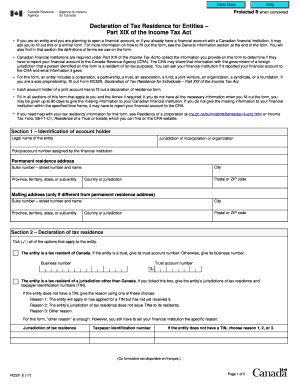

Rc521 2017

What is the Rc521

The Rc521 form is a specific document used in various administrative processes within the United States. It serves as a formal request or notification, often related to regulatory compliance or reporting requirements. Understanding the purpose of this form is essential for individuals and businesses to ensure they meet their obligations effectively.

How to use the Rc521

Using the Rc521 form involves several key steps to ensure proper completion and submission. First, gather all necessary information required for the form, including personal or business details, and any relevant documentation. Next, fill out the form accurately, ensuring that all sections are completed to avoid delays. Finally, submit the form through the designated method, whether online, by mail, or in person, as specified by the issuing authority.

Steps to complete the Rc521

Completing the Rc521 form involves a systematic approach:

- Review the instructions accompanying the form to understand the requirements.

- Gather all required information and documents to support your submission.

- Fill out the form carefully, ensuring all fields are completed accurately.

- Double-check for any errors or omissions before finalizing your submission.

- Submit the form through the appropriate channel, keeping a copy for your records.

Legal use of the Rc521

The Rc521 form must be used in compliance with applicable laws and regulations. This includes adhering to any specific guidelines set forth by the issuing agency. Ensuring that the form is filled out correctly and submitted on time is crucial to avoid potential legal issues or penalties associated with non-compliance.

Who Issues the Form

The Rc521 form is typically issued by a governmental agency or regulatory body responsible for overseeing compliance in specific sectors. This could include tax authorities, environmental agencies, or other regulatory entities. It is important to identify the correct issuing body to ensure that the form is used appropriately and submitted to the right location.

Required Documents

When completing the Rc521 form, certain documents may be required to support your submission. These could include identification documents, proof of residency, or any other relevant paperwork that verifies the information provided in the form. It is advisable to review the requirements carefully to ensure all necessary documents are included.

Quick guide on how to complete rc521

Effortlessly Prepare Rc521 on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents rapidly, without any hold-ups. Handle Rc521 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The Easiest Way to Edit and Electronically Sign Rc521

- Obtain Rc521 and click Get Form to initiate the process.

- Apply the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your document, via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Alter and electronically sign Rc521 and ensure outstanding communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rc521

Create this form in 5 minutes!

How to create an eSignature for the rc521

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rc521 form and how is it used?

The rc521 form is a specific document used for various administrative purposes, often related to compliance and record-keeping. By utilizing airSlate SignNow, businesses can efficiently fill out, sign, and send the rc521 form electronically, streamlining the process. This eliminates the need for physical paperwork and enhances overall productivity.

-

How can I electronically sign the rc521 form with airSlate SignNow?

To electronically sign the rc521 form using airSlate SignNow, simply upload your document to the platform and add your signature. The user-friendly interface makes it easy to add signatures and other necessary fields to the rc521 form. Once completed, you can send it securely to the intended recipients.

-

What are the pricing options for airSlate SignNow when using the rc521 form?

airSlate SignNow offers tiered pricing plans to accommodate different business needs for handling documents like the rc521 form. Each plan is designed to be cost-effective, allowing users to choose a package that best fits their budget and features required for managing the rc521 form efficiently.

-

What features does airSlate SignNow offer for managing the rc521 form?

AirSlate SignNow includes features such as customizable templates, real-time collaboration, and automated reminders specifically for documents like the rc521 form. These capabilities help expedite the completion of the form and ensure all necessary actions are taken promptly. Additionally, users can track the status of the rc521 form for better management.

-

Can I integrate airSlate SignNow with other applications for the rc521 form?

Yes, airSlate SignNow supports integrations with various productivity and cloud storage applications, enabling seamless processing of the rc521 form. You can connect tools like Google Drive, Dropbox, and more to enhance your workflow. This integration allows for easy access and management of the rc521 form across multiple platforms.

-

What are the benefits of using airSlate SignNow for the rc521 form?

Using airSlate SignNow for the rc521 form offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced accuracy in your document handling. The platform allows you to automate repetitive tasks, freeing up valuable time for your team. Additionally, electronic signatures ensure that your rc521 form is legally binding and secure.

-

Is airSlate SignNow compliant with legal standards for the rc521 form?

Absolutely, airSlate SignNow complies with major industry regulations and legal standards, making it a reliable option for your rc521 form. The platform adheres to e-signature laws, ensuring that your electronic signatures are valid and enforceable. This compliance provides peace of mind when handling important documents like the rc521 form.

Get more for Rc521

- Notice of dishonored check criminal keywords bad check bounced check texas form

- Mutual wills containing last will and testaments for man and woman living together not married with no children texas form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children texas form

- Mutual wills or last will and testaments for man and woman living together not married with minor children texas form

- Texas cohabitation form

- Tx paternity form

- Bill of sale in connection with sale of business by individual or corporate seller texas form

- Office lease agreement texas form

Find out other Rc521

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online