ORIGINAL APPLICATION for HOMESTEAD EXEMPTIONS 2021

What is the original application for homestead exemptions?

The original application for homestead exemptions is a formal request that property owners in Florida submit to their local property appraiser's office. This application allows homeowners to claim a reduction in property taxes on their primary residence. By filing this application, eligible homeowners can benefit from tax savings, which can significantly reduce their annual tax burden. The homestead exemption is designed to provide financial relief to residents and promote homeownership within the state.

Eligibility criteria for homestead exemptions

To qualify for the homestead exemption in Florida, applicants must meet specific criteria. The property must be the applicant's primary residence, and the homeowner must have legal or equitable title to the property. Additionally, the applicant must be a permanent resident of Florida as of January first of the tax year for which they are applying. Certain additional exemptions may apply for senior citizens, disabled individuals, and veterans, which can further enhance the benefits of the homestead exemption.

Steps to complete the original application for homestead exemptions

Completing the original application for homestead exemptions involves several key steps. First, gather necessary documents, including proof of ownership, identification, and any relevant financial information. Next, access the application form, typically available online through the local property appraiser's website or in person at their office. Fill out the form accurately, ensuring all required fields are completed. Finally, submit the application by the designated deadline, which is typically March first for the upcoming tax year.

Filing deadlines and important dates

Understanding the filing deadlines for the homestead exemption is crucial for homeowners. The primary deadline for submitting the original application for homestead exemptions in Florida is March first of the tax year. It is essential to adhere to this timeline to ensure eligibility for the tax benefits. Homeowners should also be aware of any additional deadlines related to specific exemptions, such as those for seniors or disabled individuals, which may differ from the standard deadline.

Form submission methods

The original application for homestead exemptions can be submitted through various methods, providing flexibility for homeowners. Applicants can complete the form online through their local property appraiser's website, which often offers a user-friendly interface for digital submissions. Alternatively, homeowners may choose to print the form and submit it by mail or deliver it in person to the property appraiser's office. Each method has its advantages, and homeowners should select the one that best suits their needs.

Required documents for homestead exemption application

When applying for the homestead exemption, homeowners must provide specific documents to support their application. Required documents typically include proof of ownership, such as a deed or title, a valid identification card, and evidence of residency, such as a utility bill or lease agreement. Additional documentation may be necessary for applicants seeking special exemptions, such as those for veterans or individuals with disabilities. Ensuring all required documents are included can help streamline the application process.

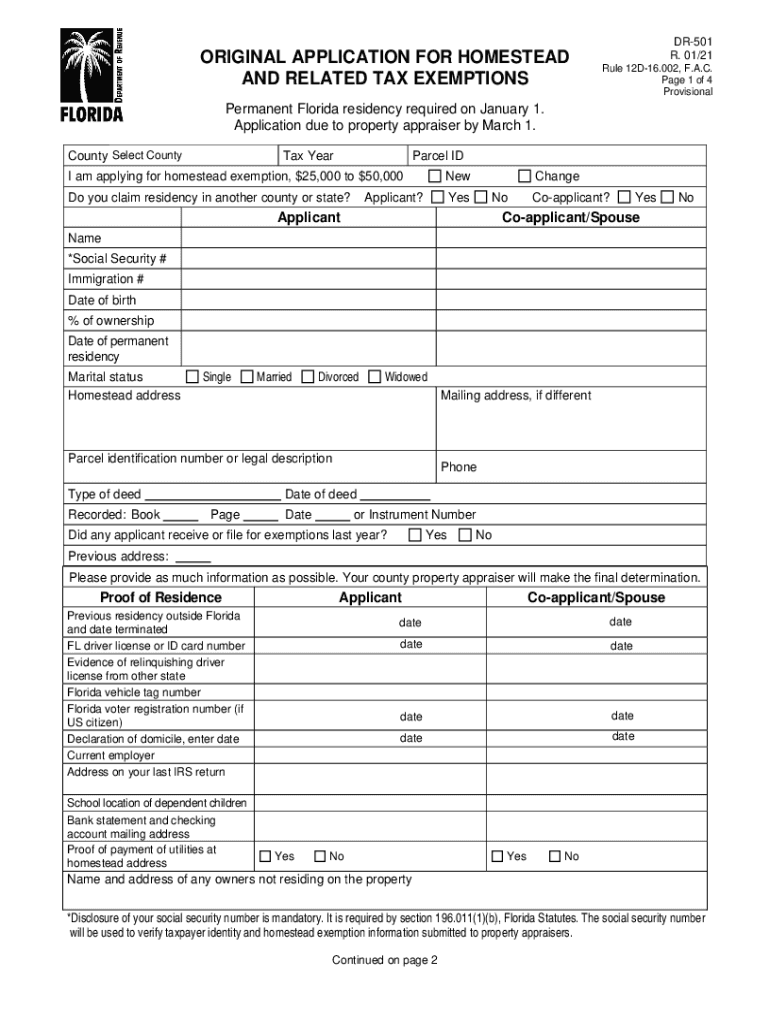

Key elements of the original application for homestead exemptions

The original application for homestead exemptions includes several key elements that applicants must complete. These elements typically consist of personal information, such as the homeowner's name, address, and contact details. The form also requires details about the property, including its legal description and current assessed value. Additionally, applicants may need to provide information about any previous exemptions claimed and certify their eligibility for the homestead exemption. Completing these elements accurately is essential for a successful application.

Quick guide on how to complete original application for homestead exemptions

Complete ORIGINAL APPLICATION FOR HOMESTEAD EXEMPTIONS effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents rapidly without delays. Manage ORIGINAL APPLICATION FOR HOMESTEAD EXEMPTIONS on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign ORIGINAL APPLICATION FOR HOMESTEAD EXEMPTIONS without stress

- Find ORIGINAL APPLICATION FOR HOMESTEAD EXEMPTIONS and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searches, or mistakes requiring new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Modify and eSign ORIGINAL APPLICATION FOR HOMESTEAD EXEMPTIONS and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct original application for homestead exemptions

Create this form in 5 minutes!

How to create an eSignature for the original application for homestead exemptions

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the homestead exemption Florida deadline 2022?

The homestead exemption Florida deadline 2022 refers to the date by which property owners must file their application to qualify for the tax exemption. In 2022, this deadline was March 1st. Failing to meet this deadline may result in missing out on signNow savings on property taxes.

-

How can airSlate SignNow help with my homestead exemption Florida application?

AirSlate SignNow simplifies the eSigning process, allowing you to quickly prepare and sign your homestead exemption Florida application online. This ensures you can meet the homestead exemption Florida deadline 2022 without delays. Additionally, you can securely store all your documents for easy access and tracking.

-

What are the benefits of filing for a homestead exemption in Florida?

Filing for a homestead exemption in Florida can signNowly reduce your taxable value, leading to lower property taxes. It also may provide additional protections from creditors and help you qualify for various county benefits. Ensuring you meet the homestead exemption Florida deadline 2022 is crucial to enjoy these benefits.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow offers robust features for document management, including eSigning, templates, and automated workflows. These features enable you to efficiently handle your homestead exemption Florida application and any other related documents. With airSlate SignNow, you can stay organized and ensure you don't miss the homestead exemption Florida deadline 2022.

-

Are there any costs associated with using airSlate SignNow for my homestead exemption application?

Using airSlate SignNow is quite cost-effective, especially when preparing important documents like your homestead exemption application. While the exact pricing may vary, airSlate SignNow offers various plans to suit different budgets. Investing in this solution could save you more on property taxes if you meet the homestead exemption Florida deadline 2022.

-

Can I integrate airSlate SignNow with other software for handling my documents?

Yes, airSlate SignNow integrates seamlessly with numerous software applications, including CRM systems and cloud storage services. This allows you to streamline your document management process when applying for your homestead exemption. By integrating, you can ensure that all documents are organized and ready before the homestead exemption Florida deadline 2022.

-

What happens if I miss the homestead exemption Florida deadline 2022?

If you miss the homestead exemption Florida deadline 2022, you may be ineligible for that year's tax savings. However, you can still file for the exemption in the following year. Knowing the deadline and using tools like airSlate SignNow can help prevent any oversights.

Get more for ORIGINAL APPLICATION FOR HOMESTEAD EXEMPTIONS

- Management aptitude test questions and answers pdf form

- Hdfc rtgs form download in excel

- Passing certificate format

- Direct transfer form for registered investments

- Direct transfer form for registered investments 782249198

- Sale form lawyers conveyancing

- Sponsorship form northern ireland chest heart and stroke nichs org

- Propuesta de gestor administrativo anses form

Find out other ORIGINAL APPLICATION FOR HOMESTEAD EXEMPTIONS

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form