FORM 568 Limited Liability Company Return of Income , FORM 568, Limited Liability Company Return of Income 2021-2026

What is the FORM 568 Limited Liability Company Return Of Income

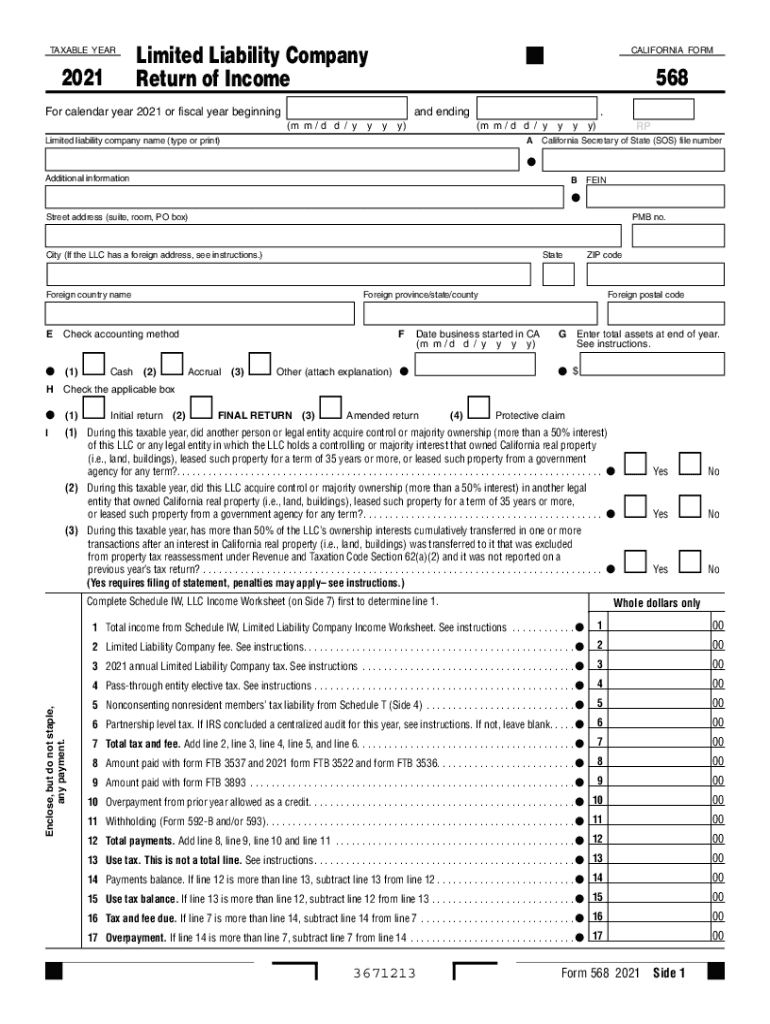

The FORM 568, known as the Limited Liability Company Return of Income, is a tax form used by limited liability companies (LLCs) in California to report their income, deductions, and other relevant financial information. This form is essential for LLCs as it helps the California Franchise Tax Board (FTB) assess the tax obligations of the business. It is crucial for compliance with state tax laws and must be filed annually by all LLCs doing business in California, regardless of whether they have income or not.

Steps to complete the FORM 568 Limited Liability Company Return Of Income

Completing the FORM 568 involves several key steps:

- Gather necessary financial records, including income statements, balance sheets, and any other documents that detail the LLC's financial activities for the year.

- Fill out the identification section of the form, including the LLC's name, address, and California Secretary of State file number.

- Report the LLC's income, deductions, and credits accurately in the respective sections of the form.

- Calculate the total tax owed based on the income reported and any applicable fees.

- Review the completed form for accuracy and ensure all required signatures are included.

- Submit the form either electronically or via mail to the appropriate address provided by the FTB.

Filing Deadlines / Important Dates

It is important for LLCs to be aware of the filing deadlines for FORM 568 to avoid penalties. The form is typically due on the 15th day of the fourth month after the close of the LLC's tax year. For most LLCs operating on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to check for any updates or changes to the deadlines each tax year.

Required Documents

To successfully complete FORM 568, several documents are necessary:

- Income statements detailing all revenue generated by the LLC.

- Expense records that outline all deductions the LLC intends to claim.

- Prior year tax returns, if applicable, to provide context for current filings.

- Any relevant documentation supporting credits or special deductions claimed on the form.

Penalties for Non-Compliance

Failure to file FORM 568 on time or inaccuracies in the form can lead to significant penalties. The California Franchise Tax Board may impose fines for late filings, which can accumulate over time. Additionally, if the form is not filed at all, the LLC may face further penalties and interest on unpaid taxes. It is essential for LLCs to ensure timely and accurate submissions to avoid these consequences.

Digital vs. Paper Version

FORM 568 can be completed and submitted either digitally or on paper. The digital version allows for easier data entry and may include features that help ensure accuracy, such as automatic calculations. Filing electronically is generally faster and can lead to quicker processing times. However, some LLCs may prefer the paper version for record-keeping purposes. Regardless of the method chosen, it is important to ensure that all information is accurate and complete.

Quick guide on how to complete 2021 form 568 limited liability company return of income 2021 form 568 limited liability company return of income

Effortlessly prepare FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools for you to create, edit, and electronically sign your documents swiftly and without delays. Manage FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-driven process today.

How to alter and electronically sign FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income with ease

- Obtain FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income and then click Get Form to initiate.

- Utilize the tools provided to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Choose how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Alter and electronically sign FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income to ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 568 limited liability company return of income 2021 form 568 limited liability company return of income

Create this form in 5 minutes!

People also ask

-

What is form 568 and why is it important for businesses?

Form 568 is a tax form used by LLCs in California to report their income and pay the necessary fees. Completing form 568 accurately is crucial for compliance with state tax regulations, avoiding penalties, and ensuring smooth financial operations for businesses.

-

How can airSlate SignNow help in preparing form 568?

airSlate SignNow simplifies the process of preparing form 568 by providing an easy-to-use platform for document management and eSigning. Users can quickly access templates, fill out the form, and obtain signatures, ensuring timely submission and compliance.

-

Is there a cost associated with using airSlate SignNow for form 568?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. Each plan provides access to essential features for managing documents like form 568, ensuring businesses can find a suitable option within their budget.

-

What features does airSlate SignNow offer for managing form 568?

airSlate SignNow includes features such as automated workflows, document templates, and real-time tracking for form 568. These tools enhance efficiency, making it easier for businesses to complete and manage their tax forms securely and accurately.

-

Can I integrate airSlate SignNow with other tools for form 568 management?

Absolutely! airSlate SignNow supports integrations with various third-party applications, allowing for seamless data transfer and document management related to form 568. This interoperability helps streamline your workflow and enhances productivity.

-

How does eSigning with airSlate SignNow work for form 568?

eSigning with airSlate SignNow for form 568 is a straightforward process. Users can send the form electronically to signers, who can review and sign it from anywhere, thus ensuring that the form is completed efficiently and securely.

-

What benefits can I expect from using airSlate SignNow for my form 568?

Using airSlate SignNow for your form 568 offers benefits such as reduced paperwork, faster processing times, and improved compliance with tax regulations. The solution maximizes efficiency by automating and streamlining document management.

Get more for FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income

- Legal last will and testament form for married person with adult children from prior marriage new york

- Legal last will and testament form for divorced person not remarried with adult children new york

- Legal last will and testament form for divorced person not remarried with no children new york

- Legal last will and testament form for divorced person not remarried with minor children new york

- Legal last will and testament form for divorced person not remarried with adult and minor children new york

- Mutual wills package with last wills and testaments for married couple with adult children new york form

- New york married couple form

- New york married couple 497322032 form

Find out other FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document