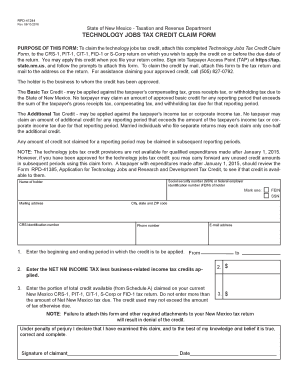

PURPOSE of THIS FORM to Claim the Technology Jobs Tax Credit, Attach This Completed Technology Jobs Tax Credit Claim 2016

What is the purpose of this form to claim the Technology Jobs Tax Credit?

The purpose of this form is to facilitate the process of claiming the Technology Jobs Tax Credit. This credit is designed to incentivize companies to create and retain technology jobs within the United States. By completing and submitting this form, businesses can potentially reduce their tax liability, thereby encouraging investment in technology and job creation.

Steps to complete the Technology Jobs Tax Credit Claim

Completing the Technology Jobs Tax Credit Claim involves several important steps:

- Gather necessary documentation, including proof of eligible technology jobs created or retained.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach any supporting documents that validate your claim.

- Review the form for accuracy and completeness before submission.

- Submit the completed form through the designated method, either online or via mail.

Eligibility criteria for the Technology Jobs Tax Credit

To qualify for the Technology Jobs Tax Credit, businesses must meet specific eligibility criteria. Generally, this includes:

- Operating as a qualified business in the technology sector.

- Creating or retaining a certain number of technology jobs within a specified timeframe.

- Meeting any additional state-specific requirements, if applicable.

Required documents for the Technology Jobs Tax Credit Claim

When filing the Technology Jobs Tax Credit Claim, it is essential to include the following documents:

- Proof of employment for eligible technology positions.

- Financial records demonstrating the impact of the credit on your business.

- Any additional documentation as specified by the tax authority.

Form submission methods for the Technology Jobs Tax Credit Claim

The Technology Jobs Tax Credit Claim can be submitted through various methods, allowing for flexibility based on business needs:

- Online submission via the designated tax authority platform.

- Mailing a physical copy of the completed form and supporting documents.

- In-person submission at local tax authority offices, if available.

IRS guidelines for the Technology Jobs Tax Credit

The IRS provides specific guidelines regarding the Technology Jobs Tax Credit, including details on eligibility, documentation requirements, and filing procedures. It is crucial for businesses to adhere to these guidelines to ensure their claims are processed efficiently and accurately.

Penalties for non-compliance with the Technology Jobs Tax Credit Claim

Failure to comply with the requirements associated with the Technology Jobs Tax Credit Claim may result in penalties. These can include:

- Denial of the tax credit.

- Potential fines or interest on unpaid taxes.

- Increased scrutiny or audits from tax authorities.

Quick guide on how to complete purpose of this form to claim the technology jobs tax credit attach this completed technology jobs tax credit claim

Effortlessly prepare PURPOSE OF THIS FORM To Claim The Technology Jobs Tax Credit, Attach This Completed Technology Jobs Tax Credit Claim on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly and without complications. Manage PURPOSE OF THIS FORM To Claim The Technology Jobs Tax Credit, Attach This Completed Technology Jobs Tax Credit Claim on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and electronically sign PURPOSE OF THIS FORM To Claim The Technology Jobs Tax Credit, Attach This Completed Technology Jobs Tax Credit Claim without hassle

- Find PURPOSE OF THIS FORM To Claim The Technology Jobs Tax Credit, Attach This Completed Technology Jobs Tax Credit Claim and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that reason.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign PURPOSE OF THIS FORM To Claim The Technology Jobs Tax Credit, Attach This Completed Technology Jobs Tax Credit Claim and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct purpose of this form to claim the technology jobs tax credit attach this completed technology jobs tax credit claim

Create this form in 5 minutes!

People also ask

-

What is the purpose of this form to claim the Technology Jobs Tax Credit?

The purpose of this form is to claim the Technology Jobs Tax Credit by detailing your qualified technology jobs. To claim this credit, attach this completed Technology Jobs Tax Credit Claim form to your tax return. This allows you to receive potential financial benefits as a technology employer.

-

How can I submit the Technology Jobs Tax Credit Claim form using airSlate SignNow?

You can easily submit the Technology Jobs Tax Credit Claim form through airSlate SignNow's user-friendly interface. Simply upload your completed form and use our eSignature features to sign. This ensures that your application is submitted accurately and securely.

-

What features does airSlate SignNow offer for managing tax credit claims?

airSlate SignNow offers features such as document templates, cloud storage, and collaboration tools that streamline the process of managing tax credit claims. These features facilitate the secure handling of your completed Technology Jobs Tax Credit Claim. This helps you stay organized and compliant with requirements.

-

Is there a cost associated with using airSlate SignNow for tax credit claims?

Yes, airSlate SignNow provides a cost-effective solution with various pricing plans that cater to different business needs. The pricing is structured to ensure that you receive maximum value for managing your Technology Jobs Tax Credit Claim process. Check our pricing page for detailed information.

-

How do I ensure my Technology Jobs Tax Credit Claim is valid?

To ensure your Technology Jobs Tax Credit Claim is valid, it is crucial to complete the form accurately and attach all required documents. Using airSlate SignNow helps standardize your submissions, minimizing errors. Remember, the purpose of this form is critical for claiming the Technology Jobs Tax Credit effectively.

-

What benefits does airSlate SignNow provide for businesses claiming tax credits?

Using airSlate SignNow simplifies the process of claiming tax credits by offering features like eSigning and automated workflows. This efficiency not only saves time but also helps ensure compliance when you claim the Technology Jobs Tax Credit. Businesses can focus more on growth while reducing administrative burdens.

-

Can I integrate airSlate SignNow with other software for my business?

Yes, airSlate SignNow offers integrations with various popular software solutions, enhancing your workflow for tax credit claims. You can easily connect your systems to streamline the data needed for the Technology Jobs Tax Credit Claim. This ensures a smooth and cohesive experience for all your business document management needs.

Get more for PURPOSE OF THIS FORM To Claim The Technology Jobs Tax Credit, Attach This Completed Technology Jobs Tax Credit Claim

- Business credit application oregon form

- Notice own form

- Individual credit application oregon form

- Wage agreement 497323777 form

- Interrogatories to plaintiff for motor vehicle occurrence oregon form

- Interrogatories to defendant for motor vehicle accident oregon form

- Llc notices resolutions and other operations forms package oregon

- Worker request for reconsideration spanish oregon form

Find out other PURPOSE OF THIS FORM To Claim The Technology Jobs Tax Credit, Attach This Completed Technology Jobs Tax Credit Claim

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online