Form 5405 Rev November Repayment of the First Time Homebuyer Credit 2022-2026

What is Form 5405: Repayment of the First Time Homebuyer Credit

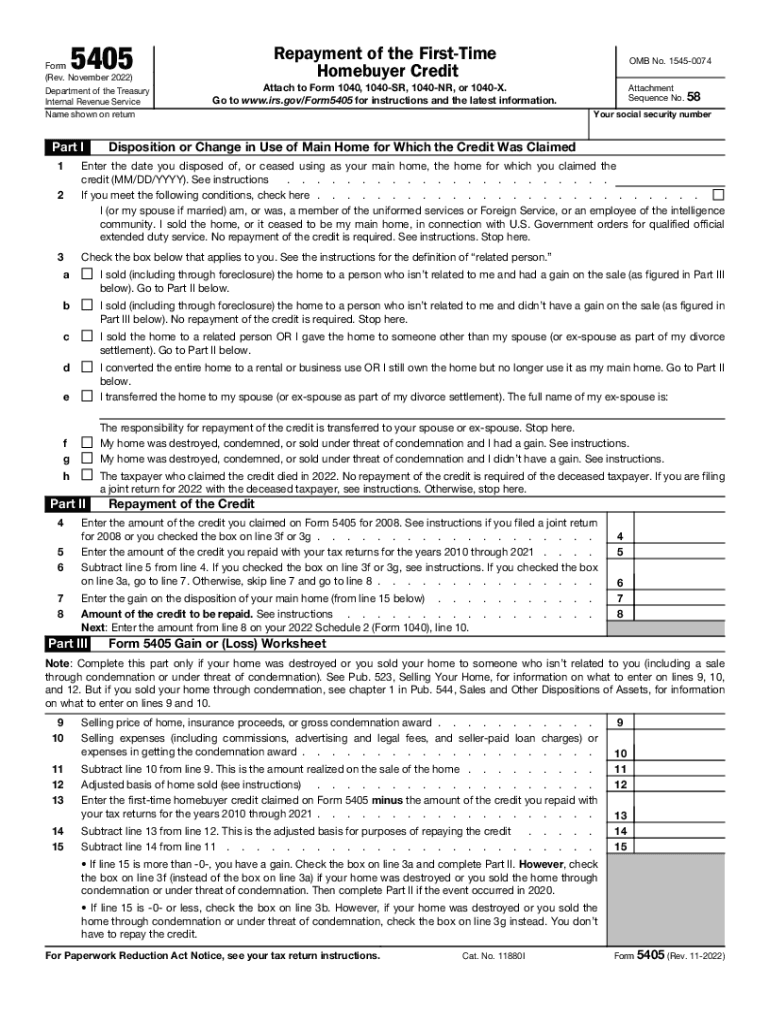

Form 5405 is a tax form used by individuals who received the first time homebuyer credit and are required to repay it. This credit was available for home purchases made in 2008 through 2010. The repayment of this credit typically occurs when the home is sold, or if the taxpayer no longer uses the home as their primary residence. Understanding the purpose of Form 5405 is essential for ensuring compliance with IRS regulations and avoiding potential penalties.

Steps to Complete Form 5405

Completing Form 5405 involves several key steps to ensure accurate reporting of the repayment. First, gather necessary information, including the original amount of the credit received and the date of the home purchase. Next, fill out the form by entering personal details and the repayment amount on the appropriate lines. It is crucial to follow the instructions carefully to avoid errors. Once completed, review the form for accuracy before submitting it with your tax return.

Eligibility Criteria for Form 5405

To be eligible for using Form 5405, taxpayers must have received the first time homebuyer credit. This credit was primarily available to first-time homebuyers who purchased a home between 2008 and 2010. Eligibility also depends on whether the taxpayer has sold the home or changed its use from a primary residence. Taxpayers who meet these criteria must complete Form 5405 to report any repayments due to the IRS.

IRS Guidelines for Form 5405

The IRS provides specific guidelines for completing and submitting Form 5405. Taxpayers should refer to the IRS instructions for detailed information on how to fill out the form correctly. These guidelines include information on repayment amounts, deadlines for submission, and any additional documentation that may be required. Following these guidelines helps ensure compliance and minimizes the risk of errors that could lead to penalties.

Filing Deadlines for Form 5405

Filing deadlines for Form 5405 align with the standard tax return deadlines. Taxpayers must submit the form along with their annual tax return, typically by April 15 of the following year. If additional time is needed, taxpayers can file for an extension, but it is important to ensure that Form 5405 is submitted by the extended deadline to avoid penalties.

Required Documents for Form 5405 Submission

When submitting Form 5405, taxpayers should have certain documents on hand to support their repayment claim. Required documents may include the original purchase agreement for the home, records of the first time homebuyer credit received, and any relevant tax returns from the years the credit was claimed. Keeping these documents organized and accessible can facilitate a smoother filing process.

Form Submission Methods for Form 5405

Form 5405 can be submitted using various methods, including online filing through tax preparation software, mailing a paper form, or submitting it in person at a local IRS office. Each method has its own benefits, and taxpayers should choose the one that best suits their needs. Electronic submission is often quicker and provides immediate confirmation of receipt, while paper submissions may take longer to process.

Quick guide on how to complete form 5405 rev november 2022 repayment of the first time homebuyer credit

Effortlessly Prepare Form 5405 Rev November Repayment Of The First Time Homebuyer Credit on Any Device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed forms, allowing you to access the correct document and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without hassles. Manage Form 5405 Rev November Repayment Of The First Time Homebuyer Credit on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven activity today.

How to Alter and Electronically Sign Form 5405 Rev November Repayment Of The First Time Homebuyer Credit with Ease

- Obtain Form 5405 Rev November Repayment Of The First Time Homebuyer Credit and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to store your changes.

- Select how you wish to share your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 5405 Rev November Repayment Of The First Time Homebuyer Credit and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5405 rev november 2022 repayment of the first time homebuyer credit

Create this form in 5 minutes!

People also ask

-

What is the form 5405 and how is it used?

The form 5405 is a document used to request a waiver of certain tax penalties. In the context of airSlate SignNow, it can be easily filled out and signed electronically, streamlining the process for users who need to manage their tax documentation efficiently.

-

How can airSlate SignNow help with form 5405 management?

airSlate SignNow provides an intuitive platform that allows you to create, send, and eSign the form 5405 seamlessly. By utilizing our electronic signature capabilities, you can ensure that your form is completed accurately and submitted on time, reducing the hassle of traditional paperwork.

-

Is there a cost associated with using airSlate SignNow for form 5405?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users. These plans are cost-effective, ensuring that you can manage your form 5405 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for handling form 5405?

AirSlate SignNow includes features such as customizable templates, real-time collaboration, and secure electronic signatures, all of which enhance the process of completing the form 5405. These tools make it easier for users to ensure accuracy and compliance in their submissions.

-

Can I integrate airSlate SignNow with other applications to manage form 5405?

Yes, airSlate SignNow supports integration with a variety of third-party applications, enabling you to link your workflows for managing the form 5405 effectively. This integration enhances productivity by allowing data to flow seamlessly between platforms.

-

What are the benefits of using airSlate SignNow for form 5405 processing?

Using airSlate SignNow for your form 5405 processing leads to increased efficiency and accuracy. The platform's electronic signature capabilities save time, reduce errors, and provide a secure method for managing sensitive documents.

-

Is airSlate SignNow secure for handling sensitive documents like form 5405?

Absolutely, airSlate SignNow employs robust security measures to protect all user data, including the form 5405. With features like encryption and secure access controls, you can trust that your sensitive information is safe.

Get more for Form 5405 Rev November Repayment Of The First Time Homebuyer Credit

Find out other Form 5405 Rev November Repayment Of The First Time Homebuyer Credit

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter