Attach One or More Forms 8283 to Your Tax IRS Tax FormsAbout Form 8283, Noncash Charitable ContributionsAttach One or More Forms

Understanding IRS Form 8283 for 2022

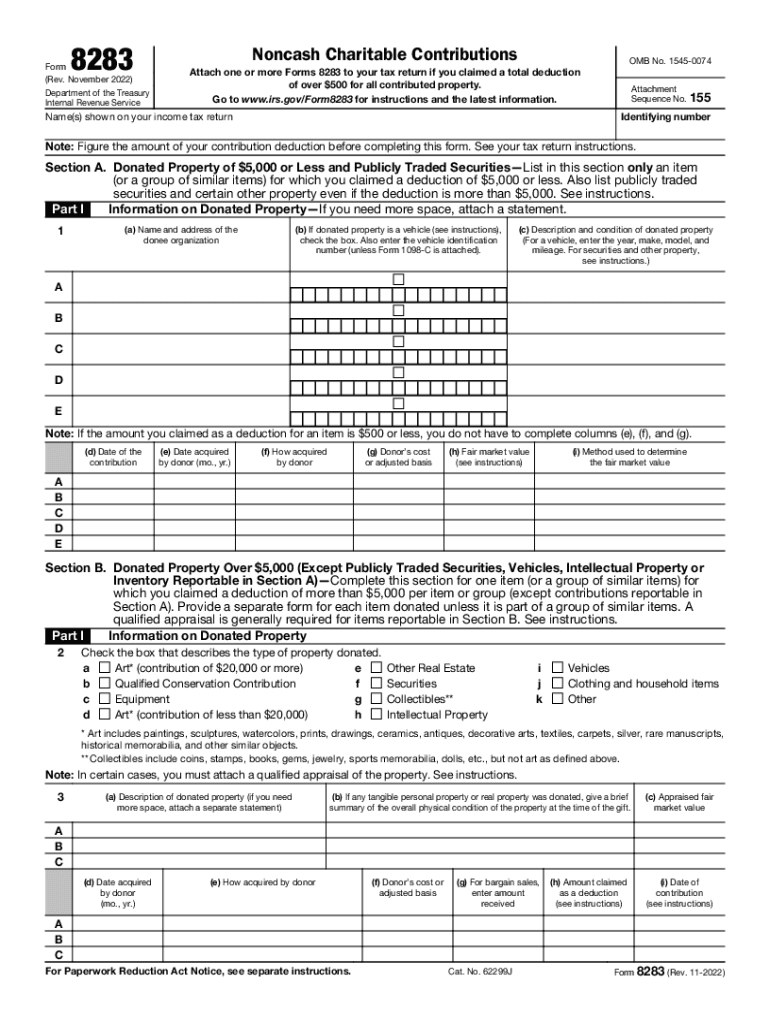

IRS Form 8283 is essential for reporting noncash charitable contributions. Taxpayers must use this form to claim deductions for items donated to qualified charitable organizations. It is crucial for individuals who have contributed items valued over $500, as it provides the IRS with detailed information about the donations. This form ensures that taxpayers comply with IRS regulations while maximizing their potential tax benefits.

Steps to Complete IRS Form 8283

Completing IRS Form 8283 involves several key steps:

- Gather documentation for your noncash contributions, including receipts and appraisals if necessary.

- Fill out Part A of the form if your total contributions are less than $5,000.

- For contributions exceeding $5,000, complete Part B, which requires additional information and a qualified appraisal.

- Ensure that you sign and date the form, as well as obtain signatures from the charity receiving the donation.

- Attach Form 8283 to your Form 1040 when filing your tax return.

Legal Use of IRS Form 8283

The legal use of IRS Form 8283 is governed by IRS guidelines, which stipulate that taxpayers must accurately report their noncash contributions to avoid penalties. The form must be filled out completely and truthfully, as any discrepancies can lead to audits or disallowed deductions. It is important to retain all supporting documents, as the IRS may request them to verify the contributions claimed.

Filing Deadlines for IRS Form 8283

Taxpayers should be aware of the filing deadlines associated with IRS Form 8283. Typically, the form must be submitted along with your annual tax return by April 15 of the following year. If you file for an extension, the deadline may be extended to October 15, but Form 8283 must still be included with your return. Timely submission is crucial to ensure that your charitable contributions are considered for tax deductions.

Required Documents for IRS Form 8283

To complete IRS Form 8283, certain documents are necessary:

- Receipts from the charitable organization for any items donated.

- An appraisal report for contributions valued over $5,000.

- Documentation supporting the fair market value of the donated items.

- Any additional forms or schedules required by the IRS for your specific tax situation.

Examples of Using IRS Form 8283

IRS Form 8283 can be utilized in various scenarios, such as:

- Donating a vehicle to a nonprofit organization, requiring an appraisal if valued over $5,000.

- Contributing artwork or collectibles, necessitating detailed descriptions and valuations.

- Making significant donations of clothing or household items, where receipts are essential for deductions.

Quick guide on how to complete attach one or more forms 8283 to your tax irs tax formsabout form 8283 noncash charitable contributionsattach one or more forms

Prepare Attach One Or More Forms 8283 To Your Tax IRS Tax FormsAbout Form 8283, Noncash Charitable ContributionsAttach One Or More Forms seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage Attach One Or More Forms 8283 To Your Tax IRS Tax FormsAbout Form 8283, Noncash Charitable ContributionsAttach One Or More Forms on any device with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to edit and eSign Attach One Or More Forms 8283 To Your Tax IRS Tax FormsAbout Form 8283, Noncash Charitable ContributionsAttach One Or More Forms effortlessly

- Obtain Attach One Or More Forms 8283 To Your Tax IRS Tax FormsAbout Form 8283, Noncash Charitable ContributionsAttach One Or More Forms and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device of your choosing. Modify and eSign Attach One Or More Forms 8283 To Your Tax IRS Tax FormsAbout Form 8283, Noncash Charitable ContributionsAttach One Or More Forms and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is IRS Form 8283 for 2022?

IRS Form 8283 for 2022 is used by taxpayers to report noncash charitable contributions. This form is essential for ensuring that you can deduct the full value of your charitable donations on your tax return. Accurate documentation is critical, and incorporating eSignature solutions can streamline this process.

-

How can airSlate SignNow help with IRS Form 8283 for 2022?

airSlate SignNow simplifies the process of completing and submitting IRS Form 8283 for 2022 by allowing users to fill out and eSign documents electronically. This ensures that all signatures are authentic and that forms are submitted promptly. Using our platform can enhance efficiency and compliance.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8283 for 2022?

Yes, there is a subscription fee for utilizing airSlate SignNow's eSigning features for IRS Form 8283 for 2022. We offer various pricing plans that cater to different business needs, ensuring you find a cost-effective solution tailored to your requirements.

-

What features does airSlate SignNow offer for IRS Form 8283 for 2022?

airSlate SignNow provides robust features for handling IRS Form 8283 for 2022, including template creation, document sharing, and cloud storage. Our user-friendly interface ensures that anyone can navigate the system with ease, making it ideal for businesses of any size.

-

Are there any integrations available for airSlate SignNow related to IRS Form 8283 for 2022?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRMs, which facilitates the management of IRS Form 8283 for 2022. These integrations enhance productivity by allowing users to access their documents directly from the tools they already use.

-

What benefits can I expect when using airSlate SignNow for IRS Form 8283 for 2022?

Using airSlate SignNow for IRS Form 8283 for 2022 offers several benefits, including improved accuracy, faster processing times, and enhanced security. Additionally, the ability to track document status in real-time provides peace of mind as you manage your charitable contributions.

-

How secure is airSlate SignNow for handling IRS Form 8283 for 2022?

airSlate SignNow employs industry-standard security measures to ensure your documents, including IRS Form 8283 for 2022, are safe. With advanced encryption and secure cloud storage, we prioritize the confidentiality and integrity of your sensitive information.

Get more for Attach One Or More Forms 8283 To Your Tax IRS Tax FormsAbout Form 8283, Noncash Charitable ContributionsAttach One Or More Forms

- Affidavit occupancy status form

- New jersey law form

- Complex will with credit shelter marital trust for large estates new jersey form

- New jersey corporation 497319384 form

- Nj workers compensation form

- New jersey workers compensation 497319386 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts where 497319387 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497319388 form

Find out other Attach One Or More Forms 8283 To Your Tax IRS Tax FormsAbout Form 8283, Noncash Charitable ContributionsAttach One Or More Forms

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document