Cdn Unite529 ComjcdnfilesCollegeChoice Advisor 529 Savings Plan Incoming Rollover Form 2020-2026

Understanding the New York Advisor Guided 529 Forms

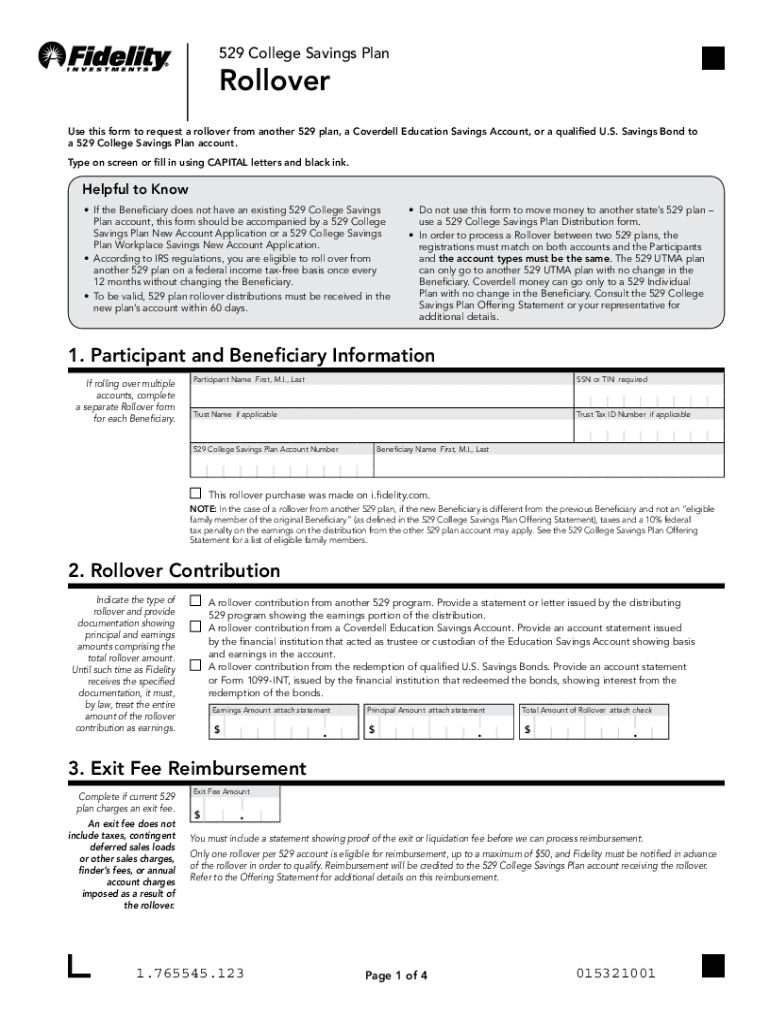

The New York Advisor Guided 529 forms are essential documents for families looking to invest in a 529 college savings plan. These forms allow account holders to manage their investments effectively and ensure compliance with state regulations. The forms facilitate various transactions, including contributions, withdrawals, and rollovers, specifically tailored for the New York 529 plan. Understanding these forms is crucial for maximizing the benefits of a 529 plan and ensuring that funds are used appropriately for educational expenses.

Steps to Complete the New York Advisor Guided 529 Forms

Completing the New York Advisor Guided 529 forms involves several key steps to ensure accuracy and compliance. Start by gathering necessary personal information, such as Social Security numbers and account details. Next, fill out the required sections of the forms, ensuring all information is correct and complete. It is important to review the forms thoroughly before submission to avoid delays. Finally, submit the forms electronically or via mail, depending on your preference and the specific requirements of the New York 529 plan.

Legal Use of the New York Advisor Guided 529 Forms

The legal use of the New York Advisor Guided 529 forms is governed by both state and federal regulations. To ensure that these forms are legally binding, they must be completed in compliance with the relevant laws, including the Internal Revenue Code and New York state regulations. Using an electronic signature solution, such as signNow, can help ensure that the forms are executed legally and securely. This compliance is crucial for maintaining the tax advantages associated with 529 plans and avoiding potential penalties.

Required Documents for New York Advisor Guided 529 Forms

When filling out the New York Advisor Guided 529 forms, certain documents are required to support your application or transaction. Commonly required documents include proof of identity, such as a government-issued ID, and any previous account statements if you are rolling over funds from another 529 plan. Additionally, you may need to provide documentation related to the beneficiary's enrollment in an eligible educational institution. Ensuring you have all necessary documents ready will streamline the process and help avoid delays.

Form Submission Methods for New York Advisor Guided 529 Forms

The New York Advisor Guided 529 forms can be submitted through various methods, offering flexibility for users. Electronic submission is often the fastest and most efficient way to process your forms. Alternatively, you can choose to print the forms and submit them via mail. If you prefer in-person assistance, visiting a local financial advisor or the New York 529 plan office may provide additional support. Each method has its own set of guidelines, so it is important to follow the instructions provided with the forms.

IRS Guidelines for New York Advisor Guided 529 Forms

Understanding IRS guidelines is essential when completing the New York Advisor Guided 529 forms. These guidelines outline the tax implications of contributions, withdrawals, and rollovers associated with 529 plans. For instance, contributions to a 529 plan may be eligible for state tax deductions, while withdrawals for qualified education expenses are typically tax-free. Familiarizing yourself with these guidelines will help ensure that you take full advantage of the tax benefits available through the New York 529 plan.

Quick guide on how to complete cdnunite529comjcdnfilescollegechoice advisor 529 savings plan incoming rollover form

Effortlessly Complete Cdn unite529 comjcdnfilesCollegeChoice Advisor 529 Savings Plan Incoming Rollover Form on Any Device

The management of online documents has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Cdn unite529 comjcdnfilesCollegeChoice Advisor 529 Savings Plan Incoming Rollover Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign Cdn unite529 comjcdnfilesCollegeChoice Advisor 529 Savings Plan Incoming Rollover Form with Ease

- Locate Cdn unite529 comjcdnfilesCollegeChoice Advisor 529 Savings Plan Incoming Rollover Form and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this task.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Cdn unite529 comjcdnfilesCollegeChoice Advisor 529 Savings Plan Incoming Rollover Form while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cdnunite529comjcdnfilescollegechoice advisor 529 savings plan incoming rollover form

Create this form in 5 minutes!

How to create an eSignature for the cdnunite529comjcdnfilescollegechoice advisor 529 savings plan incoming rollover form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are fidelity 529 forms?

Fidelity 529 forms are legal documents used to establish and manage 529 college savings plans. These forms facilitate contributions, beneficiary changes, and account management, ensuring that your investment in education is properly documented and compliant with regulations.

-

How do I fill out fidelity 529 forms using airSlate SignNow?

To fill out fidelity 529 forms using airSlate SignNow, you can upload your document directly to the platform. Our easy-to-use interface allows you to complete and eSign these forms digitally, streamlining the process and saving you time on paperwork.

-

What features does airSlate SignNow offer for managing fidelity 529 forms?

AirSlate SignNow offers various features for managing fidelity 529 forms, including electronic signatures, template creation, and document sharing. You can collaborate with stakeholders in real-time, ensuring that all parties are in sync throughout the process.

-

Are there integrations available for fidelity 529 forms with airSlate SignNow?

Yes, airSlate SignNow offers integrations with a variety of applications to enhance your experience with fidelity 529 forms. These integrations allow seamless connections with tools like Google Drive, Salesforce, and others, making document management more efficient.

-

How much does it cost to eSign fidelity 529 forms with airSlate SignNow?

AirSlate SignNow offers a cost-effective solution for eSigning fidelity 529 forms. Pricing depends on the plan you choose, allowing you to select the option that best meets your business needs while providing unlimited access to essential features.

-

What are the benefits of using airSlate SignNow for fidelity 529 forms?

Using airSlate SignNow for fidelity 529 forms streamlines the signing process, enhances security, and reduces turnaround times. With our platform, you can manage your documents from anywhere, ensuring that your education savings goals are efficiently met.

-

Can I track the status of my fidelity 529 forms with airSlate SignNow?

Absolutely! AirSlate SignNow allows you to track the status of your fidelity 529 forms in real-time. You will receive notifications and updates on the progress, ensuring that you are always informed about your document's status.

Get more for Cdn unite529 comjcdnfilesCollegeChoice Advisor 529 Savings Plan Incoming Rollover Form

- Excavation contractor package pennsylvania form

- Pennsylvania contractor 497324840 form

- Concrete mason contractor package pennsylvania form

- Demolition contractor package pennsylvania form

- Pennsylvania security application form

- Insulation contractor package pennsylvania form

- Paving contractor package pennsylvania form

- Pennsylvania work contractor form

Find out other Cdn unite529 comjcdnfilesCollegeChoice Advisor 529 Savings Plan Incoming Rollover Form

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document