Form MO PTS Property Tax Credit Schedule

What is the Form MO PTS Property Tax Credit Schedule

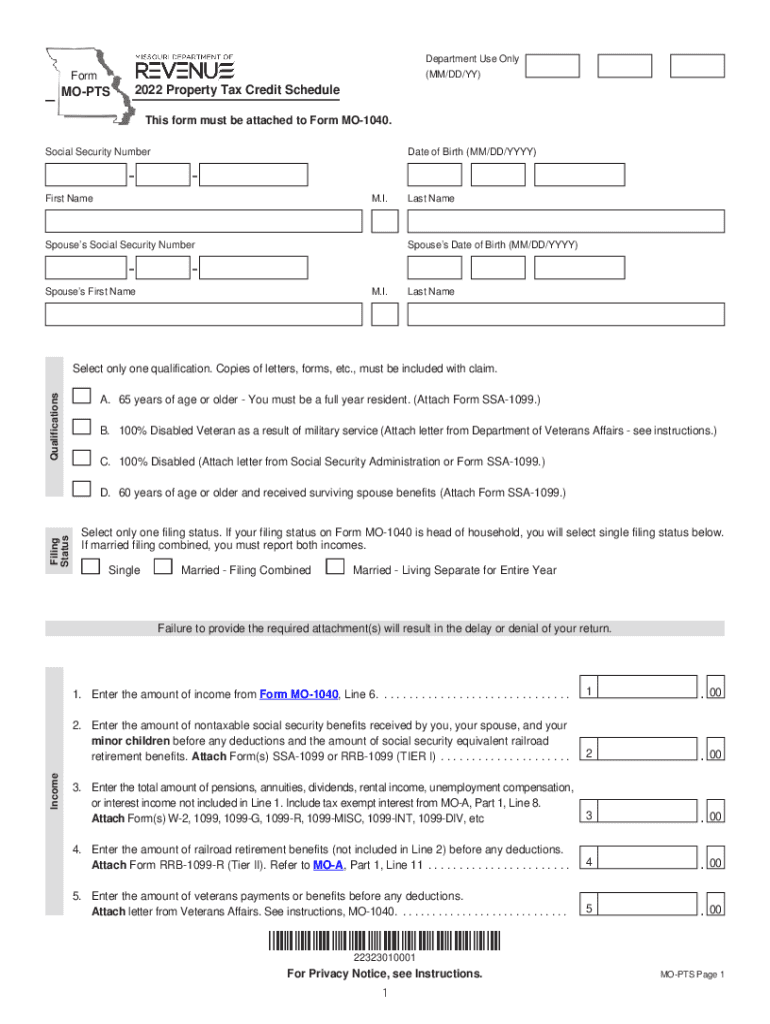

The Form MO PTS Property Tax Credit Schedule is a document used in Missouri to claim property tax credits for eligible individuals. This form is specifically designed for residents who have paid property taxes on their primary residence and meet certain income and age requirements. The credits aim to provide financial relief to qualifying taxpayers, particularly seniors, disabled individuals, and low-income households. Understanding this form is essential for ensuring that eligible residents can effectively reduce their property tax burden.

Steps to Complete the Form MO PTS Property Tax Credit Schedule

Completing the Form MO PTS Property Tax Credit Schedule involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including proof of property tax payments, income statements, and identification. Next, fill out the form with your personal information, including your name, address, and Social Security number. Be sure to provide details about your property and the amount of tax paid. After completing the form, review it for any errors, sign it, and submit it according to the instructions provided. Proper completion of this form is crucial for receiving the intended tax credits.

Eligibility Criteria for the Form MO PTS Property Tax Credit Schedule

Eligibility for the Form MO PTS Property Tax Credit Schedule is based on specific criteria set by the state of Missouri. To qualify, applicants must be residents of Missouri and have paid property taxes on their primary residence. Generally, applicants must be at least 65 years old or disabled, with income limits that vary depending on the household size. Additionally, the property must meet certain specifications, such as being the applicant's primary residence. Understanding these eligibility requirements is vital for ensuring that you can successfully claim the property tax credit.

Required Documents for the Form MO PTS Property Tax Credit Schedule

When preparing to submit the Form MO PTS Property Tax Credit Schedule, it is essential to gather all required documents. Key documents include proof of property tax payments, such as tax bills or receipts, and documentation of income, which may include pay stubs, tax returns, or Social Security statements. If applicable, provide proof of age or disability, such as a birth certificate or disability award letter. Ensuring that all necessary documents are included will facilitate a smoother application process and help avoid delays in receiving your tax credit.

How to Obtain the Form MO PTS Property Tax Credit Schedule

The Form MO PTS Property Tax Credit Schedule can be obtained through various channels. It is available online through the Missouri Department of Revenue's website, where you can download and print the form. Additionally, physical copies can be requested at local tax offices or public libraries. It is important to ensure that you are using the most current version of the form to avoid any issues during submission. Accessing the correct form is the first step in the process of claiming your property tax credit.

Legal Use of the Form MO PTS Property Tax Credit Schedule

The legal use of the Form MO PTS Property Tax Credit Schedule is governed by Missouri state tax laws. This form serves as an official request for property tax credits and must be completed in accordance with the guidelines set forth by the state. Submitting this form accurately and on time is crucial to ensure compliance with legal requirements and to avoid potential penalties. Understanding the legal implications of this form helps ensure that applicants can confidently navigate the process of claiming their entitled credits.

Quick guide on how to complete form mo pts 2022 property tax credit schedule

Effortlessly Prepare Form MO PTS Property Tax Credit Schedule on Any Device

Digital document management has gained traction among enterprises and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage Form MO PTS Property Tax Credit Schedule on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Modify and Electronically Sign Form MO PTS Property Tax Credit Schedule with Ease

- Obtain Form MO PTS Property Tax Credit Schedule and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive data with specialized tools offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form MO PTS Property Tax Credit Schedule and ensure seamless communication at any point of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a pts credit schedule in airSlate SignNow?

The pts credit schedule in airSlate SignNow refers to the structured timeline defining the usage of credits for document signing. This schedule enables users to manage their eSignature needs effectively by letting them know when their credits will expire and how they can be utilized over time.

-

How does the pts credit schedule affect pricing?

The pts credit schedule is integral to our pricing model, as it determines how many credits are allocated based on your subscription plan. Understanding this schedule helps customers anticipate costs and optimize their spending on eSigning services.

-

What are the benefits of using the pts credit schedule?

The pts credit schedule offers flexibility and transparency in managing your eSignature credits. By adhering to this schedule, users can maximize their credit usage and ensure that they have sufficient credits available for important business transactions.

-

Can I purchase additional credits outside of the pts credit schedule?

Yes, airSlate SignNow allows users to purchase additional credits beyond the pts credit schedule as needed. This feature is beneficial for businesses experiencing fluctuating document signing demands, ensuring that eSigning can continue uninterrupted.

-

Are there any integrations available with the pts credit schedule?

AirSlate SignNow offers integrations with various third-party applications that can enhance the utility of the pts credit schedule. These integrations streamline document workflows and allow users to track credit utilization across different platforms.

-

How can I track my credit usage in relation to the pts credit schedule?

users can easily track their credit usage through the airSlate SignNow dashboard, which provides insights into remaining credits and their relationship to the pts credit schedule. This feature simplifies monitoring and ensures efficient credit allocation for eSigning tasks.

-

Is the pts credit schedule customizable for different business needs?

While the pts credit schedule is designed to suit a broad range of users, custom plans can often be arranged to meet specific business needs. By contacting our sales team, companies can explore options that align better with their signing frequency and volume.

Get more for Form MO PTS Property Tax Credit Schedule

Find out other Form MO PTS Property Tax Credit Schedule

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation