CA FTB Schedule 1067B Fill Out Tax US Legal Forms 2021-2026

What is the CA FTB Schedule 1067B?

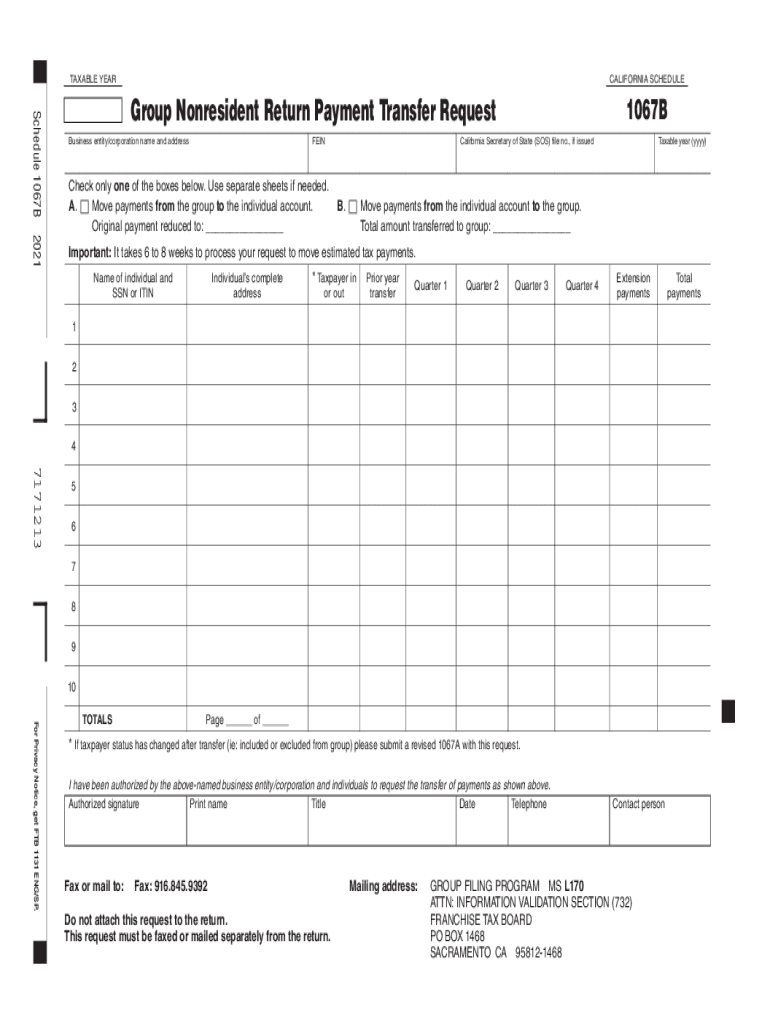

The California FTB Schedule 1067B is a tax form used for reporting nonresident income and calculating the corresponding tax obligations for individuals who earn income in California but reside elsewhere. This form is essential for ensuring compliance with California tax laws, particularly for nonresidents who have earned income from California sources. It is crucial for taxpayers to understand the purpose of this form, as it helps in determining the correct amount of tax owed to the state.

Steps to Complete the CA FTB Schedule 1067B

Completing the CA FTB Schedule 1067B involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to your income earned in California. This includes W-2 forms, 1099 forms, and any other relevant income statements. Next, fill out the form by accurately reporting your income, deductions, and credits. Be sure to double-check your calculations to avoid errors. Finally, review the completed form for completeness before submitting it to the California Franchise Tax Board.

Legal Use of the CA FTB Schedule 1067B

The legal use of the CA FTB Schedule 1067B is governed by California tax laws, which stipulate that nonresidents must report their California-source income. This form serves as a formal declaration of income and tax obligations, ensuring that taxpayers comply with state regulations. Failure to use this form correctly can result in penalties or legal repercussions, making it imperative for nonresidents to understand their responsibilities when filing.

Filing Deadlines / Important Dates

It is important for taxpayers to be aware of the filing deadlines associated with the CA FTB Schedule 1067B. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as any changes to deadlines that may occur due to special circumstances.

Required Documents

To complete the CA FTB Schedule 1067B, taxpayers must have several required documents on hand. These include:

- W-2 forms from employers indicating California income.

- 1099 forms for any freelance or contract work performed in California.

- Records of any other income earned from California sources.

- Documentation of deductions and credits that may apply.

Having these documents ready will facilitate a smoother and more accurate filing process.

Form Submission Methods

Taxpayers have several options for submitting the CA FTB Schedule 1067B. Forms can be filed online through the California Franchise Tax Board’s website, providing a convenient and efficient method. Alternatively, taxpayers may choose to mail their completed forms to the appropriate address designated by the FTB. In some cases, in-person submission may also be available at designated FTB offices. Each method has its own advantages, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete ca ftb schedule 1067b 2020 2022 fill out tax us legal forms

Complete CA FTB Schedule 1067B Fill Out Tax US Legal Forms easily on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without holdups. Manage CA FTB Schedule 1067B Fill Out Tax US Legal Forms on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to alter and eSign CA FTB Schedule 1067B Fill Out Tax US Legal Forms without hassle

- Locate CA FTB Schedule 1067B Fill Out Tax US Legal Forms and click Get Form to begin.

- Use the tools provided to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your device.

Eliminate concerns about lost or disorganized documents, tedious form searches, or errors requiring new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Edit and eSign CA FTB Schedule 1067B Fill Out Tax US Legal Forms and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca ftb schedule 1067b 2020 2022 fill out tax us legal forms

Create this form in 5 minutes!

People also ask

-

What is the 1067b feature in airSlate SignNow?

The 1067b feature in airSlate SignNow refers to a specific compliance option designed to streamline document signing processes. It helps businesses meet regulatory requirements with ease, ensuring secure and legally binding signatures.

-

How does airSlate SignNow pricing work for the 1067b feature?

airSlate SignNow offers competitive pricing for plans that include the 1067b feature. Users can select from various subscription levels, each tailored to meet the unique needs of businesses, including specific usage limits associated with the 1067b compliance.

-

What benefits does the 1067b feature offer for businesses?

The 1067b feature provides signNow benefits such as enhanced security and compliance for electronically signed documents. This not only helps in avoiding legal complications but also accelerates the signing process, improving overall business efficiency.

-

Can I integrate 1067b with other software solutions?

Yes, airSlate SignNow allows for easy integrations with various software solutions while utilizing the 1067b feature. This means you can streamline workflows across different platforms, enhancing productivity and reducing manual errors.

-

How does security work with the 1067b feature in airSlate SignNow?

The 1067b feature in airSlate SignNow employs advanced encryption and authentication methods to protect sensitive information. This ensures that all documents signed electronically remain secure, minimizing risks associated with data bsignNowes.

-

Is there a trial available for testing the 1067b feature?

AirSlate SignNow typically offers a free trial period where potential users can explore the 1067b feature. This trial allows businesses to evaluate its functionalities and see how it enhances their document signing processes.

-

What types of documents can utilize the 1067b feature?

The 1067b feature can be utilized for various document types, including contracts, agreements, and forms that require signatures. This versatility makes it suitable for diverse industries and administrative tasks.

Get more for CA FTB Schedule 1067B Fill Out Tax US Legal Forms

- Hunting forms package ohio

- Identity theft recovery package ohio form

- Durable power of attorney for health care ohio form

- Revocation of statutory durable power of attorney for health care ohio form

- Aging parent package ohio form

- Sale of a business package ohio form

- Legal documents for the guardian of a minor package ohio form

- Ohio new package form

Find out other CA FTB Schedule 1067B Fill Out Tax US Legal Forms

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form