Horry County Hospitality Tax Form

What is the Horry County Hospitality Tax Form

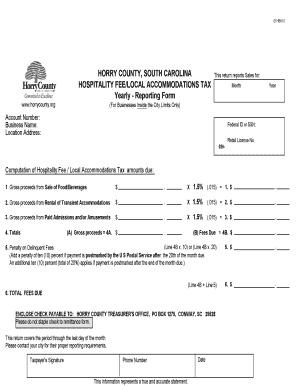

The Horry County Hospitality Tax Form is a document used by businesses in Horry County, South Carolina, to report and remit hospitality taxes. These taxes are levied on the sale of accommodations, food, and beverages within the county, aimed at funding tourism-related projects and services. Understanding this form is crucial for compliance with local tax regulations and ensuring that businesses contribute to the community's tourism infrastructure.

How to use the Horry County Hospitality Tax Form

To effectively use the Horry County Hospitality Tax Form, businesses must first gather all necessary sales data related to hospitality services. This includes total sales from accommodations, food, and beverages. Once the sales data is compiled, the form can be filled out, detailing the total taxable sales and calculating the amount of tax owed. It is essential to ensure that all figures are accurate to avoid penalties.

Steps to complete the Horry County Hospitality Tax Form

Completing the Horry County Hospitality Tax Form involves several key steps:

- Collect sales data for the reporting period, including total sales from accommodations, food, and beverages.

- Calculate the total hospitality tax owed based on the applicable tax rate.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Review the form for accuracy before submission.

- Submit the completed form along with the payment for the tax owed by the specified deadline.

Legal use of the Horry County Hospitality Tax Form

The Horry County Hospitality Tax Form must be used in accordance with local tax laws. This means that businesses are required to submit the form accurately and on time to avoid legal repercussions. Failure to comply with the regulations can result in penalties, including fines and interest on unpaid taxes. It is important for businesses to stay informed about any changes in tax laws that may affect the use of this form.

Filing Deadlines / Important Dates

Filing deadlines for the Horry County Hospitality Tax Form are typically set on a quarterly basis. Businesses must be aware of these deadlines to ensure timely submission. Important dates include:

- Quarterly filing deadlines, usually at the end of the month following the end of each quarter.

- Any specific dates for annual filings or adjustments as determined by local tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The Horry County Hospitality Tax Form can be submitted through various methods to accommodate different business needs. Options include:

- Online submission through the Horry County tax office website, which allows for quick and efficient processing.

- Mailing the completed form to the appropriate tax office address.

- In-person submission at designated tax office locations for those who prefer face-to-face interactions.

Quick guide on how to complete horry county hospitality tax form 17028263

Handle Horry County Hospitality Tax Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, enabling you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without hindrances. Manage Horry County Hospitality Tax Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Horry County Hospitality Tax Form seamlessly

- Obtain Horry County Hospitality Tax Form and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature utilizing the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Horry County Hospitality Tax Form to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the horry county hospitality tax form 17028263

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Horry County hospitality tax form and how is it used?

The Horry County hospitality tax form is a document that helps businesses report and pay taxes on hospitality services within Horry County. It's essential for compliance with local tax regulations, ensuring businesses contribute to community services funded by hospitality taxes.

-

How can airSlate SignNow assist in completing the Horry County hospitality tax form?

airSlate SignNow streamlines the process of completing the Horry County hospitality tax form by allowing users to easily fill out, sign, and send the form online. Our user-friendly interface ensures that businesses can complete these forms efficiently without any hassle.

-

Is there a cost associated with using airSlate SignNow for the hospitality tax form?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs. These plans are designed to be cost-effective, allowing users to manage the Horry County hospitality tax form and other documents without incurring hefty fees.

-

What features does airSlate SignNow offer for handling the Horry County hospitality tax form?

AirSlate SignNow provides features like eSigning, document templates, and secure cloud storage, making it easier to manage the Horry County hospitality tax form. Additionally, it offers real-time tracking and notifications, ensuring that all parties are informed throughout the process.

-

Can I integrate airSlate SignNow with other software to manage the Horry County hospitality tax form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, allowing you to manage the Horry County hospitality tax form alongside other business tools. This integration helps streamline your workflow and enhances productivity.

-

How secure is my data when using airSlate SignNow for the hospitality tax form?

Data security is a priority at airSlate SignNow. We implement advanced encryption methods to protect your sensitive information and ensure that your Horry County hospitality tax form and related documents are safe from unauthorized access.

-

What benefits does airSlate SignNow provide for businesses filing the hospitality tax form?

Using airSlate SignNow to file the Horry County hospitality tax form offers businesses signNow time savings, improved accuracy, and enhanced convenience. Our platform reduces paperwork and eliminates the need for in-person visits to submit necessary documents.

Get more for Horry County Hospitality Tax Form

Find out other Horry County Hospitality Tax Form

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online