Form it 204 LL, Partnership, Limited Liability Company, and Limited 2022-2026

What is the Form IT 204 LL?

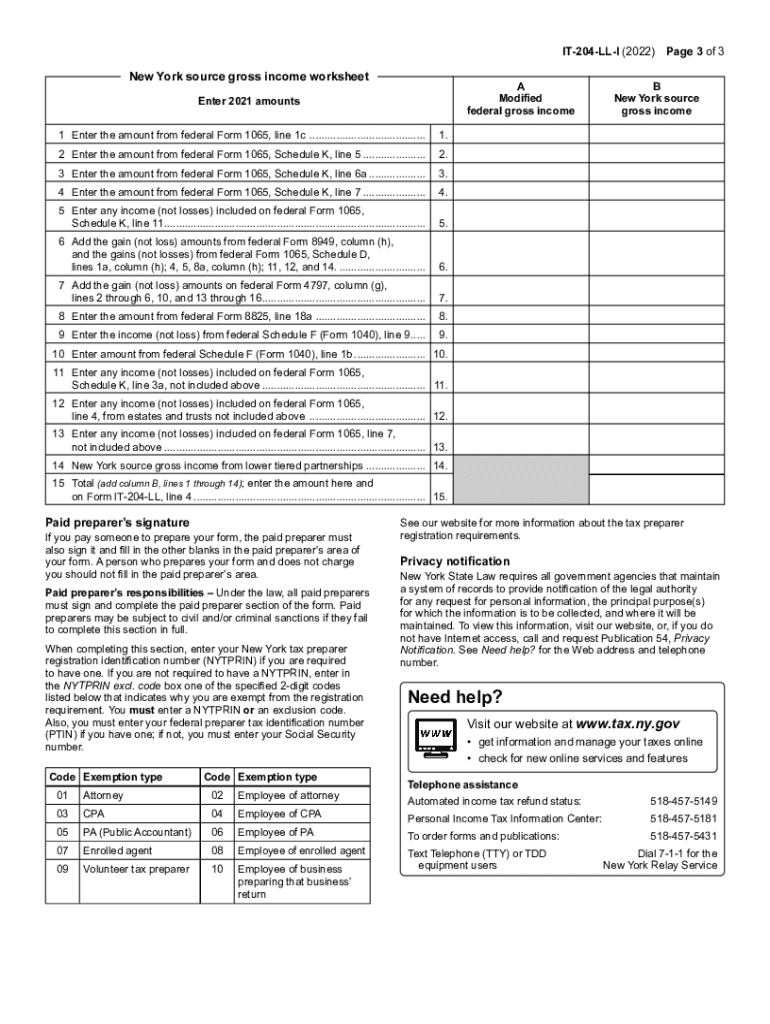

The Form IT 204 LL is a tax document specifically designed for partnerships, limited liability companies (LLCs), and limited partnerships operating in New York. This form is used to report income, deductions, and credits for these business entities. Understanding this form is crucial for compliance with state tax regulations, ensuring that businesses accurately report their financial activities. It serves as a means for the New York State Department of Taxation and Finance to assess the tax obligations of these entities.

How to use the Form IT 204 LL

Using the Form IT 204 LL involves several steps that ensure accurate reporting of your business's financial information. First, gather all necessary financial documents, including income statements and records of expenses. Next, complete the form by entering the required details, such as the business name, address, and income figures. It is essential to follow the instructions carefully to avoid errors that could lead to penalties. Once completed, the form must be submitted to the appropriate state authority by the specified deadline.

Steps to complete the Form IT 204 LL

Completing the Form IT 204 LL requires attention to detail. Here are the steps to follow:

- Gather Information: Collect all relevant financial documents, including income and expense records.

- Fill Out the Form: Enter your business information, including name, address, and tax identification number.

- Report Income: Accurately report all sources of income generated by the business.

- Detail Deductions: List all allowable deductions to reduce taxable income.

- Review for Accuracy: Double-check all entries to ensure accuracy and completeness.

- Submit the Form: File the completed form by the due date, either online or by mail.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 204 LL are critical to avoid penalties. Typically, the form must be submitted by the 15th day of the fourth month following the close of the tax year. For most businesses operating on a calendar year, this means the due date is April 15. It is important to stay informed about any changes to deadlines, as they may vary based on specific circumstances or state regulations.

Legal use of the Form IT 204 LL

The legal use of the Form IT 204 LL ensures that businesses comply with New York tax laws. Properly completing and submitting this form is essential for maintaining good standing with state authorities. Failure to file or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of this form is vital for all partnerships and LLCs operating in New York.

Required Documents

To successfully complete the Form IT 204 LL, certain documents are required. These include:

- Financial statements detailing income and expenses.

- Records of any deductions claimed.

- Partnership agreements or operating agreements for LLCs.

- Previous tax returns, if applicable.

Having these documents ready will facilitate a smoother filing process and ensure compliance with state regulations.

Quick guide on how to complete form it 204 ll partnership limited liability company and limited

Effortlessly Prepare Form IT 204 LL, Partnership, Limited Liability Company, And Limited on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the necessary template and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Form IT 204 LL, Partnership, Limited Liability Company, And Limited on any device using airSlate SignNow's applications for Android or iOS and streamline any document-related task today.

Ways to modify and eSign Form IT 204 LL, Partnership, Limited Liability Company, And Limited effortlessly

- Find Form IT 204 LL, Partnership, Limited Liability Company, And Limited and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the files or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form IT 204 LL, Partnership, Limited Liability Company, And Limited to ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 204 ll partnership limited liability company and limited

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow related to the 2021 New York instructions IT 204?

airSlate SignNow offers features that align with the 2021 New York instructions IT 204, including customizable templates, secure electronic signatures, and document workflows. These features ensure that users can efficiently comply with state regulations while streamlining their document processes.

-

How does airSlate SignNow simplify compliance with the 2021 New York instructions IT 204?

By utilizing airSlate SignNow, businesses can ensure they meet the requirements set by the 2021 New York instructions IT 204. The platform allows users to create and store legally binding documents, ensuring that their submission processes are efficient and compliant.

-

What is the pricing model for airSlate SignNow concerning the 2021 New York instructions IT 204?

airSlate SignNow offers a flexible pricing model that caters to different business needs while staying within budget for compliance with the 2021 New York instructions IT 204. There are various plans available, allowing businesses to choose the best fit according to their document management and signing needs.

-

Can airSlate SignNow assist with document integration for the 2021 New York instructions IT 204?

Yes, airSlate SignNow supports integration with various applications, which can aid in fulfilling the 2021 New York instructions IT 204. Whether you're using CRM systems or cloud storage solutions, airSlate SignNow can seamlessly integrate to ensure your workflow remains uninterrupted.

-

What benefits does airSlate SignNow provide for businesses following the 2021 New York instructions IT 204?

Businesses adhering to the 2021 New York instructions IT 204 can benefit from enhanced security, reduced paperwork, and improved efficiency with airSlate SignNow. This platform saves time and resources, allowing companies to focus more on their core activities while maintaining compliance.

-

Is airSlate SignNow user-friendly for those unfamiliar with the 2021 New York instructions IT 204?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, making it accessible even to those who may not be familiar with the technicalities of the 2021 New York instructions IT 204. The platform provides easy navigation and support resources to guide users in their document signing processes.

-

How does airSlate SignNow enhance the signing experience while following the 2021 New York instructions IT 204?

airSlate SignNow enhances the signing experience by providing features like real-time tracking and multi-party signing, which are essential for compliance with the 2021 New York instructions IT 204. This ensures that all parties are notified and engaged efficiently throughout the signing process.

Get more for Form IT 204 LL, Partnership, Limited Liability Company, And Limited

Find out other Form IT 204 LL, Partnership, Limited Liability Company, And Limited

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document