Meals and Rooms TaxDepartment of Taxes VermontmyVTaxFAQ'smyVTaxFAQ'sGetting Started with Meals and Rooms Tax Vermont 2022-2026

Understanding the Meals and Rooms Tax

The Meals and Rooms Tax in Vermont, often referred to as the MRT 441, is a tax imposed on the sale of meals and lodging. This tax is crucial for businesses in the hospitality industry, including restaurants, hotels, and other accommodations. The tax rate can vary, and it is essential for businesses to understand their obligations to comply with state regulations.

The tax applies to the total sales price of meals and rooms, and businesses must collect this tax from customers at the point of sale. Understanding the nuances of this tax helps ensure that businesses remain compliant and avoid penalties.

Steps to Complete the MRT 441 Return

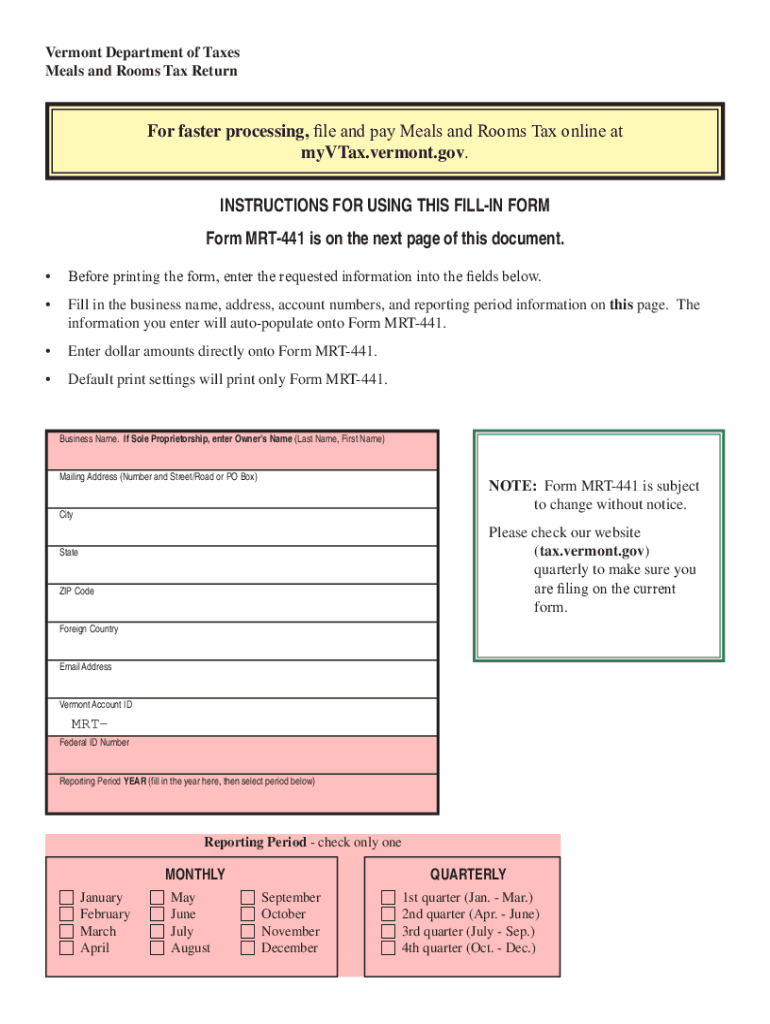

Completing the MRT 441 return involves several key steps to ensure accuracy and compliance. Start by gathering all necessary sales data for the reporting period, including total sales of meals and rooms. This information is vital for calculating the total tax owed.

Next, fill out the MRT 441 form with the required details, including your business information and the total sales figures. Ensure that you accurately calculate the tax due based on the current tax rate. Once completed, review the form for any errors before submission.

Finally, submit the MRT 441 return either online or via mail, depending on your preference. Keeping a copy of the submitted form is advisable for your records.

Legal Use of the MRT 441

The MRT 441 return is legally binding when filled out correctly and submitted on time. To ensure its validity, businesses must comply with the relevant eSignature regulations and maintain accurate records of all transactions. A digital signature can enhance the legitimacy of the document, provided it meets the requirements set forth by the state.

Compliance with federal and state tax laws is essential to avoid penalties. Businesses should familiarize themselves with the legal implications of the MRT 441 and ensure that all submissions adhere to the established guidelines.

Filing Deadlines for the MRT 441

Filing deadlines for the MRT 441 return are critical for businesses to adhere to. Typically, the return is due quarterly, with specific dates set by the Vermont Department of Taxes. Missing these deadlines can result in penalties and interest on unpaid taxes.

It is advisable for businesses to mark these deadlines on their calendars and prepare the necessary documentation well in advance. Staying organized can help ensure timely submissions and maintain compliance with state tax laws.

Required Documents for the MRT 441 Return

To complete the MRT 441 return, businesses must have several key documents on hand. These include sales records for meals and rooms, receipts, and any previous tax returns relevant to the current filing period. Accurate record-keeping is essential for substantiating the figures reported on the return.

Additionally, businesses may need to provide proof of tax payments made in previous periods, especially if there are discrepancies or audits. Maintaining thorough documentation helps support the accuracy of the MRT 441 return and ensures compliance with state regulations.

Common Penalties for Non-Compliance

Failure to comply with the requirements of the MRT 441 can lead to significant penalties. Common penalties include fines for late submissions, interest on unpaid taxes, and potential legal action for continued non-compliance. Understanding these penalties is crucial for businesses to avoid costly mistakes.

It is important to stay informed about the rules governing the MRT 441 and to take proactive steps to ensure compliance. Regular training for staff involved in tax reporting can also help mitigate the risk of errors and omissions.

Quick guide on how to complete meals and rooms taxdepartment of taxes vermontmyvtaxfaqsmyvtaxfaqsgetting started with meals and rooms tax vermont

Complete Meals And Rooms TaxDepartment Of Taxes VermontmyVTaxFAQ'smyVTaxFAQ'sGetting Started With Meals And Rooms Tax Vermont effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Meals And Rooms TaxDepartment Of Taxes VermontmyVTaxFAQ'smyVTaxFAQ'sGetting Started With Meals And Rooms Tax Vermont on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Meals And Rooms TaxDepartment Of Taxes VermontmyVTaxFAQ'smyVTaxFAQ'sGetting Started With Meals And Rooms Tax Vermont without hassle

- Obtain Meals And Rooms TaxDepartment Of Taxes VermontmyVTaxFAQ'smyVTaxFAQ'sGetting Started With Meals And Rooms Tax Vermont and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over missing or lost files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Meals And Rooms TaxDepartment Of Taxes VermontmyVTaxFAQ'smyVTaxFAQ'sGetting Started With Meals And Rooms Tax Vermont and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct meals and rooms taxdepartment of taxes vermontmyvtaxfaqsmyvtaxfaqsgetting started with meals and rooms tax vermont

Create this form in 5 minutes!

People also ask

-

What is mrt 441 and how does it integrate with airSlate SignNow?

Mrt 441 is a specific feature within airSlate SignNow that enhances document management and e-signature processes. It seamlessly integrates with existing workflows, allowing users to streamline tasks and boost productivity without complications. By leveraging mrt 441, businesses can ensure quick and secure document transactions.

-

What are the pricing options for airSlate SignNow that includes mrt 441?

airSlate SignNow offers flexible pricing plans, including options that embrace the capabilities of mrt 441. You can choose from various tiers based on your organization's size and requirements, making it a cost-effective solution for e-signatures and document management. Visit our pricing page for detailed information on how mrt 441 fits into each plan.

-

What key features does mrt 441 offer in airSlate SignNow?

Mrt 441 includes essential features such as customizable templates, real-time tracking, and secure storage. These functionalities are designed to simplify the signing process and enhance user experience. By utilizing mrt 441 within airSlate SignNow, businesses can ensure workflow efficiency and compliance.

-

How can mrt 441 benefit my business?

By adopting mrt 441, businesses can signNowly reduce the time spent on document processing with its user-friendly interface and automation features. It enhances collaboration by allowing multiple users to sign and manage documents simultaneously. Ultimately, mrt 441 helps in boosting overall operational efficiency.

-

Is airSlate SignNow with mrt 441 easy to use for non-technical users?

Yes, airSlate SignNow featuring mrt 441 is designed for users of all technical backgrounds. Its intuitive interface ensures that anyone can navigate the system without extensive training. With clear instructions and support, non-technical users can effectively utilize all of mrt 441's capabilities.

-

What integrations does mrt 441 support within airSlate SignNow?

Mrt 441 supports a wide array of integrations with popular software such as Google Workspace, Salesforce, and Microsoft Office. These integrations enable seamless data flow and enhance productivity by connecting various platforms. With mrt 441, users can consolidate their document management processes in one place.

-

Can I try airSlate SignNow with mrt 441 before committing to a purchase?

Yes! airSlate SignNow offers a free trial that includes access to mrt 441, allowing you to explore its features and benefits risk-free. During this trial period, you can assess how mrt 441 can optimize your document management workflow before making a financial commitment.

Get more for Meals And Rooms TaxDepartment Of Taxes VermontmyVTaxFAQ'smyVTaxFAQ'sGetting Started With Meals And Rooms Tax Vermont

- Minutes for organizational meeting oklahoma oklahoma form

- Sample transmittal letter to secretary of states office to file articles of incorporation oklahoma oklahoma form

- Lead based paint disclosure for sales transaction oklahoma form

- Landlord lead paint disclosure oklahoma form

- Notice of lease for recording oklahoma form

- Sample cover letter for filing of llc articles or certificate with secretary of state oklahoma form

- Supplemental residential lease forms package oklahoma

- Ok landlord 497323283 form

Find out other Meals And Rooms TaxDepartment Of Taxes VermontmyVTaxFAQ'smyVTaxFAQ'sGetting Started With Meals And Rooms Tax Vermont

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile