IRS Form 4506 C "Ives Request for Transcript of Tax Return" 2022-2026

What is the IRS Form 4506 C?

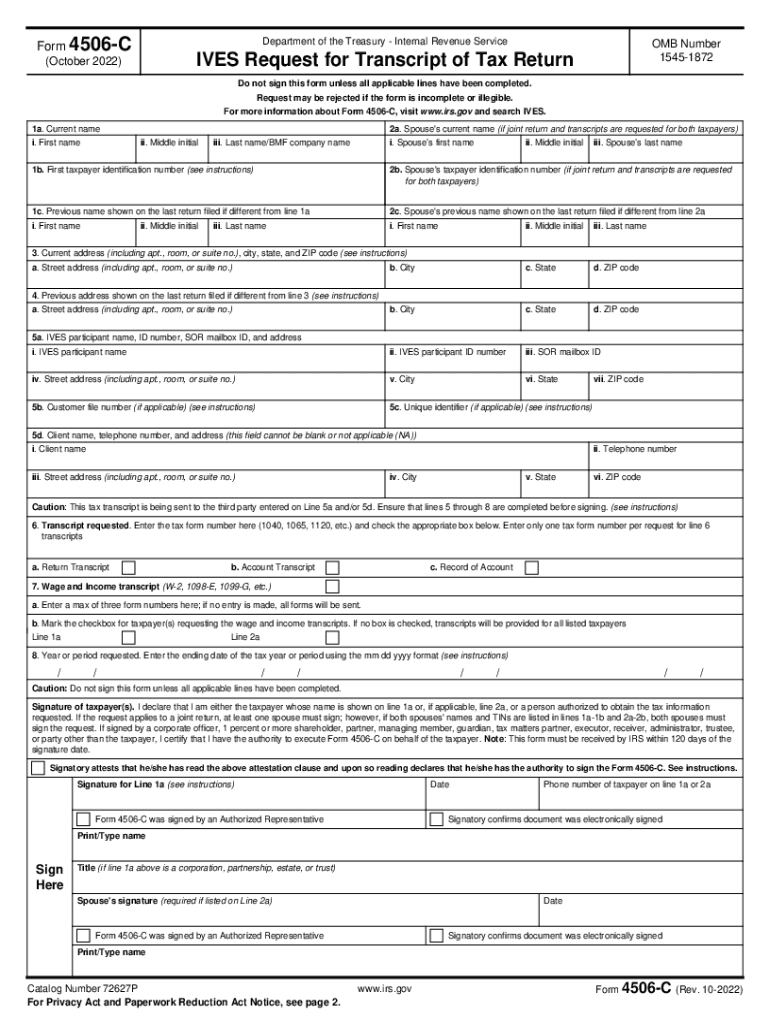

The IRS Form 4506 C, also known as the "Ives Request for Transcript of Tax Return," is a document used by taxpayers to request a transcript of their tax return information. This form is particularly useful for individuals or businesses needing to verify income or tax filing status for various purposes, such as applying for loans or mortgages. The 4506 C allows the IRS to send the requested information directly to a third party, such as a lender, ensuring a streamlined process for obtaining essential financial documentation.

How to use the IRS Form 4506 C

Using the IRS Form 4506 C involves a straightforward process. First, complete the form by providing your personal information, including your name, Social Security number, and address. Specify the type of transcript you need and the tax years for which you are requesting information. After filling out the form, sign and date it before submitting it to the IRS or the designated third party. It is important to ensure that all information is accurate to avoid delays in processing your request.

Steps to complete the IRS Form 4506 C

Completing the IRS Form 4506 C requires careful attention to detail. Follow these steps:

- Enter your name and Social Security number in the designated fields.

- Provide your address, including any previous addresses if applicable.

- Indicate the type of transcript you are requesting, such as a tax return or account transcript.

- Specify the tax years for which you need the transcripts.

- Include the name and address of the third party receiving the transcript, if applicable.

- Sign and date the form to validate your request.

Legal use of the IRS Form 4506 C

The IRS Form 4506 C is legally binding when completed and submitted correctly. It serves as an official request for tax information, allowing the IRS to release your tax records to a third party with your consent. This form must be used in compliance with IRS regulations to ensure that sensitive information is shared securely and appropriately. Misuse of the form can lead to legal consequences, including penalties for unauthorized disclosure of tax information.

Required Documents

When submitting the IRS Form 4506 C, it is essential to have certain documents ready. While the form itself does not require additional documentation, having your tax returns, identification, and any relevant financial statements can facilitate the process. If you are requesting transcripts for a third party, ensure that you have their consent and any necessary identification documents to confirm their identity.

Form Submission Methods

The IRS Form 4506 C can be submitted through various methods. You can send it via mail to the appropriate IRS address based on your location. Some financial institutions may allow you to submit the form electronically, directly through their systems. It is crucial to verify the submission method accepted by the recipient to ensure timely processing of your request. Always keep a copy of the submitted form for your records.

Quick guide on how to complete irs form 4506 c ampquotives request for transcript of tax returnampquot

Effortlessly Prepare IRS Form 4506 C "Ives Request For Transcript Of Tax Return" on Any Device

Digital document management has become popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage IRS Form 4506 C "Ives Request For Transcript Of Tax Return" on any device using airSlate SignNow’s Android or iOS applications, and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign IRS Form 4506 C "Ives Request For Transcript Of Tax Return" with Ease

- Find IRS Form 4506 C "Ives Request For Transcript Of Tax Return" and press Get Form to begin.

- Utilize our tools to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes just moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Say goodbye to lost or misfiled documents, the hassle of searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign IRS Form 4506 C "Ives Request For Transcript Of Tax Return" to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 4506 c ampquotives request for transcript of tax returnampquot

Create this form in 5 minutes!

People also ask

-

What is the purpose of the 4506 C form?

The 4506 C form is a request for the IRS to provide a copy of a tax return or tax information. It is commonly used by lenders to verify a borrower's income and financial history. By using the airSlate SignNow platform, you can easily eSign and manage your 4506 C form, streamlining the verification process.

-

How can airSlate SignNow help with the 4506 C form?

airSlate SignNow offers an intuitive interface for creating and eSigning your 4506 C form. This simplifies the process, ensuring that you can quickly collect necessary signatures and submit the form to the IRS without any hassle. The platform provides secure and efficient document management to keep your information safe.

-

Is there a cost associated with using airSlate SignNow for the 4506 C form?

Yes, airSlate SignNow operates on a subscription model with several pricing plans suited for different business needs. Each plan allows you to eSign and manage multiple documents, including the 4506 C form, making it a cost-effective solution for businesses of any size. Check our website for the latest pricing options.

-

Can the 4506 C form be integrated with other software through airSlate SignNow?

Absolutely! airSlate SignNow offers various integrations with popular software and CRM systems, making it easy to incorporate the 4506 C form into your existing workflow. This allows for seamless data transfer and enhances efficiency when handling important documents.

-

What security measures are in place for the 4506 C form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you eSign a 4506 C form through our platform, your data is protected with industry-standard encryption and secure cloud storage. We comply with all relevant regulations to ensure your sensitive information remains confidential.

-

How quickly can I complete the 4506 C form using airSlate SignNow?

With airSlate SignNow, you can complete the 4506 C form in a matter of minutes. The user-friendly interface allows you to fill out, eSign, and send the form quickly, speeding up the entire process of tax return verification. Our goal is to help you save time and enhance productivity.

-

Can I track the status of my 4506 C form with airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities for all your documents, including the 4506 C form. You'll receive notifications when your document is viewed, signed, or completed, ensuring you stay informed throughout the process and enabling better document management.

Get more for IRS Form 4506 C "Ives Request For Transcript Of Tax Return"

- Oklahoma postnuptial agreement form

- Oklahoma property search form

- Oklahoma postnuptial 497322799 form

- Quitclaim deed from husband and wife to an individual oklahoma form

- Warranty deed from husband and wife to an individual oklahoma form

- Order to answer interrogatories oklahoma form

- Ok lien 497322803 form

- Renunciation and disclaimer of property from will by testate oklahoma form

Find out other IRS Form 4506 C "Ives Request For Transcript Of Tax Return"

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free

- Sign Tennessee Joint Venture Agreement Template Free

- How Can I Sign South Dakota Budget Proposal Template

- Can I Sign West Virginia Budget Proposal Template

- Sign Alaska Debt Settlement Agreement Template Free

- Help Me With Sign Alaska Debt Settlement Agreement Template

- How Do I Sign Colorado Debt Settlement Agreement Template

- Can I Sign Connecticut Stock Purchase Agreement Template

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later