943 Employers Annual Federal Tax Return IRS Tax Forms

What is the 943 Employers Annual Federal Tax Return?

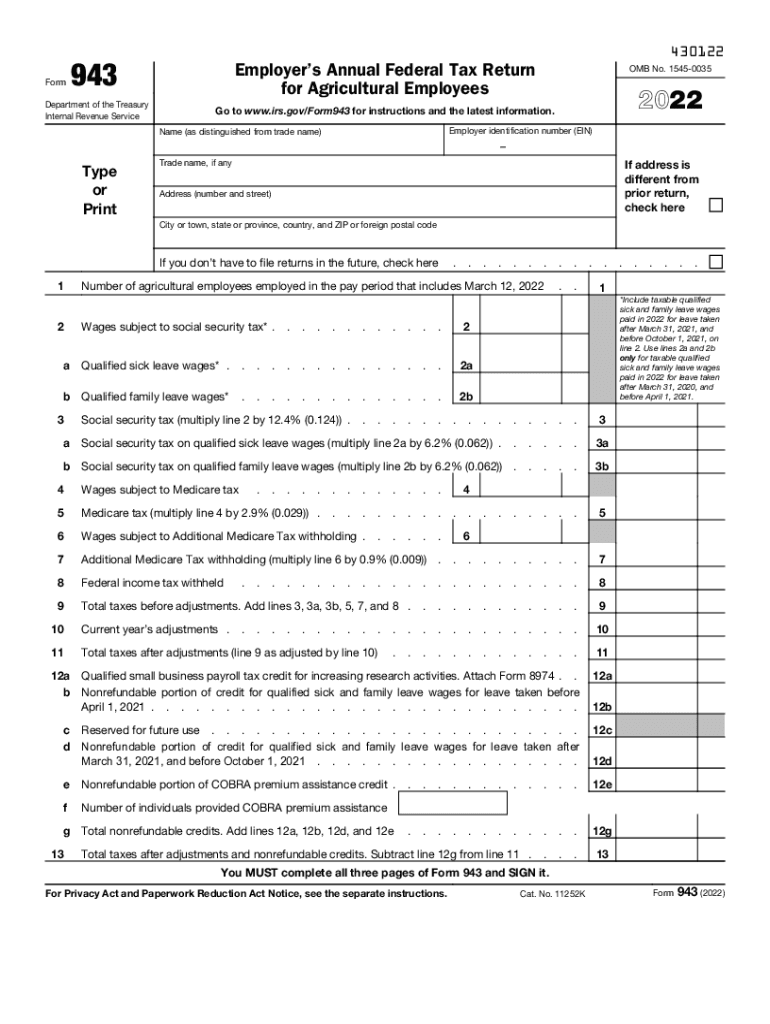

The 943 Employers Annual Federal Tax Return is a tax form used by agricultural employers in the United States to report income taxes withheld from employee wages. This form is essential for businesses that pay wages to farm workers and is filed annually with the Internal Revenue Service (IRS). The 943 form is specifically tailored for employers who are required to withhold federal income tax and Social Security tax from their employees' earnings. Understanding this form is crucial for compliance with federal tax regulations.

Steps to complete the 943 Employers Annual Federal Tax Return

Completing the 943 Employers Annual Federal Tax Return involves several key steps:

- Gather necessary information: Collect all relevant payroll records, including total wages paid, taxes withheld, and employee information.

- Fill out the form: Accurately complete all sections of the 943 form, ensuring that all figures are correct and reflect your payroll records.

- Review for accuracy: Double-check all entries for accuracy to avoid potential penalties or issues with the IRS.

- Submit the form: File the completed 943 form with the IRS by the designated deadline, either electronically or by mail.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the 943 Employers Annual Federal Tax Return. Typically, the form must be filed by January 31 of the following year for which the wages were paid. If January 31 falls on a weekend or holiday, the due date is extended to the next business day. Employers should also keep in mind any additional deadlines related to payments of withheld taxes.

Legal use of the 943 Employers Annual Federal Tax Return

The 943 form is legally required for agricultural employers who meet specific criteria set by the IRS. It serves as a formal declaration of the taxes withheld from employees' wages, ensuring compliance with federal tax laws. Failing to file the form or submitting inaccurate information can result in penalties, making it crucial for employers to understand their obligations under the law.

Form Submission Methods

Employers have several options for submitting the 943 Employers Annual Federal Tax Return. The form can be filed electronically through the IRS e-file system, which is often the preferred method for its speed and efficiency. Alternatively, employers can choose to mail the completed form to the appropriate IRS address. In-person submissions are typically not available for this form, so employers should ensure they use one of the two primary methods.

Key elements of the 943 Employers Annual Federal Tax Return

The 943 form includes several key elements that employers must complete:

- Employer information: This section requires the employer's name, address, and Employer Identification Number (EIN).

- Employee wages: Employers must report the total wages paid to employees during the tax year.

- Taxes withheld: This section details the federal income tax and Social Security tax withheld from employee wages.

- Signature: The form must be signed and dated by the employer or an authorized representative.

Quick guide on how to complete 943 employers annual federal tax return irs tax forms

Manage 943 Employers Annual Federal Tax Return IRS Tax Forms seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without complications. Handle 943 Employers Annual Federal Tax Return IRS Tax Forms on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign 943 Employers Annual Federal Tax Return IRS Tax Forms effortlessly

- Obtain 943 Employers Annual Federal Tax Return IRS Tax Forms and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize essential parts of the documents or obscure sensitive information with features that airSlate SignNow specifically offers for this purpose.

- Forge your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign 943 Employers Annual Federal Tax Return IRS Tax Forms and ensure outstanding communication at any phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for managing documents in 2022 for 943?

In 2022 for 943, airSlate SignNow provides a variety of features that streamline document management, such as eSignature capabilities, templates, and real-time tracking. These tools enable users to send, sign, and store documents effortlessly, optimizing workflows and ensuring compliance.

-

How does airSlate SignNow's pricing structure work for 2022 for 943?

airSlate SignNow offers flexible pricing plans tailored to different business needs in 2022 for 943. Customers can choose from monthly or annual subscriptions, allowing them to select the best option for their usage and budget while accessing all essential features.

-

What are the key benefits of using airSlate SignNow in 2022 for 943?

Using airSlate SignNow in 2022 for 943 provides businesses with signNow benefits, including increased productivity and reduced turnaround time for document signing. Additionally, the platform enhances collaboration and improves overall operational efficiency, making it an ideal choice for organizations of all sizes.

-

Is airSlate SignNow compatible with other software in 2022 for 943?

Yes, airSlate SignNow seamlessly integrates with several popular applications and platforms in 2022 for 943. This compatibility enables users to streamline their existing workflows by connecting with tools like Google Drive, Salesforce, and various CRM systems.

-

How secure is airSlate SignNow for sensitive documents in 2022 for 943?

airSlate SignNow prioritizes security with advanced encryption and robust compliance measures in 2022 for 943. Users can trust that their sensitive documents are protected, ensuring that all information remains confidential and compliant with industry regulations.

-

Can teams collaborate effectively using airSlate SignNow in 2022 for 943?

Absolutely! In 2022 for 943, airSlate SignNow allows teams to collaborate effectively by providing shared access to documents and enabling comments and feedback directly within the platform. This feature promotes teamwork and ensures that all stakeholders are involved in the document management process.

-

What support options are available for airSlate SignNow users in 2022 for 943?

In 2022 for 943, airSlate SignNow offers robust support options, including a knowledge base, live chat, and email support. This comprehensive assistance ensures that users can get help quickly and efficiently when they encounter any issues or have questions about the platform.

Get more for 943 Employers Annual Federal Tax Return IRS Tax Forms

Find out other 943 Employers Annual Federal Tax Return IRS Tax Forms

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement