Www Tax Newmexico Gov INSTRUCTIONS for NONTAXABLE 2007

Understanding the ACD Form 31050

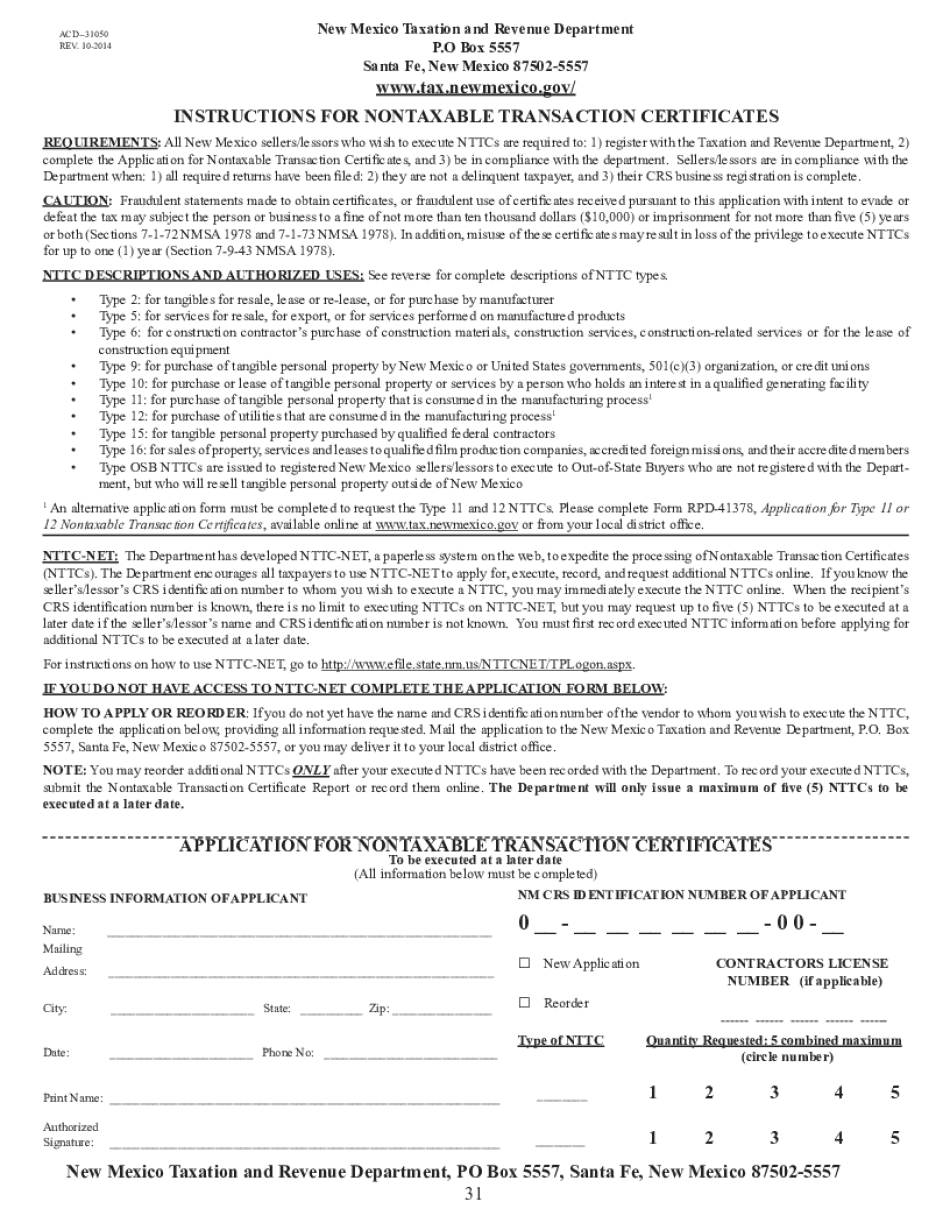

The ACD Form 31050 is a crucial document used in New Mexico for reporting transactions involving the sale or lease of property. This form serves as a seller's and lessor's copy for tax purposes, ensuring compliance with state taxation laws. It is essential for both individuals and businesses engaged in property transactions to accurately complete this form to avoid potential penalties.

Steps to Complete the ACD Form 31050

Completing the ACD Form 31050 involves several key steps:

- Gather necessary information, including property details, buyer or lessee information, and transaction amounts.

- Fill out the form accurately, ensuring all fields are completed, including the seller's and buyer's names, addresses, and the property description.

- Review the completed form for accuracy to prevent errors that could lead to tax complications.

- Submit the form to the appropriate tax authority as required, either electronically or by mail.

Required Documents for ACD Form 31050

When preparing to file the ACD Form 31050, certain documents are necessary to support the information provided:

- Proof of property ownership, such as a deed or title.

- Sales or lease agreements detailing the terms of the transaction.

- Identification documents for both the seller and buyer, such as driver's licenses or tax identification numbers.

Legal Use of the ACD Form 31050

The ACD Form 31050 is legally mandated for reporting sales and leases in New Mexico. Failing to file this form can lead to significant penalties, including fines and interest on unpaid taxes. It is important for taxpayers to understand their obligations under state law to ensure compliance and avoid legal issues.

Filing Deadlines for ACD Form 31050

Timely filing of the ACD Form 31050 is essential. The deadlines may vary based on the type of transaction and the specific tax year. Generally, forms should be submitted within a specified period following the transaction date. It is advisable to check with the New Mexico Taxation and Revenue Department for the most current deadlines to ensure compliance.

Examples of Using the ACD Form 31050

Here are a few scenarios where the ACD Form 31050 is applicable:

- A homeowner selling their property to a new buyer.

- A business leasing commercial space to a tenant.

- A real estate agent facilitating a property sale on behalf of a client.

Penalties for Non-Compliance with ACD Form 31050

Non-compliance with the requirements of the ACD Form 31050 can result in penalties imposed by the state. These may include fines, interest on overdue taxes, and potential legal action. It is critical for taxpayers to adhere to filing requirements to avoid these consequences.

Quick guide on how to complete www tax newmexico gov instructions for nontaxable

Complete Www tax newmexico gov INSTRUCTIONS FOR NONTAXABLE effortlessly on any device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Www tax newmexico gov INSTRUCTIONS FOR NONTAXABLE on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Www tax newmexico gov INSTRUCTIONS FOR NONTAXABLE with ease

- Obtain Www tax newmexico gov INSTRUCTIONS FOR NONTAXABLE and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Craft your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or disorganized documents, frustrating form navigation, or errors that require new document copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Www tax newmexico gov INSTRUCTIONS FOR NONTAXABLE and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the www tax newmexico gov instructions for nontaxable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the acd form 31050 and how can it be used?

The acd form 31050 is a specialized document used for various administrative tasks. With airSlate SignNow, you can easily fill, sign, and manage your acd form 31050 online, streamlining your workflows and ensuring efficient document processing.

-

How does airSlate SignNow enhance the acd form 31050 signing process?

airSlate SignNow offers a user-friendly interface that simplifies the signing process for your acd form 31050. By allowing multiple signers to collaborate in real-time, it reduces turnaround time and enhances overall productivity.

-

What are the pricing options for using airSlate SignNow for acd form 31050?

airSlate SignNow provides flexible pricing plans tailored to meet varied business needs. You can choose a plan that suits your usage of the acd form 31050, ensuring you receive great value for an efficient eSigning experience.

-

Are there any special features for managing the acd form 31050 on airSlate SignNow?

Yes, airSlate SignNow includes features such as customizable templates, document tracking, and automated workflows specifically for managing the acd form 31050. These tools help you stay organized and improve your document handling efficiency.

-

What benefits does airSlate SignNow provide for businesses using acd form 31050?

Using airSlate SignNow for your acd form 31050 brings numerous benefits, including faster processing times, reduced paper usage, and enhanced security. This eSigning solution helps businesses save time and resources while ensuring compliance.

-

Can I integrate airSlate SignNow with other applications for managing acd form 31050?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage your acd form 31050 alongside your existing tools. This integration facilitates smoother operation processes across your organization.

-

How does airSlate SignNow ensure the security of the acd form 31050?

AirSlate SignNow prioritizes security with features like encryption, secure access controls, and audit trails for the acd form 31050. These measures ensure that your documents remain safe while complying with industry standards.

Get more for Www tax newmexico gov INSTRUCTIONS FOR NONTAXABLE

Find out other Www tax newmexico gov INSTRUCTIONS FOR NONTAXABLE

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template