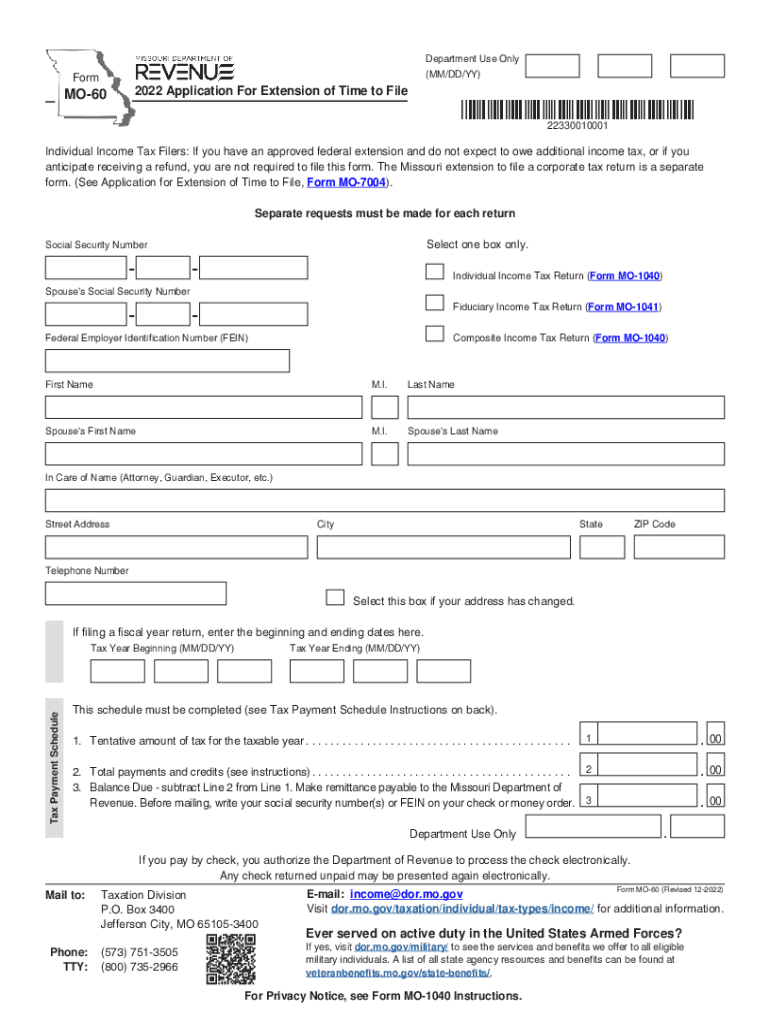

22330010001 Missouri Department of Revenue MO Gov Form

Understanding the Missouri Revenue Application

The Missouri revenue application is a crucial document used for various tax-related purposes within the state. It is essential for individuals and businesses to accurately complete this application to ensure compliance with state tax laws. The application serves as a means for taxpayers to report income, claim deductions, and calculate any taxes owed to the Missouri Department of Revenue.

Steps to Complete the Missouri Revenue Application

Completing the Missouri revenue application involves several key steps:

- Gather necessary documentation, including income statements and identification.

- Fill out the application form accurately, ensuring all information is current.

- Review the form for any errors or omissions before submission.

- Submit the completed application either online or via mail, depending on your preference.

Required Documents for Submission

To successfully complete the Missouri revenue application, you will need the following documents:

- Proof of income, such as W-2 forms or 1099 statements.

- Identification, including a driver's license or Social Security number.

- Any relevant tax documents from previous years that may affect your current application.

Eligibility Criteria for the Missouri Revenue Application

Eligibility for submitting the Missouri revenue application typically includes:

- Residency in Missouri for the tax year in question.

- Meeting the income thresholds set by the Missouri Department of Revenue.

- Filing status, such as single, married, or head of household, which may affect your application.

Form Submission Methods

The Missouri revenue application can be submitted through various methods to accommodate taxpayer preferences:

- Online: Many taxpayers prefer to submit their applications electronically for convenience and speed.

- Mail: Printed applications can be completed and sent via postal service to the appropriate address.

- In-Person: Some individuals may choose to visit local Department of Revenue offices for assistance.

Legal Use of the Missouri Revenue Application

The Missouri revenue application is legally binding when completed and submitted according to state regulations. It is essential for taxpayers to ensure that all provided information is accurate and truthful, as any discrepancies can lead to penalties or legal consequences. Utilizing a reliable eSignature solution can enhance the legal validity of the application by providing a secure and verifiable signature.

Quick guide on how to complete 22330010001 missouri department of revenue mogov

Prepare 22330010001 Missouri Department Of Revenue MO gov effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage 22330010001 Missouri Department Of Revenue MO gov on any platform using airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The easiest way to edit and eSign 22330010001 Missouri Department Of Revenue MO gov seamlessly

- Locate 22330010001 Missouri Department Of Revenue MO gov and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate issues related to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign 22330010001 Missouri Department Of Revenue MO gov and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Missouri revenue application and how does it work?

The Missouri revenue application is a digital solution that allows businesses to manage their tax-related documents efficiently. With airSlate SignNow, you can easily eSign and send these documents with a user-friendly interface. This application streamlines the process, ensuring compliance and reducing paperwork errors.

-

How much does the Missouri revenue application cost?

Pricing for the Missouri revenue application with airSlate SignNow is competitive and tailored to meet varying business needs. We offer a range of plans starting with a basic package that includes essential features for small businesses, while premium options unlock advanced tools for larger enterprises. You can easily choose a plan that aligns with your budget and requirements.

-

What features are included in the Missouri revenue application?

The Missouri revenue application offers several key features, including secure electronic signatures, document templates, and real-time tracking. Additionally, users can create custom workflows and automate repetitive tasks to enhance efficiency. These features simplify the entire document management process for businesses.

-

What are the benefits of using the Missouri revenue application?

Using the Missouri revenue application signNowly reduces turnaround times for document processing. It enhances security and compliance by keeping all documents stored safely in the cloud. Moreover, businesses benefit from improved accuracy and efficiency in handling their revenue-related paperwork.

-

Can I integrate the Missouri revenue application with other tools?

Yes, the Missouri revenue application is designed with integrations in mind, allowing businesses to connect it seamlessly with other tools they are currently using. You can integrate it with popular CRM systems, accounting software, and more, enhancing overall productivity and streamlining processes.

-

Is there a mobile version of the Missouri revenue application?

Absolutely! The Missouri revenue application is fully functional on mobile devices, allowing users to manage their documents on the go. This means you can eSign and send crucial revenue documents from your smartphone or tablet, ensuring flexibility and convenience in your operations.

-

How secure is my information with the Missouri revenue application?

The Missouri revenue application prioritizes security by implementing advanced encryption and data protection measures. airSlate SignNow complies with industry standards to ensure that all sensitive information remains safe from unauthorized access. You can trust that your documents and data are safeguarded throughout the signing process.

Get more for 22330010001 Missouri Department Of Revenue MO gov

- Living trust property record new jersey form

- Financial account transfer to living trust new jersey form

- Assignment to living trust new jersey form

- Notice of assignment to living trust new jersey form

- Revocation of living trust new jersey form

- Letter to lienholder to notify of trust new jersey form

- New jersey timber sale contract new jersey form

- New jersey forest products timber sale contract new jersey form

Find out other 22330010001 Missouri Department Of Revenue MO gov

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement