First Time Homebuyer Credit 2021

What is the First Time Homebuyer Credit

The First Time Homebuyer Credit is a tax incentive designed to assist individuals purchasing their first home. This credit can provide significant financial relief by reducing the amount of taxes owed to the IRS. Initially introduced to stimulate the housing market, it allows eligible buyers to claim a credit against their federal income tax. Understanding this credit is crucial for first time homebuyers, as it can impact their overall financial strategy during the home purchasing process.

Eligibility Criteria

To qualify for the First Time Homebuyer Credit, individuals must meet specific eligibility criteria set by the IRS. Generally, the applicant must be a first time homebuyer, defined as someone who has not owned a home in the previous three years. Additionally, the home must be purchased as a primary residence, and the buyer's income must fall below certain thresholds to qualify for the full credit. It is essential for potential homebuyers to review these criteria carefully to ensure they meet all requirements before applying.

Steps to Complete the First Time Homebuyer Credit

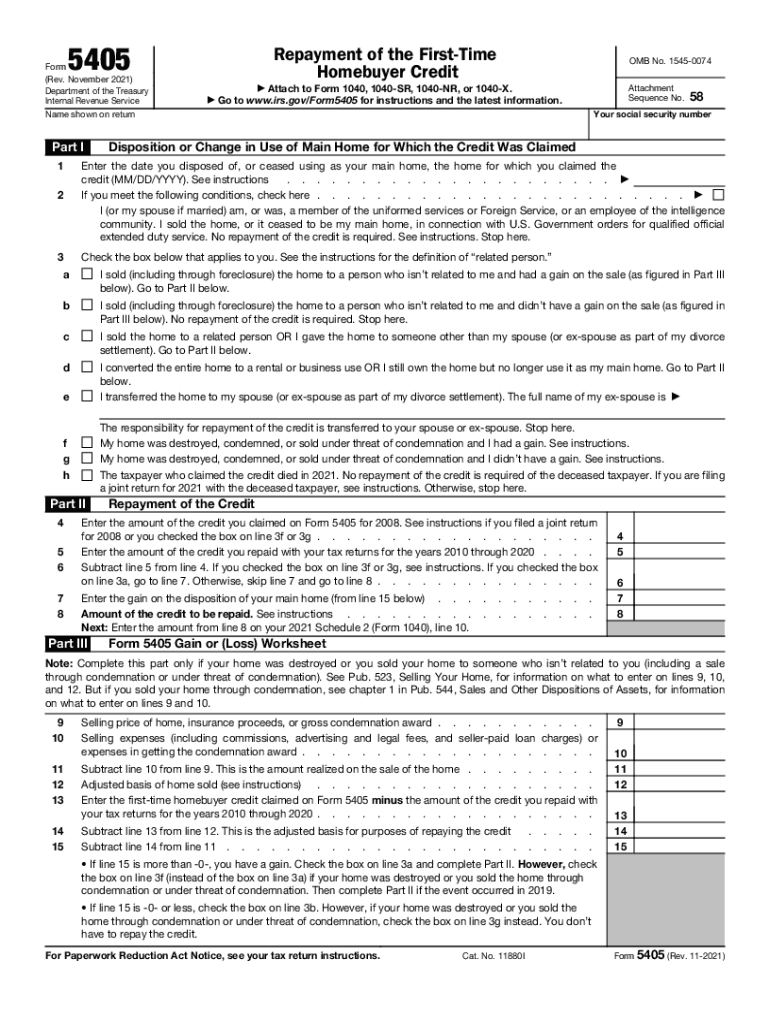

Completing the First Time Homebuyer Credit involves several key steps. First, gather all necessary documentation, including proof of home purchase and income verification. Next, fill out the appropriate IRS forms, such as the IRS 5405 form, which specifically addresses the homebuyer credit. Ensure that all information is accurate and complete to avoid delays or issues with processing. Once the forms are filled out, submit them with your tax return, either electronically or by mail, depending on your preference.

Required Documents

When applying for the First Time Homebuyer Credit, several documents are necessary to support your claim. These typically include:

- Proof of home purchase, such as a closing statement or settlement agreement.

- IRS 5405 form, which details the credit being claimed.

- Income documentation, such as W-2 forms or tax returns, to verify eligibility.

Having these documents ready can streamline the application process and ensure compliance with IRS requirements.

IRS Guidelines

The IRS provides specific guidelines regarding the First Time Homebuyer Credit, including how to apply, eligibility requirements, and deadlines for submission. It is crucial for first time homebuyers to familiarize themselves with these guidelines to avoid potential pitfalls. The IRS also outlines the repayment process for those who received the credit, detailing when and how repayments should be made if applicable. Staying informed about these guidelines can help ensure a smooth experience when claiming the credit.

Filing Deadlines / Important Dates

Filing deadlines for the First Time Homebuyer Credit are critical for applicants to note. Typically, the credit must be claimed on the tax return for the year in which the home was purchased. It is advisable to check the IRS website for the latest deadlines and any updates regarding the credit. Missing these deadlines can result in losing the opportunity to claim the credit, so staying organized and informed is essential for first time homebuyers.

Quick guide on how to complete 2021 first time homebuyer credit

Complete First Time Homebuyer Credit effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage First Time Homebuyer Credit on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign First Time Homebuyer Credit with ease

- Find First Time Homebuyer Credit and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate the issues of lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign First Time Homebuyer Credit and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 first time homebuyer credit

Create this form in 5 minutes!

How to create an eSignature for the 2021 first time homebuyer credit

How to create an e-signature for your PDF in the online mode

How to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an e-signature for a PDF on Android OS

People also ask

-

What options does airSlate SignNow offer for first time homebuyers?

airSlate SignNow provides an easy-to-use platform for first time homebuyers to send and eSign essential documents seamlessly. Our solution is designed to streamline the signing process, making it simpler to manage transactions while ensuring compliance and security.

-

How much does airSlate SignNow cost for first time homebuyers?

For first time homebuyers, airSlate SignNow offers flexible pricing plans that cater to various needs. With cost-effective solutions, you can choose the plan that best fits your budget without compromising on the features you need to effectively manage your documentation.

-

What features does airSlate SignNow provide for first time homebuyers?

First time homebuyers can benefit from features like customizable templates, real-time tracking, and robust security measures with airSlate SignNow. These features are designed to simplify the signing process and help you stay organized throughout your homebuying journey.

-

Are there any integrations available for first time homebuyers using airSlate SignNow?

Yes, airSlate SignNow offers various integrations that are beneficial for first time homebuyers. You can connect our platform with popular tools and applications, making it easier to manage all your home documentation in one place.

-

How can airSlate SignNow benefit first time homebuyers?

airSlate SignNow can signNowly benefit first time homebuyers by simplifying the document signing process and reducing the time spent on paperwork. With our secure and efficient eSignature solution, you can move forward with your home purchase with confidence.

-

Is airSlate SignNow user-friendly for first time homebuyers?

Absolutely! airSlate SignNow is designed to be user-friendly, especially for first time homebuyers who may not be familiar with digital tools. Our intuitive interface guides you through each step, making it easy to eSign documents without any hassle.

-

Can first time homebuyers access customer support with airSlate SignNow?

Yes, first time homebuyers can access robust customer support when using airSlate SignNow. Our dedicated support team is available to assist you with any questions or issues, ensuring that you have a smooth experience as you navigate your homebuying process.

Get more for First Time Homebuyer Credit

- Legal last will and testament form for divorced person not remarried with minor children wisconsin

- Legal last will and testament form for domestic partner with adult children wisconsin

- Legal last will and testament form for a domestic partner with no children wisconsin

- Legal last will and testament form for domestic partner with minor children wisconsin

- Legal last will and testament form for divorced person not remarried with adult and minor children wisconsin

- Mutual wills package with last wills and testaments for married couple with adult children wisconsin form

- Mutual wills package with last wills and testaments for married couple with no children wisconsin form

- Mutual wills package with last wills and testaments for married couple with minor children wisconsin form

Find out other First Time Homebuyer Credit

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy