Federal Form 433 D Installment Agreement TaxFormFinder 2022-2026

What is the Federal Form 433 D Installment Agreement?

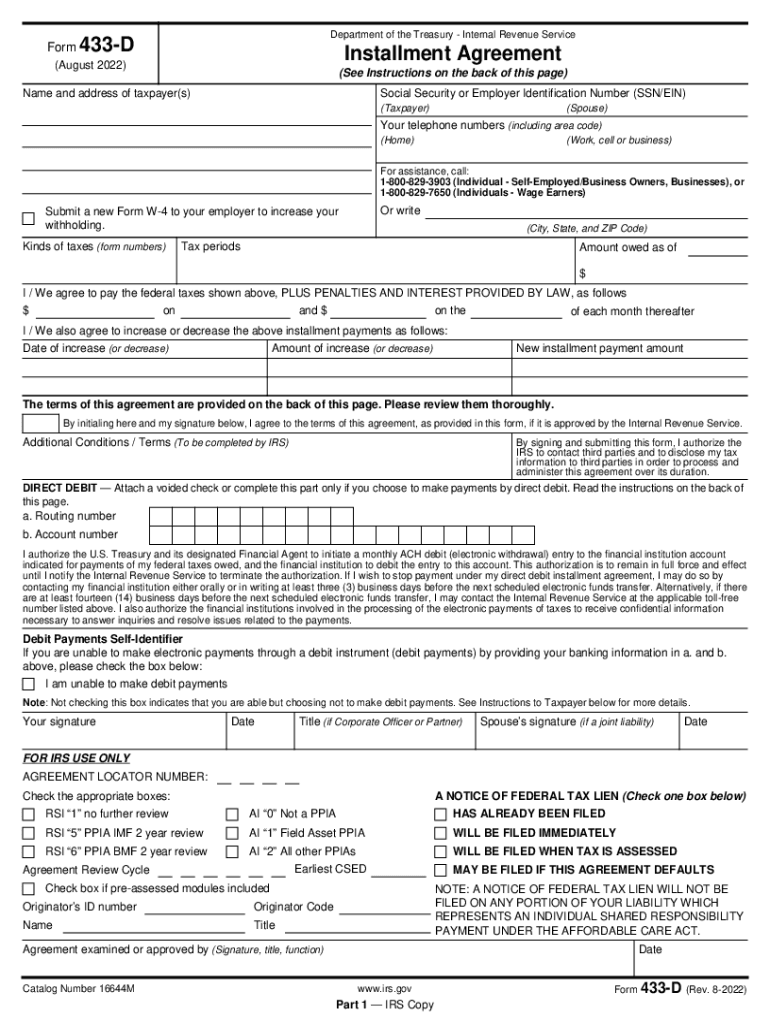

The Federal Form 433 D is an installment agreement that allows taxpayers to pay their tax liabilities over time. This form is used when a taxpayer cannot pay their full tax debt immediately and seeks to establish a payment plan with the IRS. By completing this form, individuals can propose a monthly payment amount based on their financial situation. The IRS reviews the proposal and, if accepted, the taxpayer is allowed to make regular payments until the debt is settled.

Steps to Complete the Federal Form 433 D Installment Agreement

Completing the Federal Form 433 D requires careful attention to detail. Here are the essential steps:

- Gather necessary financial information, including income, expenses, and assets.

- Fill out the form accurately, ensuring all sections are completed, including your personal information and proposed payment amounts.

- Review the completed form for any errors or omissions.

- Sign and date the form to validate your agreement.

- Submit the form to the IRS through the appropriate channels, either online or via mail.

Key Elements of the Federal Form 433 D Installment Agreement

Understanding the key elements of the Federal Form 433 D is crucial for successful completion. Important components include:

- Personal Information: Your name, Social Security number, and address.

- Financial Disclosure: Details about your income, expenses, and assets to demonstrate your ability to pay.

- Proposed Payment Plan: The amount you can afford to pay monthly and the duration of the payment plan.

- Signature: Your signature confirms your agreement to the terms outlined in the form.

Eligibility Criteria for the Federal Form 433 D Installment Agreement

To qualify for the Federal Form 433 D installment agreement, taxpayers must meet specific eligibility criteria. These include:

- Having a tax liability that is not currently in collections.

- Demonstrating an inability to pay the full amount due immediately.

- Providing accurate financial information to support the proposed payment plan.

- Agreeing to comply with all terms set forth by the IRS in the installment agreement.

Form Submission Methods

Taxpayers can submit the Federal Form 433 D through various methods. These include:

- Online Submission: Using the IRS online portal for electronic submission.

- Mail: Sending a completed paper form to the designated IRS address.

- In-Person: Visiting a local IRS office to submit the form directly.

IRS Guidelines for Installment Agreements

The IRS provides specific guidelines for taxpayers seeking installment agreements. These guidelines include:

- Requirements for financial disclosure and documentation.

- Information on the minimum monthly payment amounts.

- Details on maintaining compliance throughout the payment period.

- Consequences for failing to adhere to the agreement terms, such as potential penalties or collection actions.

Quick guide on how to complete federal form 433 d installment agreement taxformfinder

Prepare Federal Form 433 D Installment Agreement TaxFormFinder effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly and without delays. Manage Federal Form 433 D Installment Agreement TaxFormFinder on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Federal Form 433 D Installment Agreement TaxFormFinder with ease

- Find Federal Form 433 D Installment Agreement TaxFormFinder and click on Get Form to start.

- Make use of the tools we offer to fill out your document.

- Highlight important sections of the documents or black out sensitive data with the tools that airSlate SignNow provides for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Federal Form 433 D Installment Agreement TaxFormFinder and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal form 433 d installment agreement taxformfinder

Create this form in 5 minutes!

People also ask

-

What is a 2018 installment agreement?

A 2018 installment agreement is a payment plan offered by the IRS that allows taxpayers to pay their tax debt over time. This agreement can help you manage your financial obligations without the burden of making a lump-sum payment. With airSlate SignNow, you can easily eSign and manage all documents related to the 2018 installment agreement process.

-

How can airSlate SignNow help with the 2018 installment agreement?

airSlate SignNow simplifies the process of sending and signing documents required for a 2018 installment agreement. By providing a user-friendly platform, it ensures that all necessary paperwork is completed and submitted efficiently. This can help you stay organized and on track with your tax obligations.

-

Is there a cost associated with using airSlate SignNow for my 2018 installment agreement?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. The cost can vary based on the features you select, but it is designed to be a cost-effective solution for managing documents, including those related to your 2018 installment agreement. Check our pricing page for specific details.

-

What features does airSlate SignNow offer for managing the 2018 installment agreement?

airSlate SignNow comes with several features that enhance document management for the 2018 installment agreement, such as electronic signatures, customizable templates, and automated workflows. These tools help streamline the process and ensure that all documents are in order and easily accessible.

-

Can I access my 2018 installment agreement documents on mobile devices with airSlate SignNow?

Absolutely! AirSlate SignNow is designed to be mobile-friendly, allowing you to access and manage your 2018 installment agreement documents from any device. This flexibility ensures that you can complete necessary tasks on-the-go, giving you more control over your tax obligations.

-

Does airSlate SignNow integrate with other applications for my 2018 installment agreement process?

Yes, airSlate SignNow offers integrations with various applications that can enhance your workflow related to the 2018 installment agreement. By connecting your favorite apps, you can streamline processes such as document sharing, notifications, and client management.

-

What are the benefits of using airSlate SignNow for a 2018 installment agreement?

Using airSlate SignNow for your 2018 installment agreement provides numerous benefits, including reduced paperwork, faster processing times, and increased organization. The platform's ease of use also ensures that you can focus more on resolving your tax obligations rather than getting bogged down by administrative tasks.

Get more for Federal Form 433 D Installment Agreement TaxFormFinder

- Oklahoma judgment statement form

- Oklahoma filing lien form

- Ok address form

- Oklahoma landlord form

- Ok landlord tenant notice form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497323007 form

- Oklahoma tenant landlord form

- Ok tenant landlord form

Find out other Federal Form 433 D Installment Agreement TaxFormFinder

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast