PENNSYLVANIA EXEMPTION CERTIFICATE This Form Cannot Be Used to Studylib 2022-2026

Understanding the Pennsylvania Exemption Certificate

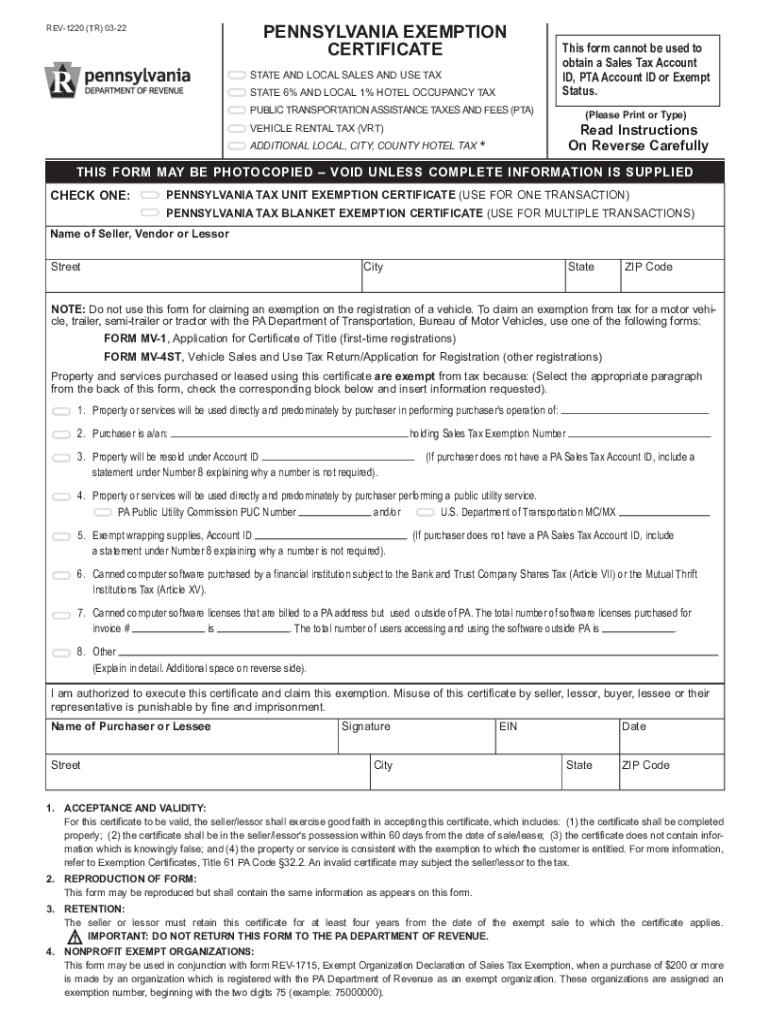

The Pennsylvania exemption certificate is a crucial document for businesses and individuals seeking to claim tax-exempt status for certain purchases. This form allows eligible entities to avoid paying sales tax on qualifying items. The exemption certificate is particularly relevant for organizations such as non-profits, government entities, and educational institutions. It is essential to understand the specific criteria that qualify a purchase as tax-exempt under Pennsylvania law.

Steps to Complete the Pennsylvania Exemption Certificate

Completing the Pennsylvania exemption certificate involves several key steps to ensure accuracy and compliance. First, obtain the correct form, typically the PA REV-1220. Next, fill in the required information, including the purchaser's name, address, and the nature of the exemption. Be sure to specify the type of exemption being claimed and provide any relevant identification numbers. Finally, sign and date the certificate to validate it. Ensure that all information is accurate to avoid potential issues during audits or inspections.

Eligibility Criteria for the Pennsylvania Exemption Certificate

To qualify for the Pennsylvania exemption certificate, certain eligibility criteria must be met. Generally, organizations that are exempt from sales tax include non-profit entities, government agencies, and educational institutions. Additionally, specific purchases, such as items used directly in manufacturing or research, may also qualify for exemption. It is important to review the Pennsylvania Department of Revenue guidelines to confirm eligibility and ensure compliance with state regulations.

Legal Use of the Pennsylvania Exemption Certificate

The legal use of the Pennsylvania exemption certificate is governed by state tax laws. This document must be used solely for qualifying purchases, and misuse can lead to penalties. The certificate serves as proof that the purchaser is exempt from sales tax on specific transactions. It is advisable to keep accurate records of all transactions involving the exemption certificate to support claims during audits. Understanding the legal implications of using this form is vital for maintaining compliance with Pennsylvania tax laws.

Required Documents for the Pennsylvania Exemption Certificate

When applying for or using the Pennsylvania exemption certificate, certain documents may be required. These typically include proof of the entity's exempt status, such as a 501(c)(3) determination letter for non-profits, or a government-issued identification number for public agencies. Additionally, businesses may need to provide documentation that outlines the nature of the exempt purchases. Having these documents readily available can streamline the process and ensure compliance with state regulations.

Form Submission Methods for the Pennsylvania Exemption Certificate

The Pennsylvania exemption certificate can be submitted through various methods, depending on the specific needs of the purchaser. Typically, the form can be provided directly to the vendor at the time of purchase. Some businesses may also accept the certificate via mail or electronically. It is important to confirm with the vendor their preferred submission method to ensure that the exemption is recognized and processed correctly.

Examples of Using the Pennsylvania Exemption Certificate

There are several scenarios in which the Pennsylvania exemption certificate can be utilized effectively. For instance, a non-profit organization purchasing office supplies for its operations can present the exemption certificate to avoid paying sales tax. Similarly, a government agency acquiring equipment for public use may use the certificate to claim tax-exempt status on that purchase. Understanding how to apply the exemption certificate in real-world situations can help entities maximize their tax savings and ensure compliance.

Quick guide on how to complete pennsylvania exemption certificate this form cannot be used to studylib

Finalize PENNSYLVANIA EXEMPTION CERTIFICATE This Form Cannot Be Used To Studylib seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle PENNSYLVANIA EXEMPTION CERTIFICATE This Form Cannot Be Used To Studylib on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign PENNSYLVANIA EXEMPTION CERTIFICATE This Form Cannot Be Used To Studylib effortlessly

- Obtain PENNSYLVANIA EXEMPTION CERTIFICATE This Form Cannot Be Used To Studylib and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow covers all your needs in document management with just a few clicks from any device you prefer. Edit and eSign PENNSYLVANIA EXEMPTION CERTIFICATE This Form Cannot Be Used To Studylib and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pennsylvania exemption certificate this form cannot be used to studylib

Create this form in 5 minutes!

People also ask

-

What is a Pennsylvania exemption certificate?

A Pennsylvania exemption certificate is a document that allows businesses to make tax-exempt purchases in the state of Pennsylvania. This certificate is essential for organizations that qualify for tax exemptions, helping them save on sales tax. By using the Pennsylvania exemption certificate, businesses can streamline their purchasing processes and reduce overall costs.

-

How can airSlate SignNow assist with Pennsylvania exemption certificates?

airSlate SignNow provides an intuitive platform for creating, sending, and eSigning Pennsylvania exemption certificates. Our solution simplifies the documentation process, allowing users to manage and store these essential forms securely. With airSlate SignNow, you can ensure that your exemption certificates are processed efficiently, saving both time and resources.

-

Are there any costs associated with using airSlate SignNow for Pennsylvania exemption certificates?

airSlate SignNow offers a cost-effective solution for managing Pennsylvania exemption certificates, with various pricing plans to fit different business needs. Our platform ensures that you have access to powerful features without breaking the bank. With a subscription, businesses can efficiently handle exemption certificates while enjoying additional functionalities that enhance productivity.

-

What are the key features of airSlate SignNow related to Pennsylvania exemption certificates?

Key features of airSlate SignNow for managing Pennsylvania exemption certificates include customizable templates, real-time tracking, and user-friendly eSignature capabilities. Our platform allows businesses to streamline their documentation workflow, ensuring compliance with state regulations. Additionally, automatic reminders help users stay on top of required actions for their exemption certificates.

-

How do I create a Pennsylvania exemption certificate using airSlate SignNow?

Creating a Pennsylvania exemption certificate with airSlate SignNow is simple. Users can start by selecting a customizable template, filling in the required information, and then sending it out for eSignature. Our platform ensures the process is quick and easy, allowing you to focus on your core business activities.

-

Can I integrate airSlate SignNow with other platforms for managing Pennsylvania exemption certificates?

Yes, airSlate SignNow seamlessly integrates with various platforms to enhance the management of Pennsylvania exemption certificates. Our integrations allow users to connect with CRM systems, accounting software, and cloud storage solutions. This connectivity enables a streamlined workflow, ensuring all documents are easily accessible and organized.

-

What benefits do I gain by using airSlate SignNow for my Pennsylvania exemption certificate needs?

Using airSlate SignNow for your Pennsylvania exemption certificate needs provides numerous benefits, including time savings, cost efficiency, and enhanced document security. Our platform simplifies the eSigning process, reducing paperwork and improving compliance. Furthermore, businesses can improve collaboration and ensure faster processing times, leading to increased productivity.

Get more for PENNSYLVANIA EXEMPTION CERTIFICATE This Form Cannot Be Used To Studylib

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return louisiana form

- Letter from tenant to landlord containing request for permission to sublease louisiana form

- Louisiana damages form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable louisiana form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration 497308510 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497308511 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement louisiana form

Find out other PENNSYLVANIA EXEMPTION CERTIFICATE This Form Cannot Be Used To Studylib

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile