Declaration of Tax Residence for EntitiesPart XIX of the Income Tax Act 2020-2026

What is the Declaration of Tax Residence for Entities Part XIX of the Income Tax Act

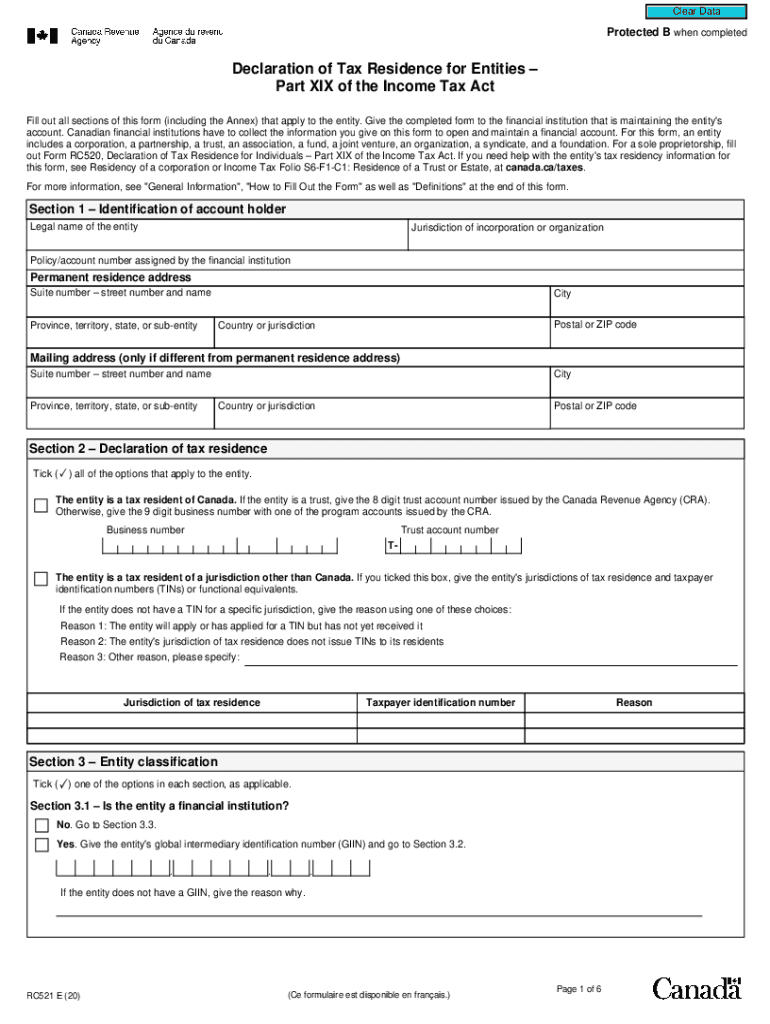

The Declaration of Tax Residence for Entities under Part XIX of the Income Tax Act is a crucial document for businesses operating in the United States. It serves to establish the tax residency status of an entity, which can affect its tax obligations and eligibility for certain benefits under tax treaties. This declaration is particularly relevant for foreign entities doing business in the U.S. or U.S. entities with foreign interests. By accurately completing this form, businesses can ensure compliance with tax regulations and avoid potential penalties.

Steps to Complete the Declaration of Tax Residence for Entities Part XIX of the Income Tax Act

Completing the Declaration of Tax Residence involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the entity, including its legal name, address, and tax identification number. Next, determine the entity's tax residency status based on its place of incorporation or management. Fill out the form carefully, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions before submission. Finally, sign the form electronically or physically, as required, to validate it.

Legal Use of the Declaration of Tax Residence for Entities Part XIX of the Income Tax Act

The Declaration of Tax Residence is legally binding when completed correctly and submitted in accordance with IRS guidelines. It is essential for entities to use this form to clarify their tax status, particularly when engaging in international business activities. The form helps prevent misunderstandings with tax authorities and provides a clear record of the entity's residency status. Compliance with the relevant laws ensures that the entity can benefit from any applicable tax treaties and avoid double taxation.

Required Documents for the Declaration of Tax Residence for Entities Part XIX of the Income Tax Act

To complete the Declaration of Tax Residence, certain documents are typically required. These may include:

- Proof of the entity's legal formation, such as articles of incorporation or a partnership agreement.

- Tax identification number issued by the IRS.

- Documentation supporting the entity's residency status, including financial statements or tax returns.

- Any relevant tax treaty agreements that may apply.

Having these documents ready can streamline the completion process and ensure that all necessary information is included.

Examples of Using the Declaration of Tax Residence for Entities Part XIX of the Income Tax Act

Entities may use the Declaration of Tax Residence in various scenarios. For instance, a U.S.-based corporation planning to expand its operations overseas may need to submit this declaration to clarify its tax status in a foreign country. Alternatively, a foreign company establishing a branch in the U.S. may need to complete the form to comply with local tax regulations. These examples illustrate the form's importance in facilitating international business operations while ensuring compliance with tax laws.

Filing Deadlines for the Declaration of Tax Residence for Entities Part XIX of the Income Tax Act

Filing deadlines for the Declaration of Tax Residence can vary based on the entity's tax year and specific circumstances. Generally, entities should submit the declaration as part of their annual tax filings. It is advisable to check the IRS guidelines or consult with a tax professional to determine the exact deadlines that apply to your situation. Timely submission is crucial to avoid penalties and ensure compliance with tax obligations.

Quick guide on how to complete declaration of tax residence for entitiespart xix of the income tax act

Complete Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to easily locate the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act stress-free

- Access Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act and hit Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight key sections of your documents or obscure sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to secure your changes.

- Choose how you wish to deliver your form, through email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act and ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct declaration of tax residence for entitiespart xix of the income tax act

Create this form in 5 minutes!

How to create an eSignature for the declaration of tax residence for entitiespart xix of the income tax act

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act?

The Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act is a document that certifies an entity's tax residency status for tax purposes. It is essential for avoiding double taxation and ensuring compliance with tax regulations. Understanding this declaration can help businesses manage their international tax obligations effectively.

-

How can airSlate SignNow assist with the Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act?

airSlate SignNow allows businesses to digitally sign and send the Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act efficiently and securely. With its user-friendly interface, entities can ensure timely submissions and maintain compliance with tax laws. This automation reduces errors and streamlines the overall process of managing tax documentation.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow provides features such as secure electronic signatures, templates for tax documents, and document tracking for the Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act. These tools simplify the preparation and submission process, ensuring that your documents are always ready when needed. Businesses can also collaborate in real-time, making it easier to gather necessary approvals.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans that cater to different organizational needs when managing the Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act. The cost-effective solution varies depending on features and volume, ensuring businesses of all sizes can find a plan that fits their budget. There are options available for individuals, small businesses, and large enterprises.

-

Can airSlate SignNow integrate with other accounting software for tax filing?

Absolutely! airSlate SignNow integrates seamlessly with multiple accounting and financial software, making it easy to manage the Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act alongside other financial documents. This integration allows for easy data transfer, helping users maintain organized records and improve accuracy in tax filings. By using integrated solutions, businesses save time and reduce manual errors.

-

What are the benefits of using airSlate SignNow for the Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act?

Using airSlate SignNow for the Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act offers several benefits, such as enhanced security for sensitive information, reduced turnaround time for document processing, and increased compliance with tax regulations. The platform's intuitive interface makes it easy for users to navigate, ensuring that all team members can participate in the tax document workflows effortlessly.

-

How does airSlate SignNow ensure security for tax-related documents?

airSlate SignNow employs top-tier security measures to protect your Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act and other sensitive documents. With encryption, secure cloud storage, and two-factor authentication, businesses can trust that their data is safe from unauthorized access. This focus on security helps entities meet legal requirements and maintain the integrity of their tax documentation.

Get more for Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act

- Pa guaranty form

- Amendment to lease or rental agreement pennsylvania form

- Warning notice due to complaint from neighbors pennsylvania form

- Lease subordination agreement pennsylvania form

- Apartment rules and regulations pennsylvania form

- Pa cancellation form

- Amendment of residential lease pennsylvania form

- Agreement for payment of unpaid rent pennsylvania form

Find out other Declaration Of Tax Residence For EntitiesPart XIX Of The Income Tax Act

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple

- Can I Sign Pennsylvania Residential lease agreement form

- Can I Sign Wyoming Residential lease agreement form

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template