I 0103 Schedule SB Form 1 Subtractions from Income Fillable 2022-2026

Understanding the Wisconsin Schedule SB Form 1 Subtractions From Income

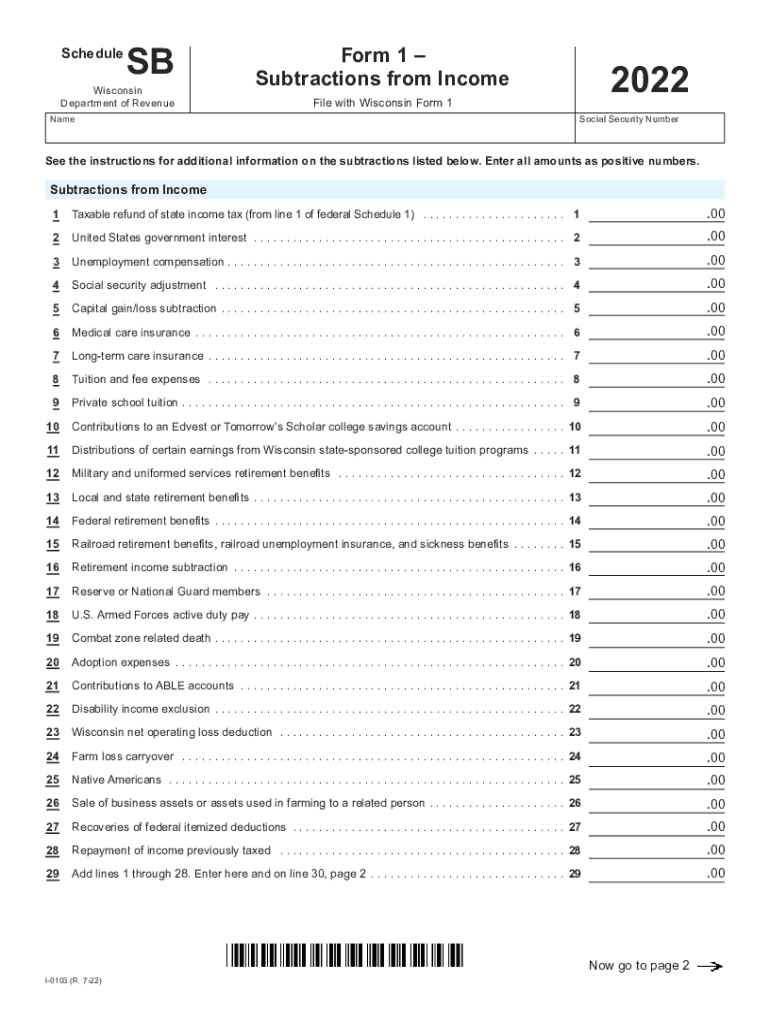

The Wisconsin Schedule SB Form 1 is a crucial document for taxpayers who need to report specific subtractions from their income. This form is primarily used to calculate various deductions that can reduce taxable income, ultimately affecting the overall tax liability. Taxpayers should be aware that the subtractions allowed can vary based on individual circumstances, such as income type and eligibility for certain credits.

Steps to Complete the Wisconsin Schedule SB Form 1

Completing the Wisconsin Schedule SB Form 1 involves several key steps to ensure accuracy and compliance with state tax regulations. First, gather all necessary documentation, including income statements and previous tax returns. Next, carefully follow the instructions provided on the form, filling in each section with the required information. Pay particular attention to the specific subtractions you qualify for, as these will directly impact your final calculations. After completing the form, review all entries for accuracy before submission.

Key Elements of the Wisconsin Schedule SB Form 1

The Schedule SB Form 1 includes several important sections that taxpayers must complete. These sections typically cover personal information, income details, and specific subtractions that apply to the taxpayer's situation. Common subtractions may include amounts for retirement contributions, certain business expenses, and other deductions that the Wisconsin Department of Revenue recognizes. Understanding these key elements is essential for maximizing potential tax benefits.

Legal Use of the Wisconsin Schedule SB Form 1

Legally, the Wisconsin Schedule SB Form 1 must be completed accurately and submitted by the designated tax filing deadline. The form serves as an official document that supports the taxpayer's claims for subtractions from income. Failure to comply with the legal requirements associated with this form can result in penalties or additional scrutiny from tax authorities. It is advisable to retain a copy of the completed form for personal records and future reference.

Filing Deadlines for the Wisconsin Schedule SB Form 1

Taxpayers should be aware of the filing deadlines associated with the Wisconsin Schedule SB Form 1. Typically, the form must be submitted by April 15 of the tax year, aligning with the federal income tax filing deadline. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines that may occur due to state regulations or other factors.

Obtaining the Wisconsin Schedule SB Form 1

The Wisconsin Schedule SB Form 1 can be obtained through the Wisconsin Department of Revenue website or by visiting local tax offices. The form is available in both digital and printable formats, allowing taxpayers to choose their preferred method of completion. Additionally, many tax preparation software programs include the Schedule SB Form 1, facilitating easier access and completion for users.

Quick guide on how to complete 2022 i 0103 schedule sb form 1 subtractions from income fillable

Complete I 0103 Schedule SB Form 1 Subtractions From Income fillable effortlessly on any device

Virtual document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without holdups. Manage I 0103 Schedule SB Form 1 Subtractions From Income fillable on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign I 0103 Schedule SB Form 1 Subtractions From Income fillable with ease

- Find I 0103 Schedule SB Form 1 Subtractions From Income fillable and then click Get Form to initiate.

- Utilize the tools provided to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would prefer to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Modify and electronically sign I 0103 Schedule SB Form 1 Subtractions From Income fillable and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 i 0103 schedule sb form 1 subtractions from income fillable

Create this form in 5 minutes!

People also ask

-

What is the wi 2020 tax schedule sb?

The wi 2020 tax schedule sb is a specific form used by individuals and businesses in Wisconsin to report income and calculate their state tax obligations. Understanding this schedule is crucial for compliance and to ensure accurate reporting. airSlate SignNow can help streamline the signing and submission process for these important documents.

-

How can airSlate SignNow help with the wi 2020 tax schedule sb?

airSlate SignNow provides a user-friendly platform to easily send, receive, and eSign the wi 2020 tax schedule sb. This not only saves time but also ensures that documents are securely handled. With our solution, you can facilitate quick approvals and reduce the risk of errors in your tax submissions.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers competitive pricing plans tailored to suit various needs, making it cost-effective for individuals and businesses handling the wi 2020 tax schedule sb. By choosing a plan that fits your volume and workflow, you can gain access to valuable features without overspending. A free trial is available to help you evaluate our services.

-

What features does airSlate SignNow offer for managing the wi 2020 tax schedule sb?

Our platform includes features such as customizable templates, bulk sending, and real-time tracking, which are all beneficial for managing the wi 2020 tax schedule sb. These tools ensure that you can efficiently collect signatures and maintain organized records of your tax documents. Enhanced security measures also help keep your sensitive information safe.

-

Can I integrate airSlate SignNow with my accounting software for the wi 2020 tax schedule sb?

Yes, airSlate SignNow seamlessly integrates with various accounting software, allowing you to easily manage the wi 2020 tax schedule sb and other tax-related documents. Integrating our solution helps streamline your workflow and minimizes the chances of errors during data transfer. This ensures that your financial records remain synchronized and up-to-date.

-

Is airSlate SignNow secure for handling tax documents like the wi 2020 tax schedule sb?

Absolutely, airSlate SignNow prioritizes security and complies with strict industry standards to protect your data. When handling sensitive documents such as the wi 2020 tax schedule sb, our platform uses encryption and secure access controls to safeguard your information. You can sign and share documents with confidence, knowing your data is protected.

-

Can I access airSlate SignNow on mobile devices for tax schedules?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to manage the wi 2020 tax schedule sb even while on the go. Our mobile app offers a streamlined interface for sending, signing, and tracking documents directly from your smartphone or tablet. This flexibility ensures you can handle your tax documents anytime, anywhere.

Get more for I 0103 Schedule SB Form 1 Subtractions From Income fillable

- Name affidavit of buyer oklahoma form

- Name affidavit of seller oklahoma form

- Non foreign affidavit under irc 1445 oklahoma form

- Owners or sellers affidavit of no liens oklahoma form

- Affidavit of occupancy and financial status oklahoma form

- Complex will with credit shelter marital trust for large estates oklahoma form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497323231 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497323232 form

Find out other I 0103 Schedule SB Form 1 Subtractions From Income fillable

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document