT's income and expenses, ensuring that all figures are supported by documentation. After completing the form, review it for accuracy before submission. It is also advisable to keep a copy for your records. The form can be submitted electronically or via mail, depending on your preference and the requirements of the IRS.

Key Elements of the 1120 REIT U.S. Income Tax Return

Several critical components must be included in the 1120 REIT form. These include:

- Income Reporting: All sources of income, including rental income and dividends, must be reported.

- Deductions: Eligible deductions, such as operating expenses and depreciation, should be clearly outlined.

- Tax Liability: The form calculates the tax liability based on the reported income and deductions.

- Signature: The form must be signed by an authorized individual, confirming the accuracy of the information provided.

IRS Guidelines for Filing the 1120 REIT

The IRS provides specific guidelines for filing the 1120 REIT form. It is essential to adhere to these guidelines to avoid penalties. Key points include:

- Filing deadlines must be strictly observed, typically the fifteenth day of the fourth month following the end of the tax year.

- Ensure that all information is accurate and complete to prevent delays or rejections.

- Be aware of any changes to tax laws that may affect the reporting requirements for REITs.

Penalties for Non-Compliance with the 1120 REIT Requirements

Failure to comply with the filing requirements of the 1120 REIT can result in significant penalties. These may include:

- Monetary fines for late filings or inaccuracies.

- Loss of tax-exempt status if the REIT does not meet the necessary criteria.

- Increased scrutiny from the IRS, leading to potential audits.

Obtaining the 1120 REIT U.S. Income Tax Return

The 1120 REIT form can be obtained from the IRS website or through tax preparation software that supports this form. It is available in a fillable PDF format, making it easy to complete electronically. Additionally, tax professionals can assist in obtaining and filing the form correctly.

Quick guide on how to complete 1120 reit us income tax return for real estateabout form 1120 reit us income tax return for real estate investm1120 reit us

Complete 1120 REIT U S Income Tax Return For Real EstateAbout Form 1120 REIT, U S Income Tax Return For Real Estate Investm1120 REIT U S seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow offers all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage 1120 REIT U S Income Tax Return For Real EstateAbout Form 1120 REIT, U S Income Tax Return For Real Estate Investm1120 REIT U S on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign 1120 REIT U S Income Tax Return For Real EstateAbout Form 1120 REIT, U S Income Tax Return For Real Estate Investm1120 REIT U S effortlessly

- Locate 1120 REIT U S Income Tax Return For Real EstateAbout Form 1120 REIT, U S Income Tax Return For Real Estate Investm1120 REIT U S and click on Get Form to begin.

- Use the tools we provide to finalize your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 1120 REIT U S Income Tax Return For Real EstateAbout Form 1120 REIT, U S Income Tax Return For Real Estate Investm1120 REIT U S and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 1120 reit estate and how does it relate to airSlate SignNow?

The 1120 reit estate tax form is crucial for real estate investment trusts. airSlate SignNow simplifies the signing process for these documents, ensuring that all stakeholders can sign and manage their 1120 reit estate paperwork efficiently and securely.

-

How can airSlate SignNow help with the 1120 reit estate document signing process?

With airSlate SignNow, users can easily send and eSign their 1120 reit estate documents from any device. The platform offers a seamless user experience that accelerates document completion while ensuring compliance and security.

-

What are the pricing options for using airSlate SignNow with 1120 reit estate documentation?

airSlate SignNow offers competitive pricing plans that can suit different business needs, including those dealing with 1120 reit estate documents. You can choose from monthly or annual subscriptions that provide cost-effective solutions for businesses of all sizes.

-

Does airSlate SignNow provide templates for 1120 reit estate forms?

Yes, airSlate SignNow offers customizable templates for 1120 reit estate forms to streamline your document management. These templates help speed up the process by ensuring consistency and compliance with existing regulations.

-

What are the benefits of using airSlate SignNow for 1120 reit estate transactions?

Using airSlate SignNow for 1120 reit estate transactions saves time, reduces errors, and enhances security. The platform’s user-friendly interface allows stakeholders to focus on their core business operations while efficiently managing important documents.

-

Can airSlate SignNow integrate with other tools for managing 1120 reit estate workflows?

Absolutely! airSlate SignNow integrates with various popular tools, enabling you to streamline your 1120 reit estate workflows. These integrations enhance productivity and ensure a smooth transition between document management tasks and other business operations.

-

Is airSlate SignNow compliant with regulations relevant to 1120 reit estate documentation?

Yes, airSlate SignNow is compliant with all relevant regulations governing eSignatures and document management, including those pertaining to 1120 reit estate documentation. This compliance ensures that your signed documents are legally binding and secure.

Get more for 1120 REIT U S Income Tax Return For Real EstateAbout Form 1120 REIT, U S Income Tax Return For Real Estate Investm1120 REIT U S

Find out other 1120 REIT U S Income Tax Return For Real EstateAbout Form 1120 REIT, U S Income Tax Return For Real Estate Investm1120 REIT U S

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple