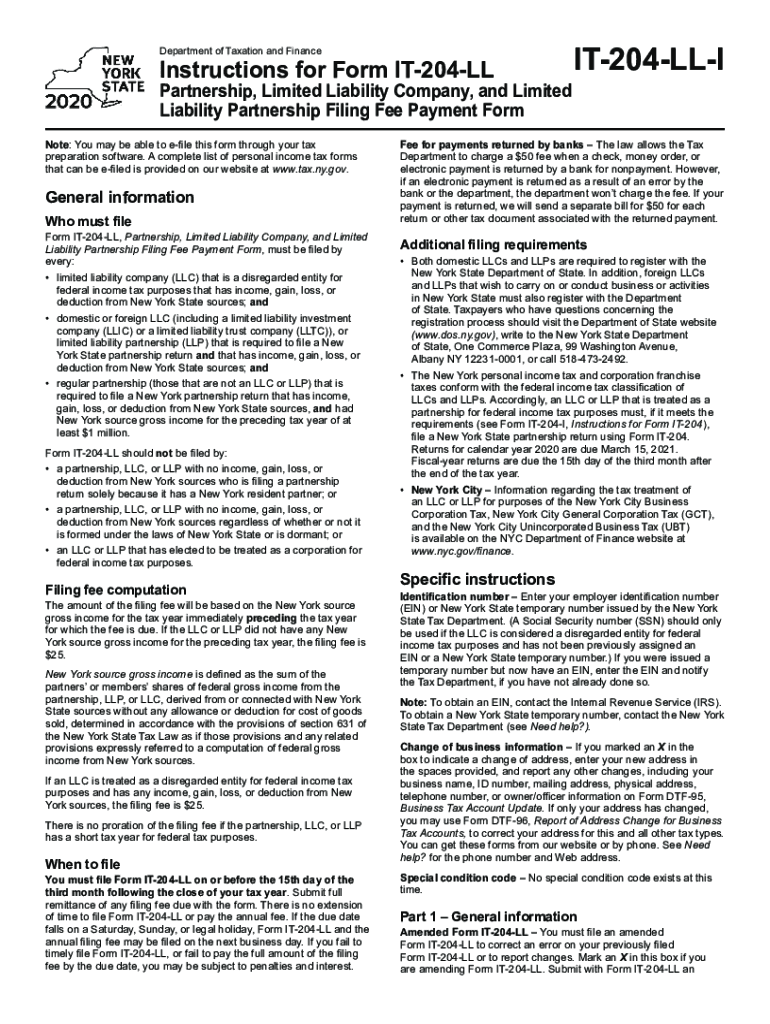

Instructions for Form it 204 LL Partnership, Limited Liability Company, and Limited Liability Partnership Filing Fee Payment for 2020

What is the Instructions for Form IT 204 LL?

The Instructions for Form IT 204 LL is a crucial document used for filing the Partnership, Limited Liability Company, and Limited Liability Partnership Filing Fee Payment for the tax year in New York. This form is essential for businesses operating under these structures to comply with state tax obligations. It outlines the necessary steps and requirements for accurately completing the form, ensuring that businesses can fulfill their legal obligations while minimizing the risk of penalties.

Steps to Complete the Instructions for Form IT 204 LL

Completing the Instructions for Form IT 204 LL involves several key steps:

- Gather necessary information about your business structure, including the legal name, address, and entity type.

- Calculate the appropriate filing fee based on your business's revenue and structure.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online or via mail, following the specified submission guidelines.

Legal Use of the Instructions for Form IT 204 LL

The legal use of the Instructions for Form IT 204 LL is paramount for ensuring compliance with New York state tax laws. This form serves as a formal declaration of a business's tax obligations and must be completed accurately to avoid legal repercussions. Understanding the legal implications of the form helps businesses maintain good standing with state authorities and avoid potential fines or penalties for non-compliance.

Filing Deadlines / Important Dates

Adhering to filing deadlines is critical for businesses using the Instructions for Form IT 204 LL. Typically, the filing deadline aligns with the business's tax return due date. It is important to stay informed about specific dates each tax year, as they can vary. Missing these deadlines may result in late fees or other penalties, emphasizing the need for timely submission.

Required Documents for Form IT 204 LL

To successfully complete the Instructions for Form IT 204 LL, certain documents are required. These may include:

- Your business's federal Employer Identification Number (EIN).

- Financial statements that reflect your business's revenue.

- Any previous year’s tax returns, if applicable.

- Documentation supporting any claims for exemptions or deductions.

Form Submission Methods

The Instructions for Form IT 204 LL can be submitted through various methods to accommodate different preferences. Businesses may choose to file online through the New York State Department of Taxation and Finance website, which often provides a more streamlined process. Alternatively, forms can be mailed directly to the appropriate state office or submitted in person, depending on the business's needs.

Quick guide on how to complete instructions for form it 204 ll partnership limited liability company and limited liability partnership filing fee payment form

Effortlessly Prepare Instructions For Form IT 204 LL Partnership, Limited Liability Company, And Limited Liability Partnership Filing Fee Payment For on Any Device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Instructions For Form IT 204 LL Partnership, Limited Liability Company, And Limited Liability Partnership Filing Fee Payment For on any platform with airSlate SignNow's Android or iOS applications and simplify your document-driven processes today.

How to Modify and Electronically Sign Instructions For Form IT 204 LL Partnership, Limited Liability Company, And Limited Liability Partnership Filing Fee Payment For with Ease

- Find Instructions For Form IT 204 LL Partnership, Limited Liability Company, And Limited Liability Partnership Filing Fee Payment For and click on Get Form to begin.

- Use the provided tools to complete your form.

- Emphasize key sections of your documents or redact sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to finalize your edits.

- Select your preferred method for sharing your form, whether it be via email, text message (SMS), or through an invitation link, or download it directly to your computer.

Eliminate worries about lost or misplaced documents, tedious form retrieval, or errors that necessitate printing new document copies. airSlate SignNow streamlines your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Instructions For Form IT 204 LL Partnership, Limited Liability Company, And Limited Liability Partnership Filing Fee Payment For to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 204 ll partnership limited liability company and limited liability partnership filing fee payment form

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 204 ll partnership limited liability company and limited liability partnership filing fee payment form

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an e-signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What are the key features of the airSlate SignNow for new york instructions it 204?

AirSlate SignNow offers a variety of features that streamline document signing and management. For new york instructions it 204, users can benefit from templates, real-time collaboration, and secure cloud storage. These features make it easy to send and eSign documents efficiently.

-

How can airSlate SignNow help with compliance related to new york instructions it 204?

AirSlate SignNow ensures compliance with various regulations related to new york instructions it 204. The platform provides audit trails and secure eSigning options, ensuring that all documents meet legal standards. This security helps businesses feel confident in their document management processes.

-

What is the pricing structure for airSlate SignNow concerning new york instructions it 204?

The pricing for airSlate SignNow varies depending on the plan chosen, but it is designed to be cost-effective for small to large businesses. Pricing options are flexible to accommodate the specific needs related to new york instructions it 204. Interested users should visit our website for the most updated pricing information.

-

Are there any integrations available with airSlate SignNow for new york instructions it 204?

Yes, airSlate SignNow offers numerous integrations that can enhance your workflows for new york instructions it 204. These integrations with popular tools such as CRM systems, cloud storage services, and productivity apps help users centralize their document management efficiently. This enables businesses to automate their processes.

-

How does airSlate SignNow enhance productivity when dealing with new york instructions it 204?

AirSlate SignNow enhances productivity by simplifying the document signing process for new york instructions it 204. The platform allows users to send documents for eSignature quickly, reducing turnaround time signNowly. This efficiency enables teams to focus on more critical tasks and increases overall productivity.

-

What are the benefits of switching to airSlate SignNow for new york instructions it 204?

Switching to airSlate SignNow for new york instructions it 204 provides numerous benefits, including cost savings, efficiency, and a user-friendly interface. It empowers businesses to manage documents seamlessly, ensuring faster eSigning and approval processes. Customers often report improved collaboration and reduced paperwork.

-

Is airSlate SignNow suitable for small businesses regarding new york instructions it 204?

Absolutely, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses dealing with new york instructions it 204. The platform's cost-effective pricing and intuitive features make it an ideal choice for small teams looking to simplify their document management. Many small businesses find it enhances their operational efficiency.

Get more for Instructions For Form IT 204 LL Partnership, Limited Liability Company, And Limited Liability Partnership Filing Fee Payment For

- Drainage contract for contractor arkansas form

- Foundation contract for contractor arkansas form

- Plumbing contractor form

- Brick mason contract for contractor arkansas form

- Roofing contract for contractor arkansas form

- Electrical contract for contractor arkansas form

- Arkansas sheetrock form

- Flooring contract for contractor arkansas form

Find out other Instructions For Form IT 204 LL Partnership, Limited Liability Company, And Limited Liability Partnership Filing Fee Payment For

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist