California Group Nonresident Tax ReturnFTB Ca Gov 2021

What is the California Group Nonresident Tax Return?

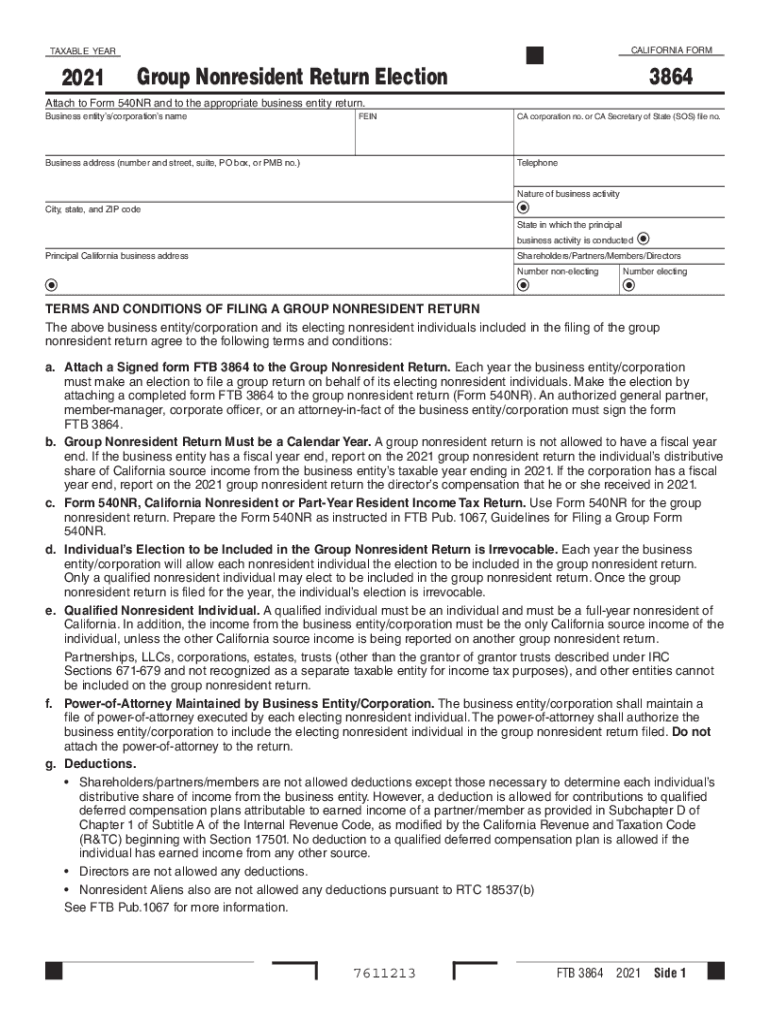

The California Group Nonresident Tax Return, often referred to as the 3864 nonresident return, is a tax form designed for nonresident individuals or entities that earn income in California. This form allows multiple nonresidents to file a single tax return collectively, simplifying the process of reporting income and calculating taxes owed to the state. It is particularly useful for partnerships or groups that have shared income sources within California. Understanding the purpose and requirements of this form is essential for compliance with California tax laws.

Steps to Complete the California Group Nonresident Tax Return

Completing the California Group Nonresident Tax Return involves several key steps:

- Gather necessary information: Collect all relevant financial documents, including income statements, deductions, and credits applicable to the group.

- Fill out the form: Accurately complete the 3864 nonresident return, ensuring all income and deductions are reported correctly.

- Review for accuracy: Double-check all entries for errors or omissions to avoid delays or penalties.

- Sign the document: Ensure that all required parties sign the form, as electronic signatures can provide a legally binding method of submission.

- Submit the return: File the completed form with the California Franchise Tax Board (FTB) by the established deadline.

Required Documents for Filing

To successfully file the California Group Nonresident Tax Return, certain documents are essential:

- Income statements for each group member, including W-2s and 1099s.

- Records of any deductions or credits claimed by the group.

- A copy of the previous year’s tax return, if applicable.

- Identification information for all group members, such as Social Security numbers or taxpayer identification numbers.

Filing Deadlines and Important Dates

It is crucial to adhere to the filing deadlines for the California Group Nonresident Tax Return to avoid penalties:

- The standard deadline for filing is typically April 15 for the preceding tax year.

- Extensions may be available, but they must be requested before the original deadline.

- Late submissions may incur penalties and interest on any taxes owed.

Legal Use of the California Group Nonresident Tax Return

The California Group Nonresident Tax Return is recognized as a legal document when filed correctly. To ensure its legal standing, the following conditions must be met:

- All information provided must be accurate and truthful.

- Signatures must be obtained from all group members, confirming their agreement with the submitted information.

- The form must comply with California tax laws and regulations, including any specific requirements set forth by the California Franchise Tax Board.

Digital vs. Paper Version of the California Group Nonresident Tax Return

Filing the California Group Nonresident Tax Return can be done either digitally or via paper submission. Each method has its advantages:

- Digital filing allows for quicker processing and confirmation of receipt from the FTB.

- Paper submissions may take longer to process and require physical mailing, but some may prefer this method for record-keeping.

- Using digital tools, such as eSignature platforms, can enhance the efficiency and security of the filing process.

Quick guide on how to complete california group nonresident tax returnftbcagov

Prepare California Group Nonresident Tax ReturnFTB ca gov effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage California Group Nonresident Tax ReturnFTB ca gov on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest method to alter and eSign California Group Nonresident Tax ReturnFTB ca gov without hassle

- Obtain California Group Nonresident Tax ReturnFTB ca gov and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Modify and eSign California Group Nonresident Tax ReturnFTB ca gov and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california group nonresident tax returnftbcagov

Create this form in 5 minutes!

People also ask

-

What is a California group nonresident return?

A California group nonresident return allows nonresidents who share a common interest, such as partners in a business, to file their taxes collectively. This return simplifies the tax reporting process and ensures compliance with California tax laws. If you're filing a California group nonresident return, it’s important to understand the specific forms and requirements involved.

-

Who should file a California group nonresident return?

Individuals who earn income in California but reside outside the state should consider filing a California group nonresident return. This includes professionals, businesses, or partnerships that generate revenue and need to report their earnings to California tax authorities. It helps streamline the tax obligations for those earning in multiple states.

-

What are the benefits of using airSlate SignNow for California group nonresident returns?

Using airSlate SignNow simplifies the entire process of managing your California group nonresident return. Our platform offers efficient document signing and storage solutions, ensuring you can swiftly handle any required documentation. With airSlate SignNow, you can collaborate seamlessly with team members and stay organized while managing your tax filings.

-

How much does airSlate SignNow cost for filing a California group nonresident return?

Pricing for airSlate SignNow is competitive and varies based on the specific features you need for your California group nonresident return. We offer flexible subscription plans that cater to different business sizes and document management needs. For detailed pricing, please visit our pricing page or contact our sales team.

-

Can I integrate airSlate SignNow with other financial tools for my California group nonresident return?

Yes, airSlate SignNow integrates seamlessly with a variety of financial tools and accounting software that can be useful for your California group nonresident return. This integration allows for better data management, easy document sharing, and streamlined workflows, enhancing efficiency during your tax preparation process.

-

Is eSigning legally valid for California group nonresident returns?

Absolutely! eSigning using airSlate SignNow is legally valid and complies with California laws. This means you can confidently sign and send your California group nonresident return documents digitally, ensuring you meet all legal requirements without the need for physical signatures.

-

What features does airSlate SignNow offer for managing documents related to California group nonresident returns?

airSlate SignNow offers a range of features tailored for managing documents linked to your California group nonresident return, including secure cloud storage, collaborative editing, and automated reminders for important deadlines. These features help keep your team organized and ensure timely submission of your tax returns.

Get more for California Group Nonresident Tax ReturnFTB ca gov

- Material noncompliance landlord form

- 7 day notice to terminate week to week lease residential from tenant to landlord oklahoma form

- 30 day notice to terminate month to month lease for residential from tenant to landlord oklahoma form

- Assignment of mortgage by individual mortgage holder oklahoma form

- Assignment of mortgage by corporate mortgage holder oklahoma form

- Oklahoma 30 day notice form

- 7 day notice to terminate week to week lease or suffer double rent residential oklahoma form

- Oklahoma 5 day form

Find out other California Group Nonresident Tax ReturnFTB ca gov

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online