Untitled 2021

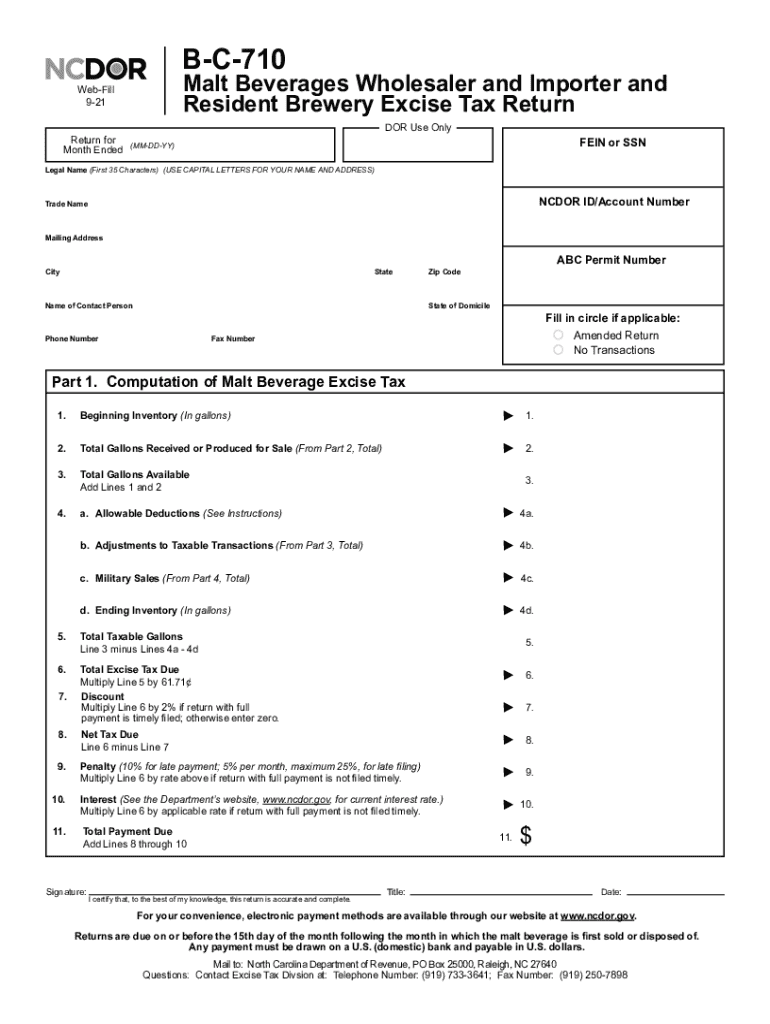

What is the b c ncdor?

The b c ncdor refers to the North Carolina Department of Revenue's form used for reporting and paying the excise tax on beer. This form is essential for businesses involved in the production, distribution, or sale of beer within the state. It ensures compliance with state tax regulations and helps maintain accurate records of beer sales and production.

Steps to complete the b c ncdor

Completing the b c ncdor involves several key steps to ensure accuracy and compliance:

- Gather necessary information about your beer production and sales.

- Access the b c ncdor form through the North Carolina Department of Revenue website.

- Fill out the required fields, including your business details and tax information.

- Calculate the total excise tax owed based on your beer sales.

- Review the completed form for accuracy.

- Submit the form electronically or via mail, as per the guidelines provided.

Legal use of the b c ncdor

The b c ncdor is legally binding when completed correctly and submitted on time. It is crucial for businesses to understand the legal implications of this form, as failure to comply with tax regulations can result in penalties. The form must be filled out in accordance with the North Carolina tax laws, ensuring that all information is truthful and accurate.

Filing Deadlines / Important Dates

Businesses must be aware of the filing deadlines associated with the b c ncdor to avoid penalties. Typically, the form must be submitted quarterly, with specific due dates outlined by the North Carolina Department of Revenue. Keeping track of these dates is essential for maintaining compliance and avoiding late fees.

Required Documents

When completing the b c ncdor, certain documents may be required to support your claims and calculations. These may include:

- Records of beer production and sales.

- Previous tax returns related to beer excise tax.

- Any relevant licenses or permits for operating a beer business in North Carolina.

Form Submission Methods

The b c ncdor can be submitted through various methods, including:

- Online submission through the North Carolina Department of Revenue's e-filing system.

- Mailing a physical copy of the completed form to the appropriate address.

- In-person submission at designated Department of Revenue offices.

Penalties for Non-Compliance

Non-compliance with the b c ncdor can lead to significant penalties, including fines and interest on unpaid taxes. It is important for businesses to understand the consequences of failing to file or pay the excise tax on time. Regularly reviewing compliance requirements can help mitigate these risks.

Quick guide on how to complete untitled 622977636

Easily Prepare Untitled on Any Device

Digital document management has become a favored choice among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly and without hassle. Manage Untitled on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

Easily Modify and eSign Untitled

- Locate Untitled and click on Get Form to begin.

- Use the available tools to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Verify all details and click on the Done button to save your updates.

- Select how you prefer to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management demands in just a few clicks from any device you choose. Modify and eSign Untitled and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct untitled 622977636

Create this form in 5 minutes!

People also ask

-

What is b c ncdor in relation to eSigning documents?

The term 'b c ncdor' often refers to the specific regulatory guidelines for documents that need to be electronically signed in North Carolina. airSlate SignNow ensures compliance with these regulations, allowing users to eSign documents securely and efficiently while meeting 'b c ncdor' requirements.

-

How does airSlate SignNow ensure compliance with b c ncdor?

airSlate SignNow is designed to meet the compliance standards set forth by 'b c ncdor' for electronic signatures. Our platform incorporates advanced security measures along with audit trails, ensuring that all eSigned documents are legally binding and aligned with state laws.

-

What features does airSlate SignNow offer for managing b c ncdor compliant documents?

With airSlate SignNow, you can easily create, send, and eSign documents that comply with 'b c ncdor' regulations. Key features include customizable templates, bulk sending options, and in-depth analytics, all aimed at streamlining your document management process.

-

Is there a free trial available for using airSlate SignNow to handle b c ncdor documents?

Yes, airSlate SignNow offers a free trial that allows users to explore the platform's capabilities for managing 'b c ncdor' compliant documents. This trial gives you access to essential features so you can experience how effectively our eSigning solution can meet your needs.

-

What are the pricing options for airSlate SignNow relevant to b c ncdor users?

airSlate SignNow provides flexible pricing plans tailored for businesses that require b c ncdor compliant eSigning solutions. Our plans cater to different organization sizes, ensuring that everyone can find a cost-effective option that suits their document signing needs.

-

Can airSlate SignNow integrate with other tools for managing b c ncdor documents?

Absolutely! airSlate SignNow offers various integrations with popular applications, enabling seamless document workflows for b c ncdor compliant transactions. Whether you use CRMs, cloud storage, or project management tools, our platform can enhance your existing processes.

-

What benefits can I expect from using airSlate SignNow for b c ncdor documents?

Using airSlate SignNow for 'b c ncdor' documents comes with numerous benefits, including faster turnaround times, enhanced security, and improved efficiency. Our user-friendly interface allows businesses to streamline their eSigning process while ensuring compliance with local regulations.

Get more for Untitled

- Writ continuing garnishment 497305488 form

- Application and affidavit for writ of possession idaho form

- Contesting claim form

- Idaho garnishment form

- Idaho small claims form

- Letter from landlord to tenant as notice to remove wild animals in premises idaho form

- Letter from landlord to tenant as notice to remove unauthorized pets from premises idaho form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497305496 form

Find out other Untitled

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF