Www Uslegalforms Comform Library536160 IrsIRS 1095 C Fill and Sign Printable Template Online

IRS Guidelines for the 1095-C Form

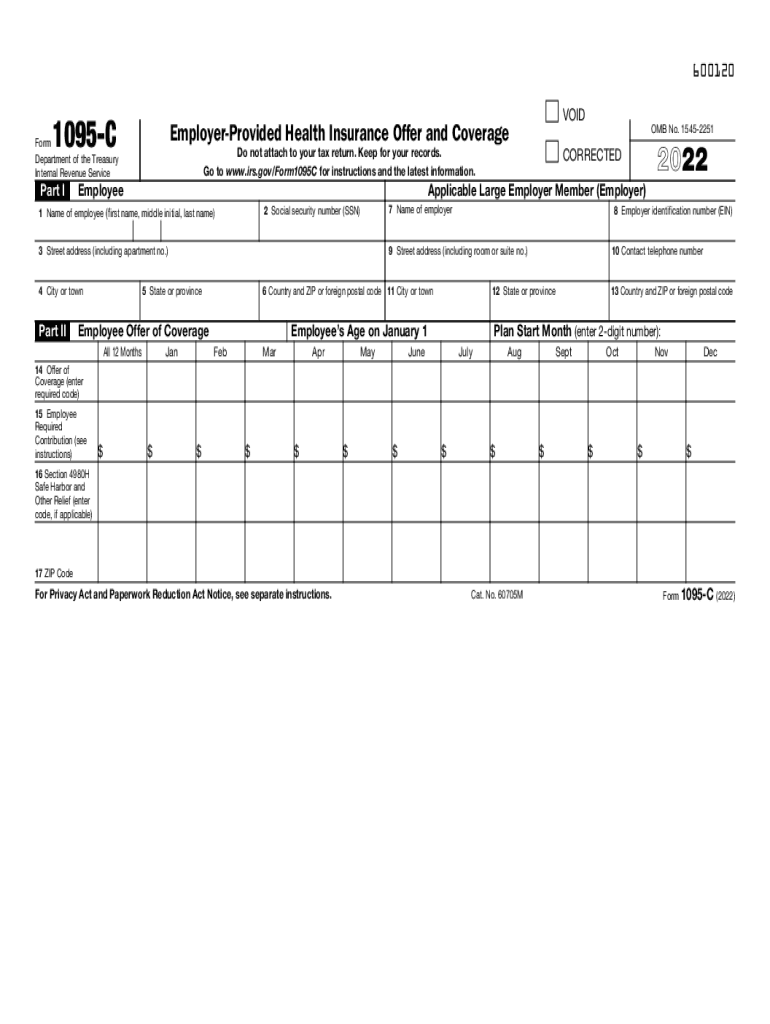

The IRS 1095-C form is an essential document used by employers to report health coverage information to the IRS and employees. This form is part of the Affordable Care Act (ACA) requirements, ensuring that applicable large employers (ALEs) provide health insurance to their full-time employees. The guidelines stipulate that employers must furnish a 1095-C to each employee by January thirty-first of the following year, detailing the health coverage offered during the previous calendar year.

Steps to Complete the 1095-C Form

Completing the 1095-C form involves several key steps to ensure accuracy and compliance. First, gather necessary employee data, including names, addresses, and Social Security numbers. Next, determine the type of health coverage provided, including the months of coverage. Fill out the form by entering the required information in the appropriate sections, such as Part I for employee details, Part II for the employer's offer of coverage, and Part III for the covered individuals. Finally, review the completed form for accuracy before submitting it to the IRS and providing copies to employees.

Filing Deadlines and Important Dates

Adhering to filing deadlines is crucial for compliance with IRS regulations regarding the 1095-C form. Employers must provide the completed forms to employees by January thirty-first. The forms must also be submitted to the IRS by February twenty-eighth if filing by paper, or by March thirty-first if filing electronically. It's important to keep these dates in mind to avoid potential penalties for late filing.

Penalties for Non-Compliance

Employers who fail to comply with the reporting requirements for the 1095-C form may face significant penalties. The IRS imposes fines for each form that is not filed or is filed incorrectly. The penalties can accumulate quickly, especially if an employer has a large number of employees. Therefore, it is essential to ensure that all forms are completed accurately and submitted on time to avoid these financial repercussions.

Digital vs. Paper Version of the 1095-C Form

Employers have the option to file the 1095-C form either digitally or on paper. The digital version offers advantages such as faster processing times and reduced risk of physical document loss. Additionally, electronic filing is often more efficient for employers managing multiple forms. However, some may prefer the traditional paper method for its tangible nature. Regardless of the method chosen, ensuring compliance with IRS guidelines is paramount.

Eligibility Criteria for Filing the 1095-C Form

Eligibility to file the 1095-C form primarily depends on the size of the employer. Applicable large employers, defined as those with fifty or more full-time employees, are required to file this form. Additionally, employers must determine whether they meet the criteria for offering health coverage to their full-time employees. Understanding these eligibility criteria is essential for compliance with ACA regulations.

Quick guide on how to complete wwwuslegalformscomform library536160 irsirs 1095 c 2021 2022 fill and sign printable template online

Easily Prepare Www uslegalforms comform library536160 irsIRS 1095 C Fill And Sign Printable Template Online on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and e-sign your documents quickly and without delays. Manage Www uslegalforms comform library536160 irsIRS 1095 C Fill And Sign Printable Template Online on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric procedure today.

How to Modify and eSign Www uslegalforms comform library536160 irsIRS 1095 C Fill And Sign Printable Template Online Effortlessly

- Locate Www uslegalforms comform library536160 irsIRS 1095 C Fill And Sign Printable Template Online and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or downloading it to your PC.

Say goodbye to lost or misplaced files, tedious searches for forms, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Www uslegalforms comform library536160 irsIRS 1095 C Fill And Sign Printable Template Online to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 1095 C 2022 fillable form?

The 1095 C 2022 fillable form is a tax document used by employers to report information about health care coverage provided to their employees. It includes details such as the employee's name, the insurance coverage details, and the months of coverage. Using airSlate SignNow, you can easily fill out and eSign the 1095 C 2022 fillable form to ensure compliance.

-

How can I access the 1095 C 2022 fillable form with airSlate SignNow?

To access the 1095 C 2022 fillable form, simply log into your airSlate SignNow account and use the template library. You can search for the 1095 C 2022 fillable form and begin filling it out directly within the platform. This seamless process allows for easy completion and signing.

-

Is airSlate SignNow a cost-effective solution for eSigning the 1095 C 2022 fillable form?

Yes, airSlate SignNow is a cost-effective solution for eSigning and managing documents like the 1095 C 2022 fillable form. With flexible pricing plans, it is designed to meet a range of business needs without breaking the bank. You can streamline your document signing process while staying budget-friendly.

-

What features does airSlate SignNow offer for filling out the 1095 C 2022 fillable form?

airSlate SignNow offers a range of features for completing the 1095 C 2022 fillable form, including a user-friendly interface, template customization, and cloud storage. Additionally, the platform supports collaboration, allowing you to invite team members to review or sign the document easily. These features enhance your overall document management experience.

-

Can I integrate airSlate SignNow with other applications for managing the 1095 C 2022 fillable form?

Absolutely! airSlate SignNow offers seamless integrations with numerous applications such as Salesforce, Google Drive, and more. This means you can manage your 1095 C 2022 fillable form alongside your existing workflows, ensuring a more efficient process and improved productivity.

-

What are the benefits of using airSlate SignNow for the 1095 C 2022 fillable form?

Using airSlate SignNow for the 1095 C 2022 fillable form provides numerous benefits, such as enhanced security, reduced processing time, and improved accuracy in document completion. The platform allows for instant eSigning, which helps speed up your workflow and ensures you meet tax deadlines effectively.

-

Is technical support available for issues related to the 1095 C 2022 fillable form?

Yes, airSlate SignNow offers comprehensive technical support for users experiencing issues with the 1095 C 2022 fillable form. Our support team is available to assist through chat, email, or phone, ensuring any challenges you face are quickly resolved. Your smooth experience is our priority!

Get more for Www uslegalforms comform library536160 irsIRS 1095 C Fill And Sign Printable Template Online

- Site work contract for contractor new york form

- Siding contract for contractor new york form

- Refrigeration contract for contractor new york form

- Drainage contract for contractor new york form

- New york contract 497321092 form

- Plumbing contract for contractor new york form

- Brick mason contract for contractor new york form

- Roofing contract for contractor new york form

Find out other Www uslegalforms comform library536160 irsIRS 1095 C Fill And Sign Printable Template Online

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF