APPLICATION for NONTAXABLE TRANSACTION CERTIFICATES 2022-2026

What is the application for nontaxable transaction certificates?

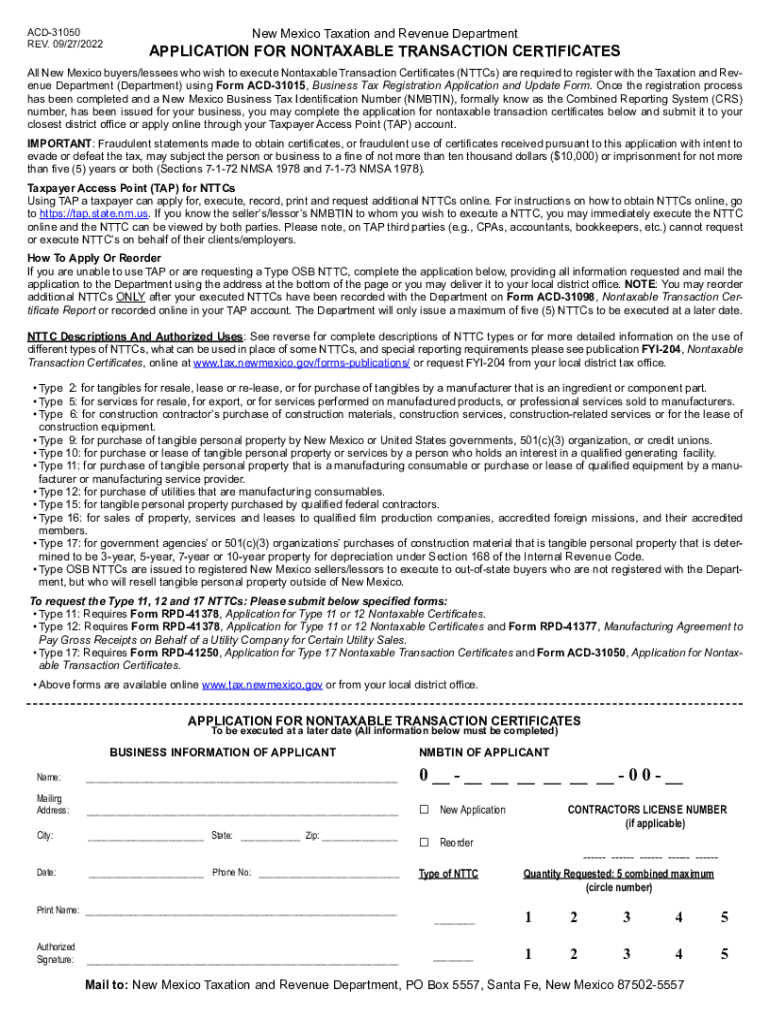

The application for nontaxable transaction certificates, often referred to as the ACD Form 31050, is a crucial document for businesses in New Mexico seeking to make tax-exempt purchases. This form allows eligible entities to apply for a certificate that exempts them from paying gross receipts tax on certain transactions. Understanding the purpose of this form is essential for businesses that engage in activities qualifying for tax exemption, such as purchasing goods for resale or specific types of services.

Steps to complete the application for nontaxable transaction certificates

Completing the ACD Form 31050 involves several key steps. First, gather all necessary information, including your business name, address, and tax identification number. Next, accurately fill out the form, ensuring that all details are correct and complete. After filling out the form, review it for any errors before submitting. It’s also important to retain a copy for your records. Once submitted, the New Mexico Taxation and Revenue Department will process your application, and you will receive your certificate if approved.

Eligibility criteria for the application for nontaxable transaction certificates

To qualify for a nontaxable transaction certificate, applicants must meet specific eligibility criteria. Generally, the applicant must be a registered business in New Mexico with a valid tax identification number. The purchases made under this certificate must be for resale or for specific exempt purposes as outlined by state regulations. It is advisable to consult the New Mexico Taxation and Revenue Department for detailed eligibility requirements to ensure compliance.

Legal use of the application for nontaxable transaction certificates

The legal use of the ACD Form 31050 is governed by New Mexico tax laws. Businesses must use the certificate responsibly, ensuring that it is only applied to qualifying purchases. Misuse of the certificate can lead to penalties, including back taxes and fines. Therefore, understanding the legal implications and adhering to the stipulations associated with the nontaxable transaction certificate is vital for maintaining compliance and avoiding legal issues.

Form submission methods for the application for nontaxable transaction certificates

Submitting the ACD Form 31050 can be done through various methods. Businesses can choose to submit the form online via the New Mexico Taxation and Revenue Department's website, by mail, or in person at designated offices. Each method has its own processing times and requirements, so it is advisable to select the one that best suits your business needs. Ensure that you keep a record of your submission for future reference.

Key elements of the application for nontaxable transaction certificates

Key elements of the ACD Form 31050 include the applicant’s business information, the type of exemption being requested, and a declaration of the intended use of the certificate. It is crucial to provide accurate and complete information to avoid delays in processing. Additionally, the form may require signatures from authorized representatives of the business, affirming the validity of the information provided.

Quick guide on how to complete application for nontaxable transaction certificates

Effortlessly Complete APPLICATION FOR NONTAXABLE TRANSACTION CERTIFICATES on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can easily access the right form and securely store it on the internet. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage APPLICATION FOR NONTAXABLE TRANSACTION CERTIFICATES on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-focused process today.

How to Alter and Electronically Sign APPLICATION FOR NONTAXABLE TRANSACTION CERTIFICATES Smoothly

- Locate APPLICATION FOR NONTAXABLE TRANSACTION CERTIFICATES and then click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or conceal sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and electronically sign APPLICATION FOR NONTAXABLE TRANSACTION CERTIFICATES and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the acd form 31050 and how can airSlate SignNow assist with it?

The acd form 31050 is a specific document required for various applications. With airSlate SignNow, you can easily customize, send, and eSign this form, ensuring compliance and efficiency in your workflow. This cost-effective solution simplifies the process, saving you time and reducing errors.

-

How much does airSlate SignNow cost for processing the acd form 31050?

Pricing for using airSlate SignNow to manage the acd form 31050 depends on the subscription plan you select. Our plans are designed to be affordable and scalable, accommodating businesses of any size. You can explore various options on our pricing page to find one that fits your needs.

-

What features does airSlate SignNow offer for the acd form 31050?

AirSlate SignNow includes numerous features for managing the acd form 31050, such as document templates, real-time tracking, and in-app notifications. You can also utilize advanced editing tools to customize the form according to your requirements. These features help streamline your processes and enhance productivity.

-

Can I integrate airSlate SignNow with other applications for handling the acd form 31050?

Yes, airSlate SignNow offers seamless integrations with many popular applications, allowing you to effectively manage the acd form 31050 alongside other tools you already use. Whether it's CRM, cloud storage, or project management software, our integrations help create a unified workflow for better efficiency.

-

What are the benefits of using airSlate SignNow for the acd form 31050?

Using airSlate SignNow for the acd form 31050 provides numerous benefits, including faster processing times, improved accuracy, and enhanced security. Our robust electronic signature platform ensures that your documents are signed legally and securely, giving you peace of mind. Plus, the intuitive interface makes it easy for anyone to use.

-

Is airSlate SignNow secure for signing the acd form 31050?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with various industry standards for handling documents such as the acd form 31050. We implement multiple layers of security to protect your data, ensuring that all signatures and transactions are safe and legitimate.

-

How can I track the status of my acd form 31050 using airSlate SignNow?

With airSlate SignNow, you can easily track the status of your acd form 31050 in real-time. The platform provides notifications and updates to keep you informed about who has signed, pending signatures, and completion status, enabling you to stay on top of important documents.

Get more for APPLICATION FOR NONTAXABLE TRANSACTION CERTIFICATES

- Letter from landlord to tenant as notice of default on commercial lease nevada form

- Residential or rental lease extension agreement nevada form

- Commercial rental lease application questionnaire nevada form

- Apartment lease rental application questionnaire nevada form

- Residential rental lease application nevada form

- Salary verification form for potential lease nevada

- Nv landlord tenant form

- Notice of default on residential lease nevada form

Find out other APPLICATION FOR NONTAXABLE TRANSACTION CERTIFICATES

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe