Partner's Instructions for Form it 204 IP Tax NY Gov 2022

Understanding the Partner's Instructions for Form IT 204 IP

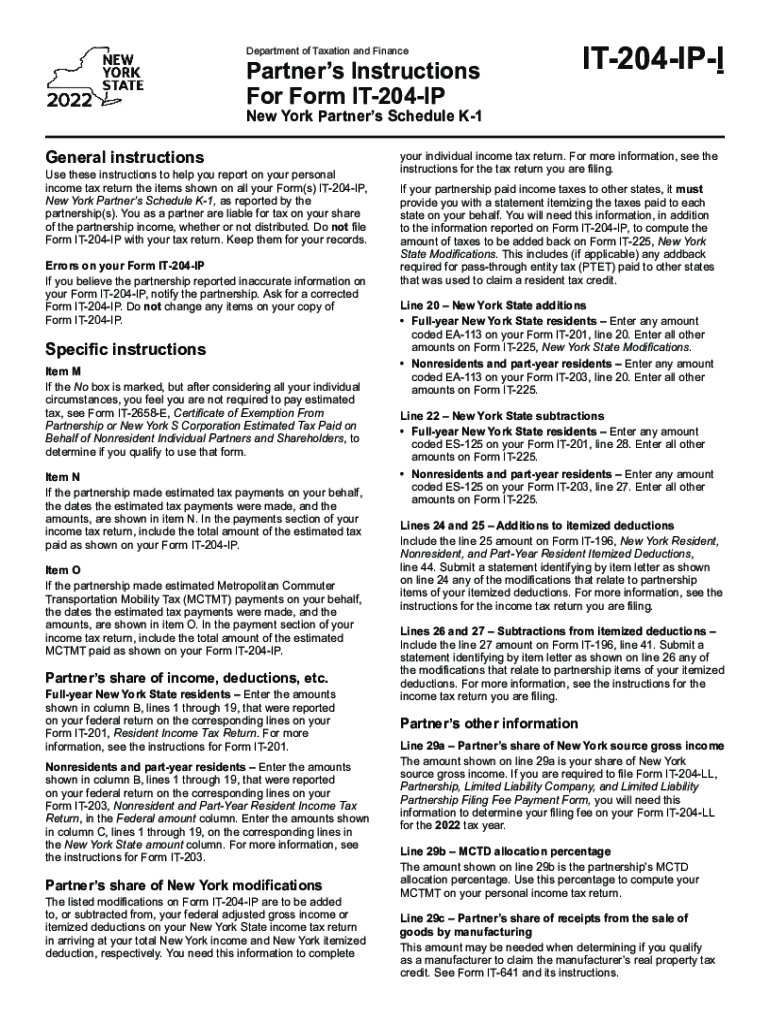

The Partner's Instructions for Form IT 204 IP provide essential guidance for individuals and entities required to file this tax form in New York. This form is specifically designed for partnerships and their partners to report information regarding income, deductions, and credits. Understanding these instructions is crucial to ensure compliance with New York State tax regulations.

These instructions detail the necessary steps for completing the form accurately, including how to report income from various sources, calculate deductions, and claim any applicable credits. Familiarity with these guidelines helps prevent errors that could lead to penalties or delays in processing.

Steps to Complete the Partner's Instructions for Form IT 204 IP

Completing the Partner's Instructions for Form IT 204 IP involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Review the specific instructions related to your partnership type to understand the reporting requirements.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported as per the guidelines.

- Double-check the completed form for accuracy and completeness before submission.

- Submit the form by the specified deadline to avoid any penalties.

Following these steps ensures a smooth filing process and helps maintain compliance with state tax laws.

Key Elements of the Partner's Instructions for Form IT 204 IP

Several key elements are essential to successfully navigating the Partner's Instructions for Form IT 204 IP:

- Income Reporting: Accurate reporting of all income earned by the partnership is critical.

- Deductions: Understanding which deductions are applicable can significantly affect the overall tax liability.

- Credits: Identifying available credits can provide additional tax relief.

- Filing Requirements: Knowing who is required to file and the deadlines for submission is crucial for compliance.

These elements form the foundation of the instructions and are vital for ensuring that the form is completed correctly.

Legal Use of the Partner's Instructions for Form IT 204 IP

The Partner's Instructions for Form IT 204 IP must be used legally and ethically to ensure compliance with New York State tax laws. This includes accurately reporting all required information and adhering to deadlines. Misuse of the instructions can lead to penalties, including fines or audits by the New York State Department of Taxation and Finance.

It is important to consult with a tax professional if there are uncertainties regarding the legal implications of the instructions or the form itself. Ensuring that all actions taken are within legal boundaries protects both the individual and the partnership.

Filing Deadlines for Form IT 204 IP

Filing deadlines are crucial for compliance with tax regulations. For Form IT 204 IP, the due date typically aligns with the partnership's tax return deadline. This is usually the fifteenth day of the third month following the end of the tax year. For partnerships that operate on a calendar year, this means the form is due by March 15.

It is advisable to mark these deadlines on your calendar and allow sufficient time for preparation and submission to avoid any late fees or penalties.

Required Documents for Form IT 204 IP

When completing Form IT 204 IP, certain documents are necessary to ensure accurate reporting:

- Partnership financial statements, including income and expense reports.

- Prior year tax returns for reference and comparison.

- Documentation of any deductions or credits being claimed.

- Identification numbers for all partners involved.

Having these documents ready will streamline the completion process and help ensure that all required information is accurately reported.

Quick guide on how to complete partners instructions for form it 204 ip taxnygov

Effortlessly Prepare Partner's Instructions For Form IT 204 IP Tax NY gov on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing users to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources needed to create, edit, and electronically sign your documents quickly and without delays. Handle Partner's Instructions For Form IT 204 IP Tax NY gov on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

Steps to Edit and Electronically Sign Partner's Instructions For Form IT 204 IP Tax NY gov with Ease

- Obtain Partner's Instructions For Form IT 204 IP Tax NY gov and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information using the tools specifically designed for this purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Partner's Instructions For Form IT 204 IP Tax NY gov to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct partners instructions for form it 204 ip taxnygov

Create this form in 5 minutes!

How to create an eSignature for the partners instructions for form it 204 ip taxnygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IT 204 IP instructions?

The IT 204 IP instructions are guidelines designed to assist users in completing their tax forms electronically. These comprehensive instructions help ensure compliance with New York State tax regulations while making the e-filing process more efficient.

-

How can airSlate SignNow help with IT 204 IP instructions?

airSlate SignNow simplifies the e-filing of tax forms by allowing users to send and electronically sign documents seamlessly. This means that the IT 204 IP instructions can be easily followed and executed, reducing errors and enhancing overall workflow.

-

Are there any costs associated with using airSlate SignNow for IT 204 IP instructions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are competitively priced, ensuring you get value while effectively handling IT 204 IP instructions and other document-related tasks.

-

What features does airSlate SignNow offer for managing IT 204 IP instructions?

airSlate SignNow provides a range of features including eSigning, document sharing, and automated workflows. These features make it easy to manage IT 204 IP instructions and streamline your document processes.

-

Can airSlate SignNow integrate with other applications to assist with IT 204 IP instructions?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications like Google Drive and Salesforce. These integrations enhance your ability to manage IT 204 IP instructions and other business documents in one place.

-

What benefits does airSlate SignNow provide in relation to IT 204 IP instructions?

Using airSlate SignNow offers several benefits, including improved speed, reduced paperwork, and increased accuracy when processing IT 204 IP instructions. This ensures a smoother experience for both taxpayers and accountants alike.

-

Is airSlate SignNow user-friendly for understanding IT 204 IP instructions?

Yes! airSlate SignNow is designed with user-friendliness in mind, making it easy for users to understand and apply IT 204 IP instructions. The intuitive interface allows you to navigate through the process without hassle.

Get more for Partner's Instructions For Form IT 204 IP Tax NY gov

- Hvac contract for contractor south carolina form

- Landscape contract for contractor south carolina form

- Commercial contract for contractor south carolina form

- Excavator contract for contractor south carolina form

- Renovation contract for contractor south carolina form

- Concrete mason contract for contractor south carolina form

- Demolition contract for contractor south carolina form

- Framing contract for contractor south carolina form

Find out other Partner's Instructions For Form IT 204 IP Tax NY gov

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT