Desktop Form 4137 Social Security & Medicare Tax on 2024

Understanding the 4137 Tax Form

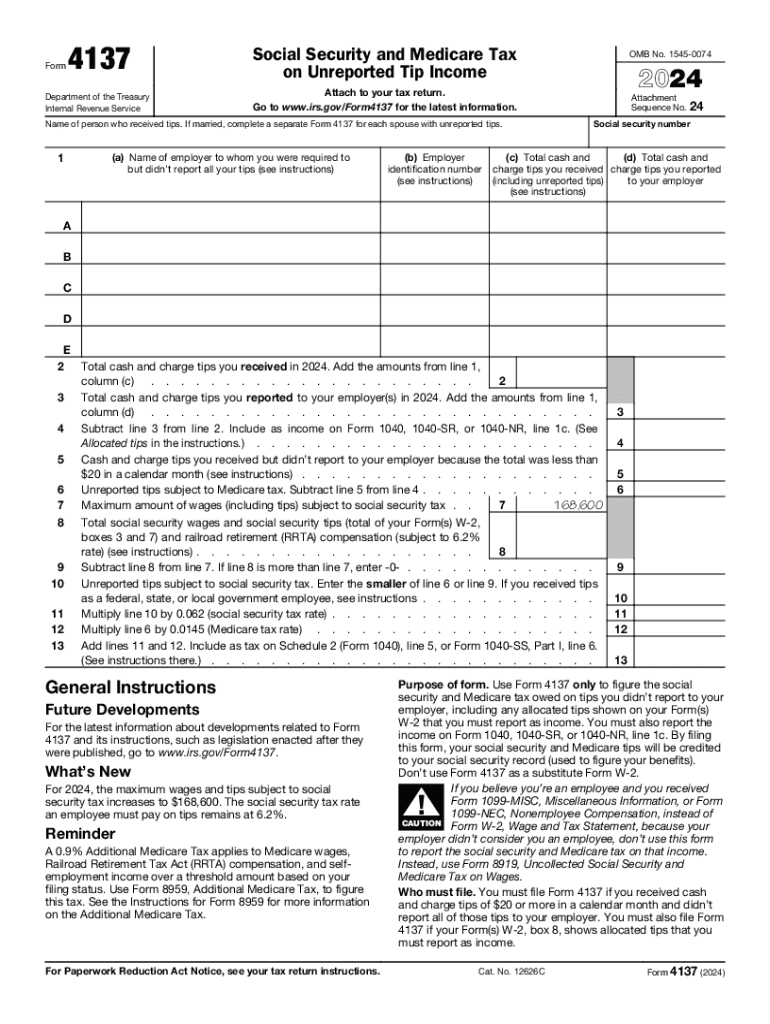

The 4137 tax form, officially known as the IRS 4137 form, is used to report unreported tip income. This form is particularly relevant for employees in the service industry, such as waitstaff and bartenders, who receive tips that may not be reported to their employer. By completing the 4137 form, individuals can accurately declare their tip income, ensuring compliance with IRS regulations regarding Social Security and Medicare taxes.

How to Complete the 4137 Tax Form

Filling out the 4137 form involves several steps. First, gather all necessary information regarding your unreported tip income. This includes the total amount of tips received during the year and any other relevant income details. Next, follow these steps:

- Enter your personal information, including your name and Social Security number.

- Report the total amount of unreported tips in the designated section.

- Calculate the Social Security and Medicare taxes owed on the reported tip income.

- Review the form for accuracy before submission.

Once completed, the form should be submitted along with your tax return to the IRS.

Obtaining the 4137 Tax Form

The 4137 form can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is important to ensure that you are using the most current version of the form to avoid any compliance issues. Additionally, tax professionals can provide assistance in obtaining and completing the form correctly.

IRS Guidelines for the 4137 Tax Form

The IRS has specific guidelines regarding the use of the 4137 tax form. It is important to understand the following:

- The form must be submitted for each tax year that you have unreported tip income.

- Accurate reporting is crucial to avoid penalties for non-compliance.

- Keep records of your tip income and any related documentation for at least three years in case of an audit.

Penalties for Non-Compliance

Failing to report tip income using the 4137 form can lead to significant penalties. The IRS may impose fines for underreporting income, which can include both monetary penalties and interest on unpaid taxes. In severe cases, criminal charges may be pursued for tax evasion. It is essential to adhere to reporting requirements to avoid these consequences.

Eligibility Criteria for Using the 4137 Tax Form

To use the 4137 form, you must meet certain eligibility criteria. Primarily, this form is intended for employees who receive tips as part of their income but do not report them to their employer. This includes individuals in various service roles, such as hospitality and personal services. Additionally, you should have a valid Social Security number and be filing a federal tax return for the year in which the tips were received.

Create this form in 5 minutes or less

Find and fill out the correct desktop form 4137 social security amp medicare tax on

Create this form in 5 minutes!

How to create an eSignature for the desktop form 4137 social security amp medicare tax on

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4137 tax form and who needs to use it?

The 4137 tax form is used by individuals who receive tips or other compensation that is not reported on a W-2 form. This form helps report these earnings to the IRS, ensuring compliance with tax regulations. If you work in a service industry where tips are common, you will likely need to use the 4137 tax form.

-

How can airSlate SignNow help with the 4137 tax form?

airSlate SignNow provides a seamless way to eSign and send the 4137 tax form electronically. Our platform simplifies the process, allowing you to complete and submit your tax documents quickly and securely. With airSlate SignNow, you can ensure that your 4137 tax form is filed accurately and on time.

-

Is there a cost associated with using airSlate SignNow for the 4137 tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage documents like the 4137 tax form efficiently. You can choose a plan that fits your budget while ensuring you have access to all essential features.

-

What features does airSlate SignNow offer for managing the 4137 tax form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the 4137 tax form. These features streamline the process, making it easier to fill out and submit your tax documents. Additionally, our platform ensures that your information is kept secure throughout the process.

-

Can I integrate airSlate SignNow with other software for the 4137 tax form?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your ability to manage the 4137 tax form. Whether you use accounting software or other document management tools, our platform can seamlessly connect to improve your workflow and efficiency.

-

What are the benefits of using airSlate SignNow for the 4137 tax form?

Using airSlate SignNow for the 4137 tax form provides numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform allows you to complete and submit your tax documents quickly, reducing the risk of errors. Additionally, the secure eSigning feature ensures that your sensitive information is protected.

-

How does airSlate SignNow ensure the security of my 4137 tax form?

airSlate SignNow prioritizes the security of your documents, including the 4137 tax form, by employing advanced encryption and secure storage solutions. Our platform complies with industry standards to protect your data from unauthorized access. You can trust that your information is safe while using our services.

Get more for Desktop Form 4137 Social Security & Medicare Tax On

- Tbear graphic organizer form

- Navmc 11000 form

- Sample reference letter for condo association form

- Vrs form 26

- Httpsir ptcbio comstatic files9b67142f 514d 4 form

- Microsoft word wire transfer request form2016

- Hold harmless agreement indemnification agreemen form

- Departamento de asuntos del consumidor de californ form

Find out other Desktop Form 4137 Social Security & Medicare Tax On

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer