Fill Iosocial Security and Medicare Tax OnFillable Social Security and Medicare Tax on Unreported Tip 2022

Understanding the 4137 Form

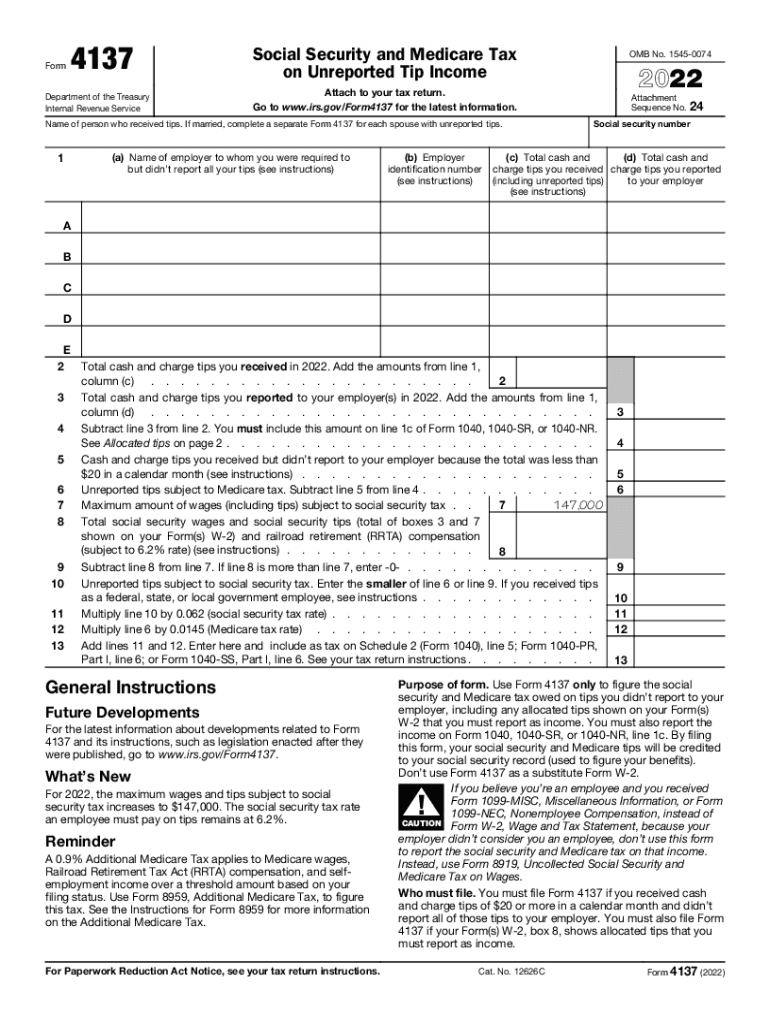

The 4137 form, also known as the unreported tip income form, is a crucial document for individuals who earn tips and need to report this income to the IRS. This form is particularly important for employees in the service industry, such as waitstaff and bartenders, who may not receive a regular paycheck that reflects their actual earnings. By accurately completing the 4137, individuals can ensure compliance with tax regulations and avoid potential penalties for underreporting income.

Steps to Complete the 4137 Form

Completing the 4137 form involves several key steps to ensure accuracy and compliance with IRS guidelines. First, gather all relevant information regarding your tip income for the year. This includes daily records of tips received, which can help substantiate your claims. Next, fill out the form by providing your personal information, including your name, Social Security number, and the total amount of unreported tips. It is essential to calculate the correct amount of Social Security and Medicare tax owed on your reported tips, as this will affect your overall tax liability. Finally, review the completed form for accuracy before submission.

IRS Guidelines for the 4137 Form

The IRS has specific guidelines regarding the use of the 4137 form. It is essential to report all tips received, as failure to do so can lead to penalties. The IRS requires that employees report tips that total twenty dollars or more in a month. When completing the form, ensure that you follow the IRS instructions carefully, as any discrepancies can result in an audit or additional taxes owed. The IRS also provides resources and publications that can assist in understanding the requirements for reporting tip income.

Filing Deadlines for the 4137 Form

Filing deadlines for the 4137 form align with the standard tax filing deadlines in the United States. Typically, individual tax returns are due on April fifteenth of each year. If you are filing your taxes and including the 4137 form, ensure that it is submitted by this date to avoid late fees and penalties. If you need additional time, you may file for an extension, but be aware that any taxes owed must still be paid by the original deadline to avoid interest charges.

Penalties for Non-Compliance

Failing to accurately report tip income using the 4137 form can lead to significant penalties from the IRS. These penalties may include fines and interest on unpaid taxes. Additionally, the IRS may impose a higher penalty for willful neglect or intentional misreporting of income. It is crucial to take the reporting of tip income seriously and ensure that all information is complete and accurate to avoid these potential consequences.

Digital vs. Paper Version of the 4137 Form

When it comes to submitting the 4137 form, individuals have the option of using a digital or paper version. The digital version allows for easier completion and submission, often with built-in checks for accuracy. Many tax software programs facilitate the filling out of the 4137 form, making it accessible and convenient. On the other hand, the paper version can be filled out manually and mailed to the IRS. Regardless of the method chosen, ensure that the form is completed accurately and submitted on time.

Quick guide on how to complete filliosocial security and medicare tax onfillable social security and medicare tax on unreported tip

Complete Fill iosocial security and medicare tax onFillable Social Security And Medicare Tax On Unreported Tip seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage Fill iosocial security and medicare tax onFillable Social Security And Medicare Tax On Unreported Tip on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and electronically sign Fill iosocial security and medicare tax onFillable Social Security And Medicare Tax On Unreported Tip effortlessly

- Locate Fill iosocial security and medicare tax onFillable Social Security And Medicare Tax On Unreported Tip and select Get Form to begin.

- Utilize the available tools to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to preserve your modifications.

- Choose your preferred method to send your form—via email, text (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Fill iosocial security and medicare tax onFillable Social Security And Medicare Tax On Unreported Tip to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct filliosocial security and medicare tax onfillable social security and medicare tax on unreported tip

Create this form in 5 minutes!

People also ask

-

What is form 4137?

Form 4137 is used to report unreported tips to the IRS. By utilizing airSlate SignNow, users can easily fill out and electronically sign form 4137, streamlining the submission process.

-

How can I complete form 4137 with airSlate SignNow?

To complete form 4137 using airSlate SignNow, simply upload the form, fill out the required fields, and add your eSignature. Our platform ensures that the process is user-friendly and efficient.

-

Is there a cost associated with using airSlate SignNow for form 4137?

airSlate SignNow offers various pricing plans, providing cost-effective options for individuals and businesses looking to electronically sign documents, including form 4137. You can choose a plan that fits your needs and budget.

-

What features does airSlate SignNow offer for form 4137?

AirSlate SignNow provides a variety of features for handling form 4137, including document upload, eSignature functionality, and secure storage. This ensures that your important tax documents are easily accessible and safely stored.

-

Can I integrate airSlate SignNow with other applications for form 4137?

Yes, airSlate SignNow integrates seamlessly with various applications, making it easy to manage form 4137 within your existing workflows. This integration allows for better organization and efficiency in your document handling.

-

What are the benefits of using airSlate SignNow for form 4137?

Using airSlate SignNow for form 4137 offers numerous benefits, such as reduced paperwork, faster processing times, and enhanced security. Our platform simplifies the signing process, ensuring that you can focus more on your business.

-

Is airSlate SignNow secure for submitting form 4137?

Absolutely, airSlate SignNow prioritizes security for all documents, including form 4137. Our platform utilizes encryption and secure data storage to protect your sensitive information.

Get more for Fill iosocial security and medicare tax onFillable Social Security And Medicare Tax On Unreported Tip

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497319999 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement new mexico form

- Landlord about rent 497320001 form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants new mexico form

- Letter tenant notice 497320003 form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat new mexico form

- Assignment of lien corporation or llc new mexico form

- New mexico claim form

Find out other Fill iosocial security and medicare tax onFillable Social Security And Medicare Tax On Unreported Tip

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors