Schedule N Form 990 Liquidation, Termination, Dissolution, or Significant Disposition of Assests

Understanding the Schedule N Form 990 for Liquidation and Termination

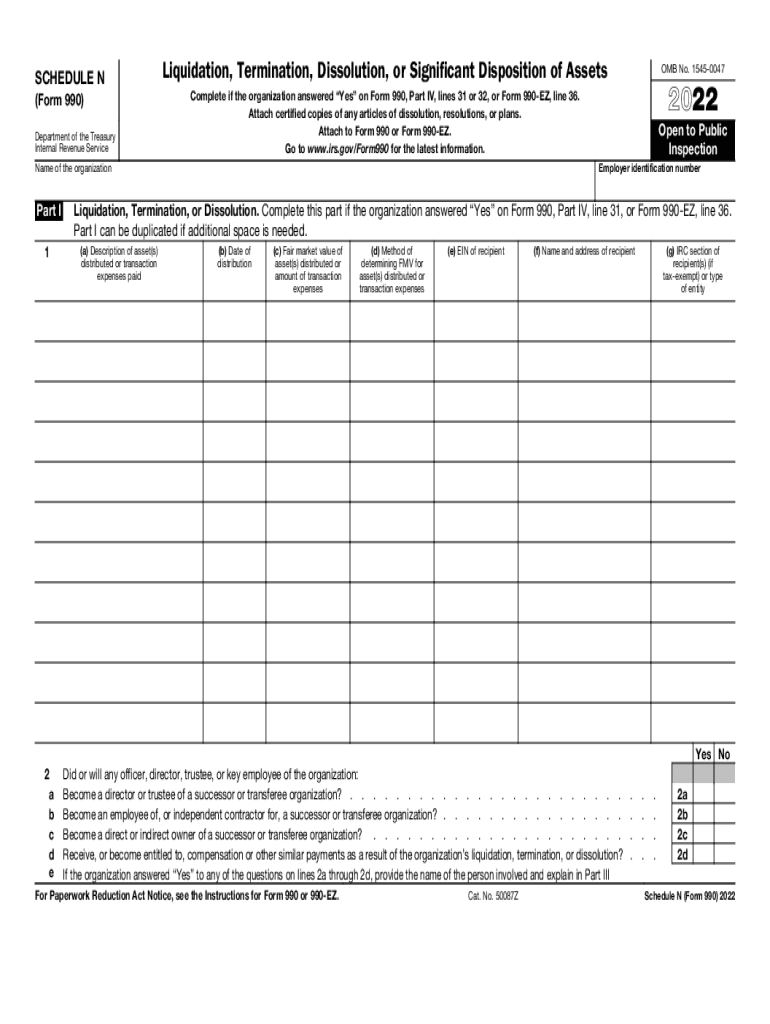

The Schedule N Form 990 is essential for organizations undergoing liquidation, termination, or significant disposition of assets. This form provides the IRS with critical information regarding the organization's financial status and the distribution of its assets. It ensures compliance with federal regulations and helps maintain transparency during the dissolution process. Organizations must report any significant asset disposals, including sales, transfers, or other means of asset liquidation, to accurately reflect their financial activities.

Steps to Complete the Schedule N Form 990

Completing the Schedule N Form 990 involves several key steps:

- Gather necessary information: Collect all relevant financial data, including details of assets being disposed of and their fair market value.

- Fill out the form: Provide accurate information in each section, including the reason for liquidation and the method of asset disposition.

- Review for accuracy: Ensure all entries are correct and complete to avoid delays or penalties.

- Submit the form: File the Schedule N Form 990 with the IRS by the designated deadline, either online or by mail.

Legal Considerations for the Schedule N Form 990

Understanding the legal implications of the Schedule N Form 990 is crucial for compliance. Organizations must adhere to IRS guidelines and state-specific regulations regarding asset disposal. Failure to comply can result in penalties, including fines or loss of tax-exempt status. It is advisable for organizations to consult with legal or tax professionals to ensure all legal requirements are met during the liquidation process.

Filing Deadlines for the Schedule N Form 990

Timely filing of the Schedule N Form 990 is essential to avoid penalties. The form is typically due on the 15th day of the fifth month after the end of the organization’s fiscal year. Organizations should be aware of any extensions that may apply and plan accordingly to meet these deadlines. Keeping track of filing dates helps maintain compliance and avoids unnecessary complications.

Required Documents for Schedule N Form 990 Submission

When submitting the Schedule N Form 990, organizations must include several supporting documents:

- Financial statements reflecting the organization’s assets and liabilities.

- Documentation of asset dispositions, including sales contracts or transfer agreements.

- Any relevant correspondence with the IRS regarding the organization’s status or asset management.

IRS Guidelines for Schedule N Form 990

The IRS provides specific guidelines for completing and submitting the Schedule N Form 990. Organizations must ensure they understand these guidelines to avoid errors. Key aspects include accurately reporting the type of asset disposed of, the method of disposition, and any related financial transactions. Staying informed about IRS updates can help organizations remain compliant and avoid issues during the filing process.

Quick guide on how to complete 2022 schedule n form 990 liquidation termination dissolution or significant disposition of assests

Effortlessly Prepare Schedule N Form 990 Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without interruptions. Handle Schedule N Form 990 Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

How to Edit and eSign Schedule N Form 990 Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests with Ease

- Find Schedule N Form 990 Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests and click Get Form to begin.

- Utilize the available tools to complete your form.

- Select key sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule N Form 990 Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is IRS 990 termination and how does it affect my nonprofit organization?

IRS 990 termination refers to the process of discontinuing the filing of Form 990, which is necessary for tax-exempt organizations. If your nonprofit is terminated, it may lose its tax-exempt status and face penalties. Understanding IRS 990 termination is crucial for maintaining compliance and ensuring that your organization continues to operate without interruptions.

-

How can airSlate SignNow assist with IRS 990 termination documentation?

airSlate SignNow offers an efficient platform to sign and manage documents related to IRS 990 termination processes. With customizable templates and secure eSigning, you can prepare the necessary paperwork seamlessly. Our solution ensures that you maintain compliance and keep important records organized.

-

What are the pricing options for using airSlate SignNow for IRS 990 termination management?

airSlate SignNow offers flexible pricing plans that cater to various organizational needs, including features tailored for IRS 990 termination management. You can select a plan that fits your budget while gaining access to essential signing tools and document management features. Pricing depends on the number of users and added functionalities.

-

Does airSlate SignNow offer any integrations that can help streamline IRS 990 termination processes?

Yes, airSlate SignNow integrates with various applications like Google Drive, Dropbox, and CRM systems that can enhance your IRS 990 termination processes. These integrations allow you to store, manage, and share important documents more efficiently. Seamless workflows facilitate quicker execution of your termination documentation.

-

What are the benefits of using airSlate SignNow for IRS 990 termination tasks?

Using airSlate SignNow for IRS 990 termination tasks can signNowly reduce the time and effort in preparing and signing essential documents. Our platform's user-friendly interface and secure technology ensure compliance and confidentiality throughout the process. Additionally, real-time updates and tracking keep you informed of each step.

-

Is airSlate SignNow compliant with IRS regulations regarding IRS 990 termination?

Absolutely, airSlate SignNow ensures that all processes align with IRS regulations for IRS 990 termination and other nonprofit requirements. Our platform is designed to provide secure document management while maintaining compliance, so you can confidently handle all necessary forms. We prioritize data security and compliance throughout the signing process.

-

What features does airSlate SignNow offer to simplify the IRS 990 termination workflow?

airSlate SignNow provides a variety of features that streamline the IRS 990 termination workflow, including templates for quick document preparation, document tracking, and reminders for important deadlines. Automating the signing process reduces manual errors and accelerates completion, making your operations more efficient. Comprehensive support is available to address any queries you may have.

Get more for Schedule N Form 990 Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house new 497319421 form

- Nj annual report form

- Notices resolutions simple stock ledger and certificate new jersey form

- Minutes for organizational meeting new jersey new jersey form

- Nj sample letter state form

- Js 44 civil cover sheet federal district court new jersey form

- New jersey acknowledgment form

- Affidavit merit nj form

Find out other Schedule N Form 990 Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template