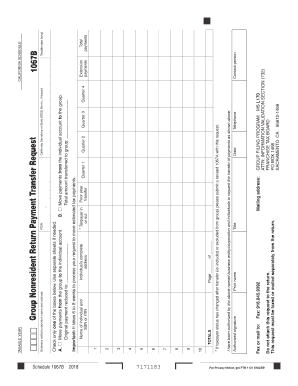

1067b 2018

What is the 1067b?

The CA Form 1067b, also known as the California Nonresident Return Payment Transfer Request, is a tax form used by nonresident individuals who need to request the transfer of payments related to their California income tax obligations. This form is essential for ensuring that nonresidents can properly manage their tax responsibilities while complying with state regulations. It provides a structured way to report income earned in California and request any necessary adjustments or transfers of payments.

How to use the 1067b

To effectively use the CA Form 1067b, individuals must first gather all relevant financial information, including income earned in California and any applicable deductions. The form requires specific details about the taxpayer, such as name, address, and Social Security number. Once the form is filled out, it can be submitted electronically through a secure platform, ensuring compliance with California tax laws. Utilizing an electronic signature solution can streamline the process, making it easier to manage and submit the form accurately.

Steps to complete the 1067b

Completing the CA Form 1067b involves several key steps:

- Gather Information: Collect all necessary documents, including income statements and previous tax returns.

- Fill Out the Form: Enter personal information and details regarding income earned in California.

- Review for Accuracy: Double-check all entries to ensure there are no errors.

- Sign and Submit: Use a reliable eSignature solution to sign the form digitally and submit it through the appropriate channels.

Legal use of the 1067b

The CA Form 1067b is legally recognized by the California Franchise Tax Board. It must be completed accurately and submitted within the designated time frame to avoid penalties. The form is designed to comply with state tax laws, allowing nonresidents to fulfill their tax obligations effectively. Utilizing electronic signatures on this form is accepted under the ESIGN Act, ensuring that digital submissions hold the same legal weight as traditional handwritten signatures.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the CA Form 1067b. Typically, the form must be submitted by the same deadlines as other California tax returns, which is usually April 15 for most individuals. However, extensions may be available under certain circumstances. Keeping track of these important dates helps ensure compliance and avoids potential late fees or penalties.

Required Documents

When completing the CA Form 1067b, several documents are required to support the information provided:

- Income statements from California sources.

- Previous year's tax returns, if applicable.

- Any relevant documentation for deductions or credits claimed.

Having these documents readily available can facilitate the completion of the form and ensure that all information is accurate and verifiable.

Quick guide on how to complete 2018 form 1067b nonresident return payment transfer request 2018 form 1067b nonresident return payment transfer request

Your assistance manual on how to prepare your 1067b

If you’re wondering how to finalize and submit your 1067b, here are a few quick pointers on how to streamline tax reporting.

Initially, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that enables you to modify, create, and complete your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, allowing you to revisit and amend responses as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to finalize your 1067b in minutes:

- Set up your account and start working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to open your 1067b in our editor.

- Complete the necessary fillable fields with your information (text entries, numbers, checkmarks).

- Employ the Sign Tool to affix your legally-binding eSignature (if required).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper can increase return errors and delay refunds. Of course, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 1067b nonresident return payment transfer request 2018 form 1067b nonresident return payment transfer request

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 1067b nonresident return payment transfer request 2018 form 1067b nonresident return payment transfer request

How to generate an electronic signature for your 2018 Form 1067b Nonresident Return Payment Transfer Request 2018 Form 1067b Nonresident Return Payment Transfer Request online

How to generate an electronic signature for the 2018 Form 1067b Nonresident Return Payment Transfer Request 2018 Form 1067b Nonresident Return Payment Transfer Request in Google Chrome

How to generate an eSignature for putting it on the 2018 Form 1067b Nonresident Return Payment Transfer Request 2018 Form 1067b Nonresident Return Payment Transfer Request in Gmail

How to create an electronic signature for the 2018 Form 1067b Nonresident Return Payment Transfer Request 2018 Form 1067b Nonresident Return Payment Transfer Request right from your smartphone

How to make an eSignature for the 2018 Form 1067b Nonresident Return Payment Transfer Request 2018 Form 1067b Nonresident Return Payment Transfer Request on iOS

How to create an eSignature for the 2018 Form 1067b Nonresident Return Payment Transfer Request 2018 Form 1067b Nonresident Return Payment Transfer Request on Android devices

People also ask

-

What is the 1067b feature in airSlate SignNow?

The 1067b feature in airSlate SignNow enhances document signing efficiency by providing advanced eSignature capabilities. This allows users to create, send, and manage documents seamlessly while ensuring compliance and security. Businesses can benefit from this feature by streamlining their workflow and reducing turnaround times.

-

How does airSlate SignNow's 1067b compare in pricing with other eSignature solutions?

airSlate SignNow's pricing for the 1067b feature is highly competitive compared to other eSignature solutions. We offer flexible pricing plans that cater to businesses of all sizes, ensuring you get the most value for your investment. With cost-effective options, users can leverage the 1067b capabilities without breaking the bank.

-

What are the benefits of using the 1067b feature in airSlate SignNow?

The 1067b feature in airSlate SignNow provides multiple benefits, including improved document turnaround time and enhanced security measures. Users can easily track document statuses and receive notifications, ensuring a smoother signing process. This level of efficiency can drastically improve overall business productivity.

-

Can I integrate 1067b with other software tools?

Yes, airSlate SignNow's 1067b feature offers seamless integrations with popular software tools like CRM systems, project management apps, and cloud storage services. This flexibility allows businesses to incorporate eSigning directly into their existing workflows. Integrating 1067b enhances collaboration and ensures documents are easily accessible.

-

Is there a free trial available for the 1067b feature in airSlate SignNow?

Absolutely! airSlate SignNow offers a free trial that includes access to the 1067b feature, allowing prospective customers to explore its capabilities without any commitment. This trial period enables users to experience firsthand how 1067b can enhance their document signing processes.

-

What types of documents can I sign using 1067b in airSlate SignNow?

Using the 1067b feature in airSlate SignNow, you can sign a variety of document types, including contracts, agreements, and forms. The platform supports various file formats, making it easy to manage all your signing needs in one place. This versatility makes 1067b a perfect solution for businesses in any industry.

-

How secure is the 1067b feature in airSlate SignNow?

The 1067b feature in airSlate SignNow is built with robust security measures to protect your documents and signatures. It implements encryption, secure access protocols, and compliant processes to ensure your data remains safe and confidential. Trust in 1067b for a secure eSigning experience.

Get more for 1067b

Find out other 1067b

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online