REV 1220 TR 05 20 FI 2020

What is the REV 1220 TR 05 20 FI?

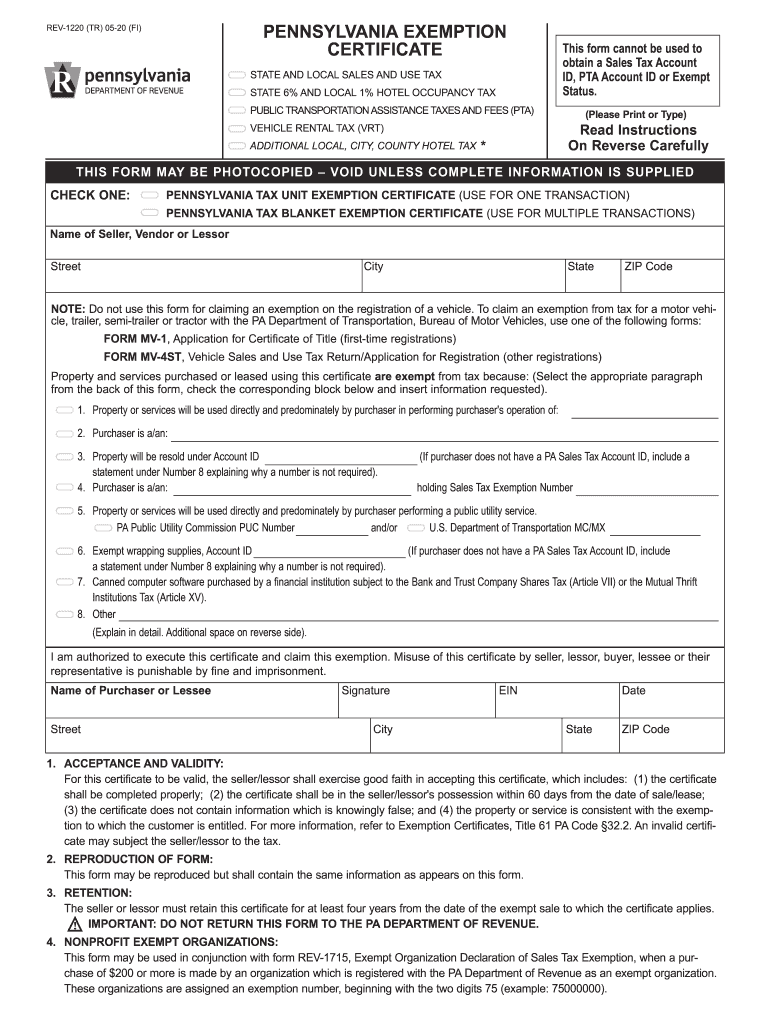

The REV 1220 TR 05 20 FI is a Pennsylvania tax exemption certificate form utilized by businesses and organizations to claim exemption from sales tax. This form is essential for entities that qualify under specific categories, such as non-profit organizations, government agencies, and certain educational institutions. By completing this form, eligible entities can avoid paying sales tax on purchases related to their exempt purposes. Understanding the purpose and requirements of the REV 1220 is crucial for compliance with Pennsylvania tax regulations.

Steps to Complete the REV 1220 TR 05 20 FI

Completing the REV 1220 TR 05 20 FI involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including the entity's name, address, and tax identification number. Next, identify the specific exemption category that applies to your organization. Carefully fill out the form, ensuring all fields are completed accurately. Once the form is filled out, it must be signed by an authorized representative of the entity. Finally, retain a copy for your records and provide the completed form to vendors to claim the sales tax exemption.

Legal Use of the REV 1220 TR 05 20 FI

The legal use of the REV 1220 TR 05 20 FI is governed by Pennsylvania state tax laws. This form is legally binding when completed correctly and used by eligible entities. Misuse of the form, such as submitting it without proper eligibility, can result in penalties and back taxes owed. It is essential to understand the legal implications of using this form and to ensure that it is only used for qualifying purchases. Compliance with state regulations helps maintain the integrity of the tax exemption process.

Eligibility Criteria for the REV 1220 TR 05 20 FI

Eligibility for the REV 1220 TR 05 20 FI is determined by specific criteria set forth by the Pennsylvania Department of Revenue. Generally, organizations that qualify include non-profit entities, government agencies, and educational institutions. To be eligible, the organization must be established for a purpose that aligns with the tax-exempt categories defined by state law. It is important to review these criteria carefully to ensure that your organization qualifies before submitting the form.

Form Submission Methods

The REV 1220 TR 05 20 FI can be submitted through various methods, including online, by mail, or in-person. For online submissions, organizations may use the Pennsylvania Department of Revenue's electronic filing system, which streamlines the process. Alternatively, the form can be printed and mailed to the appropriate tax office or delivered in person. Each submission method has its own processing times, so it is advisable to choose the method that best suits your needs and timelines.

Key Elements of the REV 1220 TR 05 20 FI

Key elements of the REV 1220 TR 05 20 FI include essential information that must be accurately provided for the form to be valid. This includes the entity's name, address, tax identification number, and the specific reason for claiming the exemption. Additionally, the form requires a signature from an authorized representative, affirming that the information provided is true and accurate. Ensuring that all key elements are correctly filled out is critical for the form's acceptance by vendors and tax authorities.

Quick guide on how to complete rev 1220 tr 05 20 fi

Complete REV 1220 TR 05 20 FI effortlessly on any device

Managing documents online has become popular among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Administer REV 1220 TR 05 20 FI on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The simplest method to alter and eSign REV 1220 TR 05 20 FI with ease

- Obtain REV 1220 TR 05 20 FI and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign REV 1220 TR 05 20 FI and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rev 1220 tr 05 20 fi

Create this form in 5 minutes!

How to create an eSignature for the rev 1220 tr 05 20 fi

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What is a PA tax exempt form and how does airSlate SignNow help?

A PA tax exempt form is a document utilized to claim exemption from Pennsylvania sales tax for eligible purchases. airSlate SignNow simplifies the process by allowing you to create, send, and eSign these forms effortlessly, ensuring compliance and efficiency.

-

How much does it cost to use airSlate SignNow for managing PA tax exempt forms?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can utilize the platform for managing PA tax exempt forms at a cost-effective rate, ensuring that you receive maximum value without compromising on features.

-

Can I integrate airSlate SignNow with other tools for my PA tax exempt forms?

Yes, airSlate SignNow provides seamless integrations with various business applications, which can help you manage your PA tax exempt forms more efficiently. By connecting with tools like CRM, accounting software, and document management systems, you can streamline your workflow.

-

What features does airSlate SignNow offer for PA tax exempt forms?

airSlate SignNow offers features like customizable templates, electronic signatures, and automated reminders specifically tailored for PA tax exempt forms. These features enhance the signing experience and ensure that your documents are processed quickly.

-

How does airSlate SignNow ensure the security of my PA tax exempt forms?

Security is a top priority at airSlate SignNow. Your PA tax exempt forms are protected with advanced encryption and secure storage, ensuring that sensitive information remains confidential during the signing process.

-

Is it easy for my clients to sign PA tax exempt forms using airSlate SignNow?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for your clients to eSign PA tax exempt forms from any device. The intuitive interface and simple navigation ensure a smooth signing experience.

-

Can I track the status of my PA tax exempt forms with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents, including your PA tax exempt forms. You can easily monitor who has viewed or signed the document, helping you stay organized and informed.

Get more for REV 1220 TR 05 20 FI

Find out other REV 1220 TR 05 20 FI

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors