FTB Publication 1006 California Tax Forms and Related 2023-2026

Understanding the California Group Nonresident Return

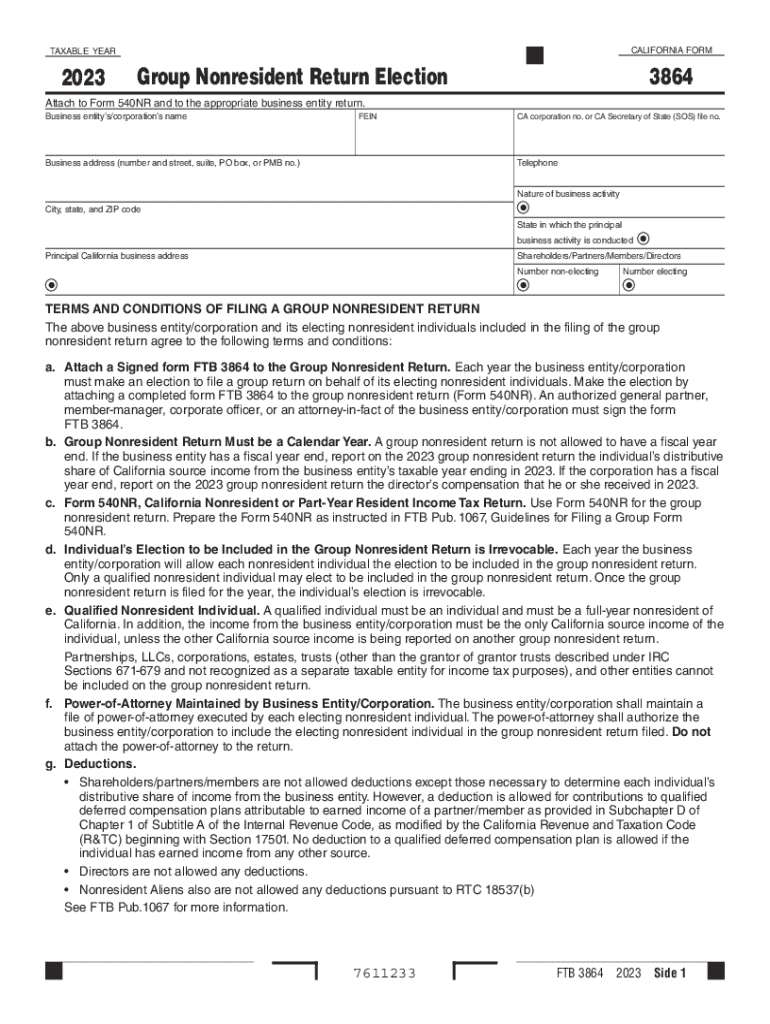

The California group nonresident return is a specific tax form designed for groups of nonresidents who earn income in California. This form allows multiple nonresidents to file a single return, simplifying the process for those who meet certain criteria. It is particularly useful for partnerships, LLCs, or corporations that have nonresident members. By using this form, taxpayers can report their income, deductions, and credits collectively, which may lead to a more efficient tax filing process.

Eligibility Criteria for Filing

To qualify for filing a California group nonresident return, certain eligibility criteria must be met. Generally, all members of the group must be nonresidents of California, and they must have earned income from California sources. Additionally, the group should consist of individuals who are part of the same business entity, such as a partnership or an LLC. It is essential to ensure that all members agree to file the return as a group, as individual filings may not be permitted in this context.

Steps to Complete the California Group Nonresident Return

Completing the California group nonresident return involves several key steps:

- Gather necessary documentation, including income statements and expense records for all group members.

- Complete California Form 3864, ensuring that all income and deductions are accurately reported.

- Review the form for accuracy, confirming that all members' information is correctly included.

- Submit the completed form to the California Franchise Tax Board (FTB) by the designated deadline.

Each step is crucial for ensuring compliance and avoiding potential penalties.

Filing Deadlines and Important Dates

Filing deadlines for the California group nonresident return typically align with the general tax filing deadlines. It is important to be aware of these dates to avoid late penalties. Generally, the deadline for filing is April 15 for most taxpayers, but this may vary based on specific circumstances, such as extensions or special provisions for certain groups. Keeping track of these dates can help ensure timely submission and compliance with California tax laws.

Form Submission Methods

The California group nonresident return can be submitted through various methods. Taxpayers have the option to file online through the California Franchise Tax Board's e-filing system, which offers a convenient and secure way to submit forms. Alternatively, the form can be mailed to the FTB, or in some cases, filed in person at designated locations. Each submission method has its advantages, so it is essential to choose the one that best fits the group's needs.

Penalties for Non-Compliance

Failing to file the California group nonresident return on time or inaccurately reporting information can lead to significant penalties. The California Franchise Tax Board may impose fines based on the amount of tax owed and the duration of the delay. Additionally, interest may accrue on any unpaid taxes. It is crucial for groups to understand these potential penalties and take proactive steps to ensure compliance with all filing requirements.

Create this form in 5 minutes or less

Find and fill out the correct ftb publication 1006 california tax forms and related

Create this form in 5 minutes!

How to create an eSignature for the ftb publication 1006 california tax forms and related

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a California group nonresident return?

A California group nonresident return is a tax return filed by nonresident individuals who are part of a group that has income sourced from California. This return allows the group to report their income collectively, simplifying the tax process. Understanding this return is crucial for nonresidents to ensure compliance with California tax laws.

-

How can airSlate SignNow help with filing a California group nonresident return?

airSlate SignNow provides an easy-to-use platform for businesses to send and eSign documents related to the California group nonresident return. With our solution, you can streamline the document management process, ensuring that all necessary forms are completed and signed efficiently. This helps reduce errors and saves time during tax season.

-

What are the pricing options for airSlate SignNow when filing a California group nonresident return?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses filing a California group nonresident return. Our plans are designed to be cost-effective, providing access to essential features without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing California group nonresident returns?

Our platform includes features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing California group nonresident returns. These tools help ensure that your documents are organized and easily accessible. Additionally, our user-friendly interface makes it simple to navigate through the filing process.

-

Are there any integrations available with airSlate SignNow for California group nonresident returns?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your California group nonresident return. These integrations allow for smooth data transfer and enhance your overall workflow. By connecting with your existing tools, you can streamline the filing process even further.

-

What are the benefits of using airSlate SignNow for California group nonresident returns?

Using airSlate SignNow for California group nonresident returns offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of loss or fraud. Additionally, the ease of use allows you to focus more on your business rather than on administrative tasks.

-

Is airSlate SignNow compliant with California tax regulations for nonresident returns?

Absolutely! airSlate SignNow is designed to comply with California tax regulations, including those related to the California group nonresident return. Our platform is regularly updated to reflect any changes in tax laws, ensuring that you remain compliant while filing your returns. You can trust us to help you navigate the complexities of tax compliance.

Get more for FTB Publication 1006 California Tax Forms And Related

- Bill nye the atmosphere answers form

- Victorian seniors card application form pdf

- Consent form for sports participation 251616257

- Justice is harmony in dash form

- Cym basketball score sheet form

- Spanish american war worksheet form

- Bukura agricultural college intake 2022 form

- Willingness certificate form

Find out other FTB Publication 1006 California Tax Forms And Related

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney