Indian River County Property Appraiser 2023

What is the Indian River County Property Appraiser

The Indian River County Property Appraiser is a vital office responsible for determining the value of properties within Indian River County, Florida. This office plays a crucial role in the assessment of real estate for tax purposes, ensuring that property values are fair and equitable. The appraiser's office also oversees the administration of various tax exemptions, including the homestead exemption, which can significantly reduce property taxes for eligible homeowners. Understanding the functions of the Indian River County Property Appraiser helps residents navigate property taxes and exemptions effectively.

How to use the Indian River County Property Appraiser

Utilizing the Indian River County Property Appraiser's services can be straightforward. Residents can access property records, view assessment values, and apply for exemptions through the office's website. The online portal provides tools for searching property information by address or owner name. Additionally, the site offers resources for understanding property tax assessments and filing for exemptions, making it easier for residents to manage their property-related inquiries.

Eligibility Criteria for Homestead Exemption

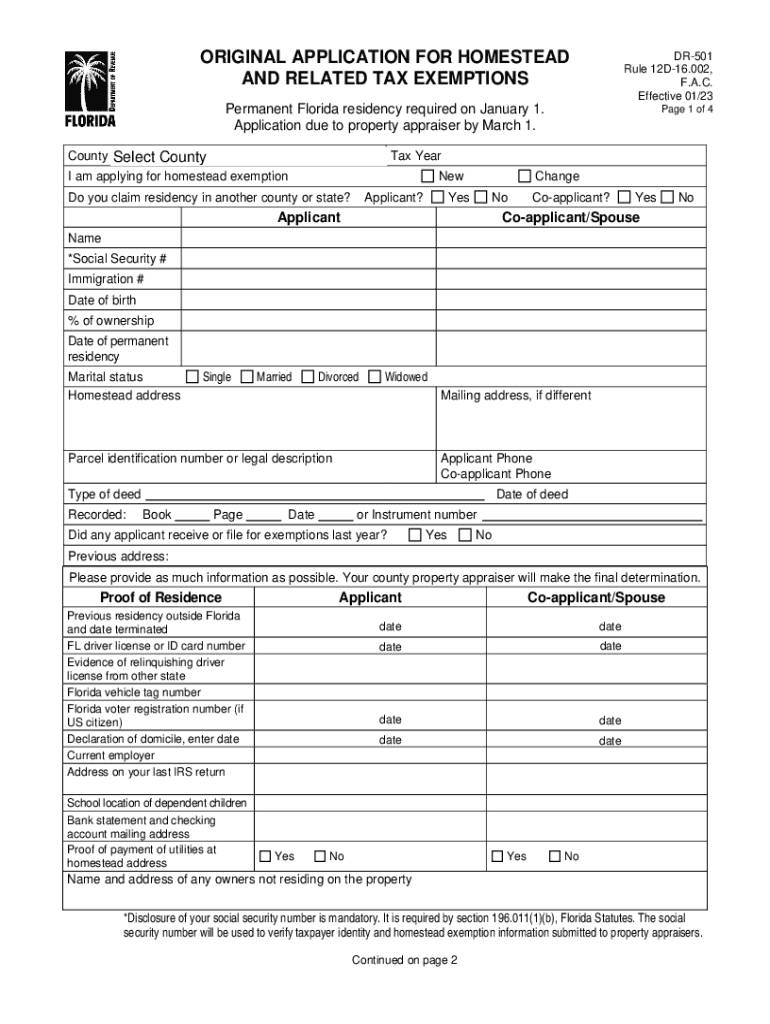

To qualify for the homestead exemption in Indian River County, applicants must meet specific criteria. Homeowners must occupy the property as their primary residence as of January first of the tax year. Additionally, applicants must be U.S. citizens or legal residents and must not claim a homestead exemption on any other property. It is essential to provide proof of residency, such as a Florida driver's license or utility bill, when submitting the application. Understanding these eligibility requirements is crucial for ensuring that homeowners can benefit from potential tax savings.

Steps to complete the Indian River County Property Appraiser application

Completing the Indian River County Property Appraiser application involves several key steps. First, gather necessary documentation, including proof of residency and identification. Next, access the application form, which can typically be found on the property appraiser's website. Fill out the form accurately, ensuring all required fields are completed. Once the form is ready, submit it either online, by mail, or in person at the appraiser's office. It is important to adhere to submission deadlines to ensure timely processing of the application.

Required Documents for Application

When applying for property tax exemptions through the Indian River County Property Appraiser, specific documents are required to support your application. These documents may include a valid Florida driver's license, proof of residency such as a utility bill, and, if applicable, documentation of any other exemptions claimed. Ensuring that all required documents are included with the application can help facilitate a smoother review process and increase the likelihood of approval.

Form Submission Methods

The Indian River County Property Appraiser offers multiple methods for submitting applications, accommodating various preferences. Homeowners can submit their applications online through the property appraiser's website, which provides a convenient and efficient option. Alternatively, applications can be mailed directly to the office or submitted in person. Each method has its advantages, and homeowners should choose the one that best fits their needs to ensure their application is processed promptly.

Penalties for Non-Compliance

Failing to comply with property tax regulations in Indian River County can result in penalties. Homeowners who do not file for exemptions they are eligible for may miss out on potential tax savings. Additionally, late submissions of applications can lead to denial of the exemption for that tax year. Understanding the consequences of non-compliance is essential for homeowners to protect their financial interests and ensure they are taking full advantage of available benefits.

Quick guide on how to complete indian river county property appraiser

Effortlessly Prepare Indian River County Property Appraiser on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely retain it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Indian River County Property Appraiser on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to Edit and Electronically Sign Indian River County Property Appraiser with Ease

- Find Indian River County Property Appraiser and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all information and then click on the Done button to save your modifications.

- Choose your preferred method of submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Indian River County Property Appraiser to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indian river county property appraiser

Create this form in 5 minutes!

How to create an eSignature for the indian river county property appraiser

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does an Indian River property appraiser provide?

An Indian River property appraiser offers comprehensive property valuation services, helping homeowners, buyers, and real estate professionals assess property values accurately. These appraisers consider factors such as location, property condition, and recent sales data to provide reliable appraisals. Utilizing an experienced Indian River property appraiser can ensure that you receive fair market valuations.

-

How much does it cost to hire an Indian River property appraiser?

The cost of hiring an Indian River property appraiser varies based on the property type and the complexity of the appraisal. Generally, you can expect to pay between $300 to $600 for residential properties. However, larger or more complex properties may incur higher fees, and it’s advisable to get a detailed quote before proceeding.

-

What are the benefits of using an Indian River property appraiser?

Using an Indian River property appraiser ensures you receive an accurate and unbiased property valuation, which is essential for informed decision-making. This can help you negotiate better prices, secure financing, and ensure proper tax assessments. Additionally, a professional appraisal can enhance confidence for buyers and sellers in real estate transactions.

-

How long does an appraisal take with an Indian River property appraiser?

Typically, the appraisal process with an Indian River property appraiser can take anywhere from a few hours to a couple of days. After the initial inspection, appraisers need time to research comparable sales and complete the valuation report. You can usually expect to receive the final report within a week after the appraisal date.

-

Do Indian River property appraisers need to be certified?

Yes, Indian River property appraisers must be certified or licensed to perform appraisals in Florida. This ensures that they adhere to state regulations and maintain professional standards. Hiring a certified appraiser guarantees a level of expertise and credibility in the appraisal process.

-

What factors do Indian River property appraisers consider during an appraisal?

Indian River property appraisers evaluate various factors such as location, property size, condition, and recent sales of comparable properties in the area. They also consider market trends and economic conditions that may influence property values. This thorough analysis ensures you receive a fair and equitable appraisal.

-

Can Indian River property appraisers assist in tax assessment appeals?

Yes, Indian River property appraisers can provide valuable assistance during tax assessment appeals. They can prepare detailed reports that support property owners' claims for lower assessments due to discrepancies in valuation or market conditions. Utilizing an appraiser's expertise can strengthen your case for an appealing tax assessment.

Get more for Indian River County Property Appraiser

- Me deed to form

- Discovery interrogatories from plaintiff to defendant with production requests maine form

- Maine notice form

- Discovery interrogatories from defendant to plaintiff with production requests maine form

- Maine divorce form

- Maine disclosure hearing form

- Statement of claim maine form

- Heirship affidavit descent maine form

Find out other Indian River County Property Appraiser

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization