Docs Aws Amazon Com General LatestAmazon API Gateway Endpoints and Quotas AWS General Reference Form

Understanding the New Mexico Tax Clearance

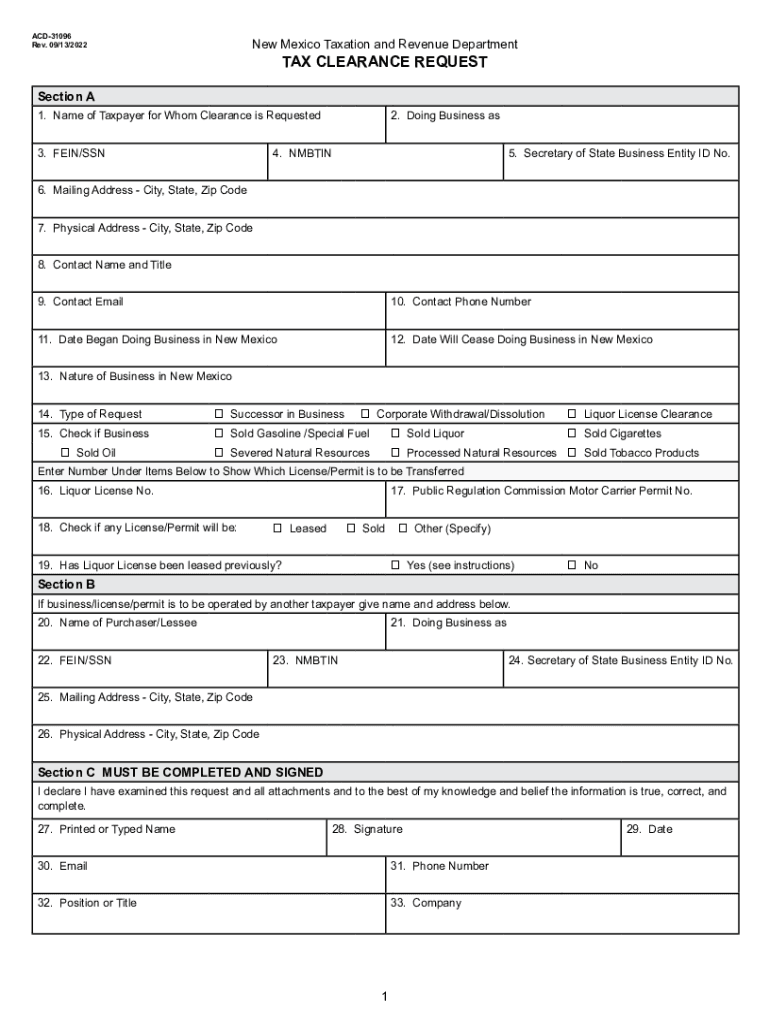

The New Mexico tax clearance, often referred to as the certificate of no tax due, is an essential document for individuals and businesses seeking to demonstrate compliance with state tax obligations. This certificate confirms that the taxpayer has no outstanding tax liabilities with the New Mexico Taxation and Revenue Department. It is commonly required for various transactions, including business licenses, permits, and loan applications.

Steps to Obtain the New Mexico Certificate of No Tax Due

To acquire the New Mexico certificate of no tax due, follow these steps:

- Gather necessary information, including your taxpayer identification number and details about your business or personal tax filings.

- Complete the form ACD-31096, which is the official request for the tax clearance.

- Submit the completed form to the New Mexico Taxation and Revenue Department, either online or by mail.

- Wait for processing, which typically takes a few business days. You will receive a notification once your request is processed.

Required Documents for the ACD-31096 Submission

When filling out the ACD-31096 form, ensure you have the following documents ready:

- Your most recent tax return.

- Any correspondence from the New Mexico Taxation and Revenue Department regarding your tax status.

- Identification documents, such as a driver's license or Social Security number.

Form Submission Methods

The ACD-31096 form can be submitted through various methods:

- Online: Use the New Mexico Taxation and Revenue Department's online portal for a faster processing time.

- By Mail: Send the completed form to the appropriate address listed on the form.

- In-Person: Visit a local Taxation and Revenue Department office to submit your request directly.

Eligibility Criteria for New Mexico Tax Clearance

To be eligible for the New Mexico certificate of no tax due, you must meet specific criteria:

- All tax returns must be filed for the relevant tax periods.

- No outstanding tax liabilities should exist, including penalties and interest.

- All payments must be current and up to date.

Penalties for Non-Compliance

Failure to obtain the New Mexico tax clearance when required can result in several penalties:

- Inability to secure business licenses or permits.

- Potential fines or fees imposed by the state.

- Increased scrutiny from tax authorities regarding your tax compliance.

Quick guide on how to complete docsawsamazoncom general latestamazon api gateway endpoints and quotas aws general reference

Complete Docs aws amazon com General LatestAmazon API Gateway Endpoints And Quotas AWS General Reference effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without any delays. Manage Docs aws amazon com General LatestAmazon API Gateway Endpoints And Quotas AWS General Reference on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

How to edit and eSign Docs aws amazon com General LatestAmazon API Gateway Endpoints And Quotas AWS General Reference with ease

- Locate Docs aws amazon com General LatestAmazon API Gateway Endpoints And Quotas AWS General Reference and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Docs aws amazon com General LatestAmazon API Gateway Endpoints And Quotas AWS General Reference and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is New Mexico tax clearance and why is it important?

New Mexico tax clearance is a document that verifies a business's good standing with the state's tax obligations. It is essential for maintaining compliance with local regulations and is often required for bidding on government contracts or obtaining licenses.

-

How can airSlate SignNow help me obtain my New Mexico tax clearance?

airSlate SignNow streamlines the process of collecting and signing the necessary documents needed for New Mexico tax clearance. Our platform allows you to quickly prepare, send, and eSign forms, ensuring you meet submission deadlines efficiently.

-

Is there a cost associated with obtaining New Mexico tax clearance through airSlate SignNow?

Yes, while airSlate SignNow offers cost-effective solutions, there may be fees associated with obtaining New Mexico tax clearance itself. However, using our platform can save you time and resources, making the overall process more affordable.

-

What features does airSlate SignNow offer for managing New Mexico tax clearance requests?

airSlate SignNow offers several features such as document templates, automated reminders, and real-time notifications that enhance the management of New Mexico tax clearance requests. These tools help ensure you stay organized and on track throughout the approval process.

-

Can airSlate SignNow integrate with other software I use for business operations concerning New Mexico tax clearance?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software systems, allowing you to manage New Mexico tax clearance along with your existing business operations. This integration helps ensure a smooth workflow and minimizes the need for manual data entry.

-

What are the benefits of using airSlate SignNow for my New Mexico tax clearance?

Using airSlate SignNow for your New Mexico tax clearance offers numerous benefits, including enhanced efficiency, improved document security, and a user-friendly interface. Our platform simplifies the eSignature process, allowing you to focus on growing your business.

-

How long does it take to get New Mexico tax clearance using airSlate SignNow?

The timeframe for obtaining New Mexico tax clearance can vary based on specific requirements, but airSlate SignNow helps expedite the eSigning process. By minimizing back-and-forth communication and enabling quick document access, we aim to signNowly reduce the overall processing time.

Get more for Docs aws amazon com General LatestAmazon API Gateway Endpoints And Quotas AWS General Reference

- Tenant notice remove 497319951 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497319952 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair new mexico form

- Letter from tenant to landlord containing notice that doors are broken and demand repair new mexico form

- Nm tenant landlord form

- Nm tenant landlord 497319956 form

- Letter notice demand 497319957 form

- Letter demand repair form

Find out other Docs aws amazon com General LatestAmazon API Gateway Endpoints And Quotas AWS General Reference

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word