Schedule Sb Form 1 Fill Online, Printable pdfFiller 2022

What is the Schedule SB Form?

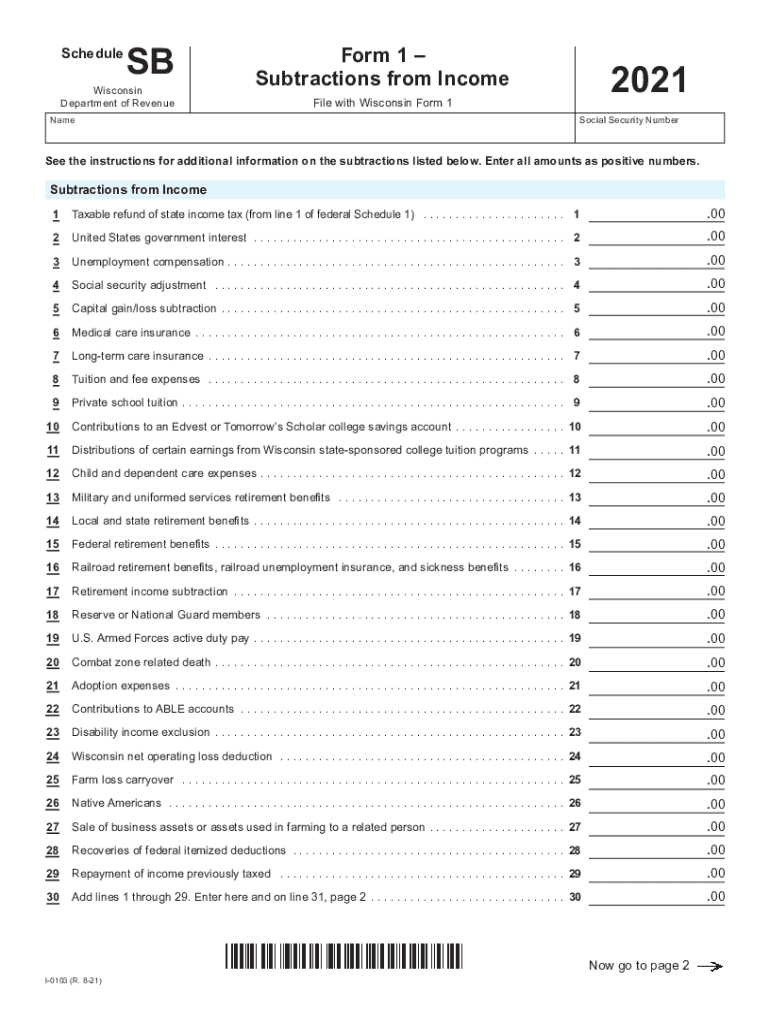

The Schedule SB form, specifically the Wisconsin Schedule SB, is a critical document used for reporting subtractions from income for individuals and businesses in Wisconsin. This form is essential for taxpayers who need to adjust their taxable income based on specific deductions allowed by the state. Understanding the purpose and requirements of this form is vital for accurate tax reporting and compliance with state regulations.

Steps to Complete the Schedule SB Form

Completing the Wisconsin Schedule SB form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully read the instructions provided with the form to understand which subtractions apply to your situation. Fill out the form by entering the required information, ensuring that all figures are accurate. Finally, review the completed form for any errors before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Wisconsin Schedule SB form. Typically, the deadline for submitting this form aligns with the state income tax return due date, which is usually April 15. However, if you file for an extension, ensure that you also extend the deadline for submitting the Schedule SB. Keeping track of these dates helps avoid penalties and ensures timely compliance.

Legal Use of the Schedule SB Form

The legal use of the Wisconsin Schedule SB form is governed by state tax laws. The form must be completed accurately and submitted to the Wisconsin Department of Revenue to be considered valid. It is important to understand that any misrepresentation or errors on the form can lead to legal consequences, including fines or audits. Therefore, utilizing a reliable eSignature solution can enhance the legal standing of your submitted documents.

Required Documents for the Schedule SB Form

When preparing to fill out the Wisconsin Schedule SB form, certain documents are required to support your claims for subtractions. These may include W-2 forms, 1099 forms, and any other relevant income documentation. Additionally, receipts or records that justify the subtractions claimed should be kept on hand in case of an audit. Having these documents organized will facilitate a smoother filing process.

Form Submission Methods

The Wisconsin Schedule SB form can be submitted through various methods, including online filing, mail, or in-person submission. Online filing is often the most efficient method, allowing for quicker processing and confirmation of receipt. If choosing to mail the form, ensure it is sent to the correct address and consider using a trackable mailing option. In-person submissions can be made at designated state offices, providing an opportunity for immediate assistance if needed.

Examples of Using the Schedule SB Form

Understanding how to apply the Wisconsin Schedule SB form can be enhanced by reviewing examples. For instance, a self-employed individual may use the form to subtract business expenses from their income, while a retired person might claim deductions related to retirement income. Each taxpayer's situation is unique, and examining various scenarios can provide clarity on how to effectively utilize the form for tax benefits.

Quick guide on how to complete schedule sb form 1 fill online printable pdffiller

Effortlessly prepare Schedule Sb Form 1 Fill Online, Printable PdfFiller on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Schedule Sb Form 1 Fill Online, Printable PdfFiller on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Simple steps to modify and electronically sign Schedule Sb Form 1 Fill Online, Printable PdfFiller with ease

- Find Schedule Sb Form 1 Fill Online, Printable PdfFiller and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Schedule Sb Form 1 Fill Online, Printable PdfFiller to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule sb form 1 fill online printable pdffiller

Create this form in 5 minutes!

People also ask

-

What is the 2020 schedule sb for airSlate SignNow?

The 2020 schedule sb refers to the planned timeline and milestones for the airSlate SignNow features and updates released in 2020. This schedule includes enhancements that improve user experience and functionality. It is a great resource to understand our commitment to delivering a seamless eSigning process.

-

How much does airSlate SignNow cost in relation to the 2020 schedule sb?

Pricing for airSlate SignNow is competitive, and our plans reflect the upgrades and features outlined in the 2020 schedule sb. We offer different pricing tiers to suit various business needs, ensuring you get excellent value. For detailed pricing, you can visit our pricing page or contact our sales team.

-

What are the main features of airSlate SignNow highlighted in the 2020 schedule sb?

The 2020 schedule sb highlights several key features of airSlate SignNow, including customizable templates, advanced analytics, and robust security measures. These features are designed to streamline your document management and signing processes. We focus on delivering comprehensive solutions that meet your eSigning needs.

-

Can I integrate airSlate SignNow with other applications as described in the 2020 schedule sb?

Yes, the 2020 schedule sb emphasizes our commitment to seamless integrations with popular applications like Google Drive, Salesforce, and more. This flexibility allows you to enhance your existing workflows while using airSlate SignNow for secure eSigning. These integrations simplify your processes and increase productivity.

-

What benefits can I expect from using airSlate SignNow as mentioned in the 2020 schedule sb?

Using airSlate SignNow, as indicated in the 2020 schedule sb, will help you save time and reduce document turnaround times signNowly. The platform simplifies eSigning, reduces manual errors, and enhances collaboration among team members. Overall, it provides an efficient solution for managing documents electronically.

-

Is training available for new users as per the 2020 schedule sb?

Absolutely! The 2020 schedule sb includes detailed provisions for user training. We offer resources such as webinars, tutorials, and dedicated support to ensure you maximize the value of airSlate SignNow. Our team is here to assist you as you get acquainted with the platform.

-

What types of documents can I eSign using airSlate SignNow according to the 2020 schedule sb?

You can eSign various documents through airSlate SignNow, including contracts, agreements, and forms, as outlined in the 2020 schedule sb. The platform accommodates a wide range of document types to suit your business needs. This versatility allows you to engage in secure, compliant eSigning across numerous industries.

Get more for Schedule Sb Form 1 Fill Online, Printable PdfFiller

- Newly widowed individuals package louisiana form

- Employment interview package louisiana form

- Employment employee personnel file package louisiana form

- Assignment of mortgage package louisiana form

- Assignment of lease package louisiana form

- Louisiana purchase 497309353 form

- Satisfaction cancellation or release of mortgage package louisiana form

- Premarital agreements package louisiana form

Find out other Schedule Sb Form 1 Fill Online, Printable PdfFiller

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online