University of California Retirement Plan UCRPUCnetUniversity of California Retirement Plan UCRPUCnetUniversity of California Ret 2022-2026

Understanding the California Withholding Election

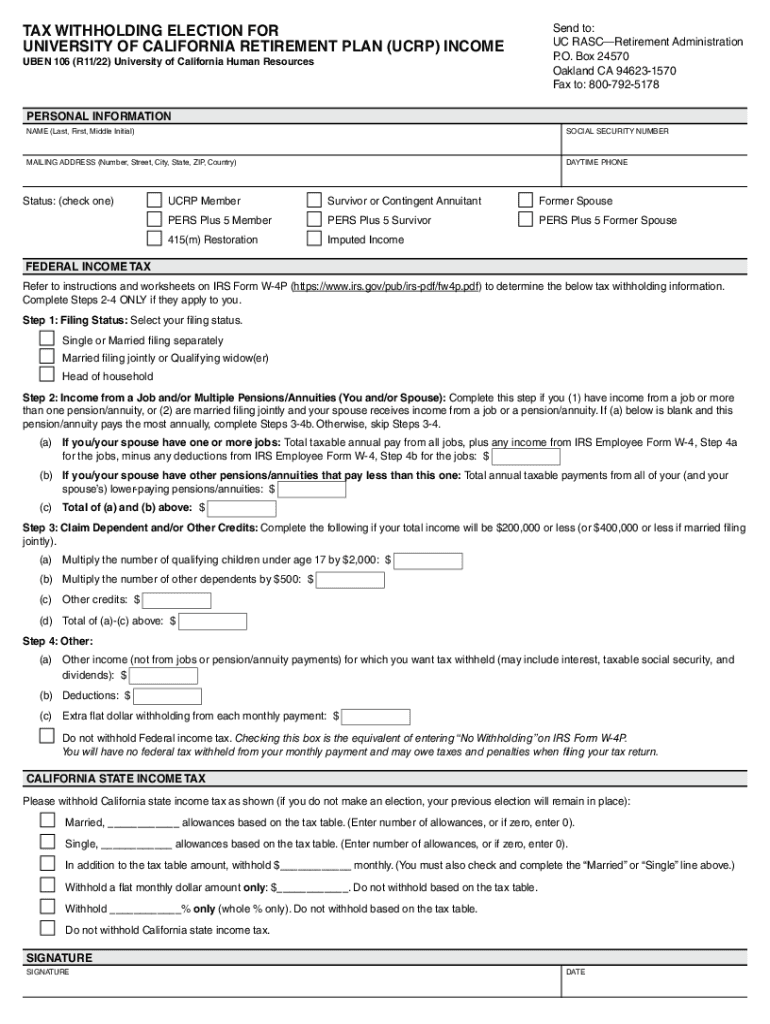

The California withholding election allows employees to choose how much state income tax is withheld from their paychecks. This option is particularly important for those who may have additional income or deductions that affect their overall tax liability. By making an informed decision regarding withholding, individuals can better manage their finances and avoid surprises during tax season.

Steps to Complete the California Withholding Election

Completing the California tax election form involves several straightforward steps. First, gather your personal information, including your Social Security number and filing status. Next, determine your expected income and deductions for the year. This will help you assess how much tax you should withhold. After that, fill out the CA tax election form accurately, ensuring all details are correct. Finally, submit the form to your employer, who will adjust your withholding accordingly.

Legal Use of the California Withholding Election

The California withholding election is legally binding when completed correctly. It is essential to ensure that the form is signed and dated to validate the election. Additionally, electronic signatures are acceptable under U.S. law, provided they comply with the ESIGN and UETA regulations. Using a secure eSignature platform can help maintain the integrity of your submission and ensure compliance with legal requirements.

Required Documents for the California Withholding Election

To complete the California withholding election, you will need specific documents. These include your Social Security number, details about your filing status, and any relevant income information. If you have multiple sources of income or expect significant changes in your financial situation, it may also be beneficial to have your prior year’s tax return on hand for reference.

IRS Guidelines for State Withholding Elections

While the California withholding election is state-specific, it is important to be aware of IRS guidelines regarding state tax withholding. The IRS provides general rules on how to determine the appropriate amount of withholding based on your total income and tax situation. Familiarizing yourself with these guidelines can help ensure that your California withholding election aligns with federal requirements.

Penalties for Non-Compliance with Withholding Elections

Failure to comply with the California withholding election can result in penalties. If you do not withhold enough tax throughout the year, you may face underpayment penalties when filing your state tax return. It is crucial to review your withholding regularly, especially if your financial situation changes, to avoid these potential penalties.

Quick guide on how to complete university of california retirement plan ucrpucnetuniversity of california retirement plan ucrpucnetuniversity of california

Effortlessly Complete University Of California Retirement Plan UCRPUCnetUniversity Of California Retirement Plan UCRPUCnetUniversity Of California Ret on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage University Of California Retirement Plan UCRPUCnetUniversity Of California Retirement Plan UCRPUCnetUniversity Of California Ret across any platform with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Simplest Way to Edit and eSign University Of California Retirement Plan UCRPUCnetUniversity Of California Retirement Plan UCRPUCnetUniversity Of California Ret with Ease

- Obtain University Of California Retirement Plan UCRPUCnetUniversity Of California Retirement Plan UCRPUCnetUniversity Of California Ret and click on Get Form to begin.

- Employ the tools we offer to complete your document.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Decide how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign University Of California Retirement Plan UCRPUCnetUniversity Of California Retirement Plan UCRPUCnetUniversity Of California Ret and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct university of california retirement plan ucrpucnetuniversity of california retirement plan ucrpucnetuniversity of california

Create this form in 5 minutes!

People also ask

-

What is a California withholding election?

A California withholding election is a process that allows employees to choose how much state income tax to withhold from their paychecks. By optimizing the withholding amounts, individuals can better manage their tax obligations and avoid over-withholding. Understanding this election is crucial for California residents to ensure they are compliant and efficient with their tax planning.

-

How does airSlate SignNow facilitate the California withholding election?

airSlate SignNow streamlines the process of submitting your California withholding election forms by providing a seamless eSigning experience. Users can easily send and eSign required documents electronically, ensuring timely submissions. This feature minimizes paperwork and helps maintain accurate records for California tax filings.

-

Are there any costs associated with using airSlate SignNow for a California withholding election?

Using airSlate SignNow comes with affordable pricing plans that cater to businesses of all sizes. Whether you're a freelancer or a corporate entity, our solutions are designed to be cost-effective while still offering extensive features for managing your California withholding election documents. Explore our pricing page for more details on subscription options.

-

What features does airSlate SignNow offer for managing withholding elections?

airSlate SignNow provides features including customizable templates, secure document storage, and automatic reminders to ensure your California withholding election forms are handled efficiently. Our platform allows for easy document sharing and collaboration, helping teams to stay organized and compliant. These features streamline workflow and reduce errors in the process.

-

Is airSlate SignNow compliant with California withholding requirements?

Yes, airSlate SignNow is fully compliant with California withholding requirements, ensuring that your documents meet all necessary regulations. Our platform keeps up with state laws, allowing you to focus on your business while we handle compliance. This assurance gives users peace of mind when filing their California withholding elections.

-

How does airSlate SignNow integrate with other tools for managing taxes?

airSlate SignNow offers robust integrations with several popular accounting and payroll software solutions. This ensures that your California withholding election data can seamlessly flow between systems, reducing manual entry and improving accuracy. By integrating your tools, you can maintain comprehensive tax records effortlessly.

-

Can I access airSlate SignNow on mobile for my California withholding election?

Absolutely! airSlate SignNow is accessible on both desktop and mobile devices, allowing you to manage your California withholding election documents anytime, anywhere. This flexibility ensures you can complete necessary tasks on the go, making your document management much more efficient and convenient.

Get more for University Of California Retirement Plan UCRPUCnetUniversity Of California Retirement Plan UCRPUCnetUniversity Of California Ret

Find out other University Of California Retirement Plan UCRPUCnetUniversity Of California Retirement Plan UCRPUCnetUniversity Of California Ret

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document