BUREAU of INTERNAL REVENUE Department of Finance 2021-2026

Understanding the Bureau of Internal Revenue

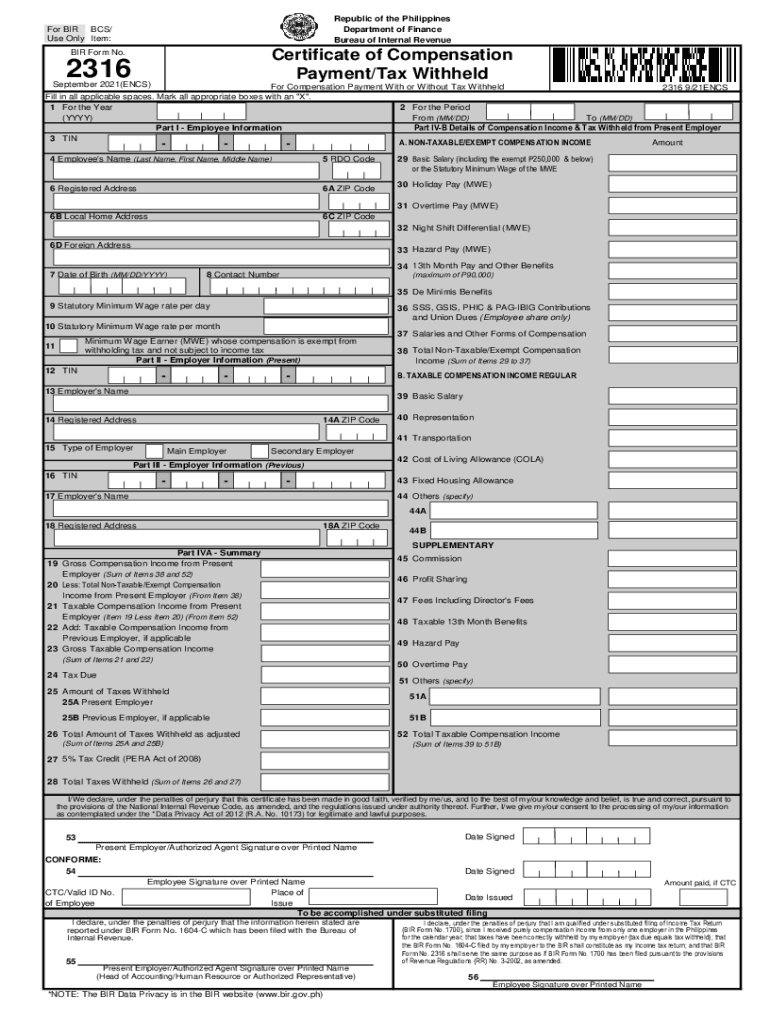

The Bureau of Internal Revenue (BIR) is a vital agency under the Department of Finance in the Philippines, responsible for the collection of taxes and enforcement of tax laws. It plays a crucial role in the country's financial system by ensuring that the government receives the necessary funds to operate effectively. The BIR oversees various tax-related processes, including the issuance of tax identification numbers (TIN), which are essential for individuals and businesses to comply with tax obligations.

Steps to Complete the BIR TIN Application

Filling out the BIR TIN application involves several straightforward steps. Begin by gathering necessary documents, such as valid identification and proof of residency. Next, you can access the application form, which is typically available online or at BIR offices. Carefully fill out the form, ensuring all information is accurate and complete. After completing the application, submit it either online or in person at the nearest BIR office. It is essential to keep a copy of the submitted application for your records.

Required Documents for BIR TIN Application

When applying for a BIR TIN, specific documents are required to verify your identity and residency. Commonly required documents include:

- Valid government-issued identification (e.g., passport, driver's license)

- Proof of residency (e.g., utility bill, lease agreement)

- Completed application form

Ensure that all documents are current and legible to avoid delays in processing your application.

Eligibility Criteria for BIR TIN Application

Eligibility for obtaining a BIR TIN varies based on individual circumstances. Generally, any individual or business entity that is subject to taxation in the Philippines is eligible to apply. This includes:

- Individuals earning income from employment or business

- Self-employed individuals

- Corporations and partnerships

It is important to review specific eligibility requirements based on your situation to ensure compliance with BIR regulations.

Legal Use of the BIR TIN

The BIR TIN serves as a unique identifier for taxpayers in the Philippines, facilitating the accurate tracking of tax obligations. It is legally required for various transactions, including filing tax returns, opening bank accounts, and applying for loans. Failure to obtain a TIN can result in penalties and complications in fulfilling tax responsibilities.

Form Submission Methods for BIR TIN Application

Submitting your BIR TIN application can be done through multiple methods to accommodate different preferences. You can choose to:

- Submit the application online through the BIR's official website

- Visit a local BIR office to submit the application in person

- Mail the completed application form to the appropriate BIR office

Each method has its advantages, so select the one that best suits your needs and ensures timely processing.

Quick guide on how to complete bureau of internal revenue department of finance

Prepare BUREAU OF INTERNAL REVENUE Department Of Finance effortlessly on any device

Web-based document administration has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the right form and securely retain it online. airSlate SignNow equips you with all the instruments necessary to generate, modify, and eSign your documents quickly without delays. Manage BUREAU OF INTERNAL REVENUE Department Of Finance on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign BUREAU OF INTERNAL REVENUE Department Of Finance stress-free

- Find BUREAU OF INTERNAL REVENUE Department Of Finance and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Indicate important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that function.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you wish to send your form, through email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign BUREAU OF INTERNAL REVENUE Department Of Finance and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bureau of internal revenue department of finance

Create this form in 5 minutes!

People also ask

-

What is a BIR TIN application and why do I need it?

A BIR TIN application is the process of obtaining a Tax Identification Number (TIN) from the Bureau of Internal Revenue (BIR). This identification is crucial for businesses and individuals in the Philippines to comply with tax regulations. Having a valid TIN ensures you can issue official receipts and comply with government requirements.

-

How can airSlate SignNow assist with my BIR TIN application?

airSlate SignNow simplifies the documentation process for your BIR TIN application. With its eSigning features, you can easily sign and send the necessary forms electronically, saving time and reducing paper usage. This streamlined workflow enhances your efficiency and ensures all documents are securely managed.

-

What are the pricing options for using airSlate SignNow for my BIR TIN application?

airSlate SignNow offers flexible pricing plans designed to fit various business needs. With options ranging from basic to enterprise-level, you can choose a plan that best suits your requirements for eSigning documents related to your BIR TIN application. Each plan includes a range of features to facilitate document management.

-

What features does airSlate SignNow provide for handling a BIR TIN application?

airSlate SignNow offers several features that enhance the BIR TIN application process, such as customizable templates, automated workflows, and real-time tracking of document status. These features allow you to efficiently manage submissions and improve compliance with BIR requirements. Additionally, eSigning ensures that your applications are executed swiftly.

-

Can I integrate airSlate SignNow with other software to assist with my BIR TIN application?

Yes, airSlate SignNow supports integrations with various business applications, allowing you to efficiently manage your BIR TIN application workflow. Integrating with CRM systems, document management solutions, and other tools helps you automate repetitive tasks and ensure seamless data flow. This integration capability enhances overall productivity.

-

What are the benefits of using airSlate SignNow for BIR TIN applications?

Using airSlate SignNow for BIR TIN applications offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The electronic nature of the platform ensures quick processing and easier tracking of your application. Moreover, eSigning saves time and makes it easier to collaborate with team members remotely.

-

Is there customer support available if I need help with my BIR TIN application?

Absolutely! airSlate SignNow provides comprehensive customer support to assist you with any issues related to your BIR TIN application. Whether you need help with software functionality or specific document requirements, their knowledgeable support team is ready to guide you through the process.

Get more for BUREAU OF INTERNAL REVENUE Department Of Finance

- Order to waive notice to putative father for name change of minor oregon form

- Alternative service form

- Motion alternative service form

- Alternative service 497324131 form

- Oregon unsecured installment payment promissory note for fixed rate oregon form

- Oregon note form

- Oregon installments fixed rate promissory note secured by personal property oregon form

- Oregon installments fixed rate promissory note secured by commercial real estate oregon form

Find out other BUREAU OF INTERNAL REVENUE Department Of Finance

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself