Instructions for Form it 204 IP New York Partners Schedule K 1 Tax Year 2023

Understanding the Instructions for Form IT 204 IP

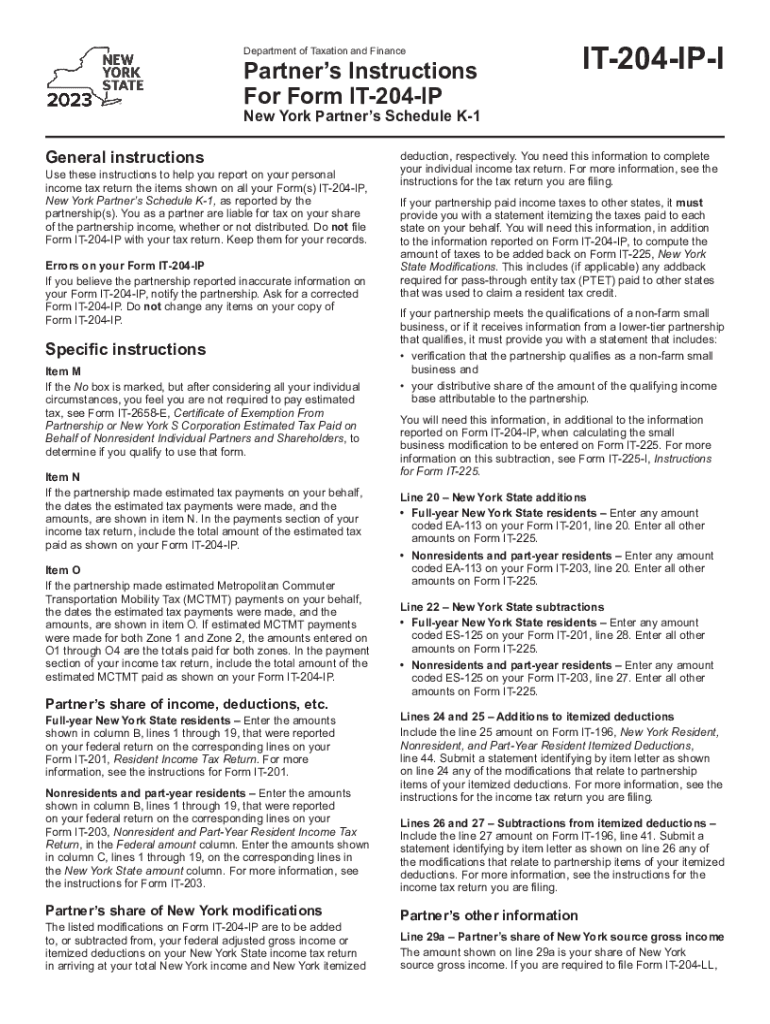

The Instructions for Form IT 204 IP are essential for partners in a New York partnership who need to report income, deductions, and credits. This form, also known as the New York Partners Schedule K-1, is specifically designed for partnerships to provide each partner with their share of the partnership's income. It is crucial for tax compliance and accurate reporting on individual tax returns. The form outlines how partners should report their income from the partnership, ensuring that all parties are aware of their tax obligations.

Steps to Complete Form IT 204 IP

Completing Form IT 204 IP involves several key steps:

- Gather necessary financial documents, including the partnership's income statement and any relevant deductions.

- Fill out the partner's information, including name, address, and taxpayer identification number.

- Report the partner's share of income, deductions, and credits as provided by the partnership.

- Review the completed form for accuracy before submission.

- Submit the form along with the partnership's tax return.

Legal Use of Form IT 204 IP

The legal use of Form IT 204 IP is integral to the tax reporting process for partnerships in New York. This form ensures that partners correctly report their share of the partnership's income and comply with state tax laws. Failure to accurately complete and file this form can lead to penalties and interest on unpaid taxes. It is important for partners to understand their legal obligations and ensure that the information reported is complete and truthful.

Key Elements of Form IT 204 IP

Key elements of Form IT 204 IP include:

- Partner's identification information, including name and taxpayer identification number.

- Details of the partnership's income, deductions, and credits allocated to each partner.

- Signature of the partner or authorized representative, certifying the accuracy of the information.

These elements are crucial for ensuring that the form meets all legal and regulatory requirements.

Filing Deadlines for Form IT 204 IP

Filing deadlines for Form IT 204 IP are aligned with the partnership's tax return due date. Typically, partnerships must file their tax returns by the fifteenth day of the third month following the end of their fiscal year. For partnerships operating on a calendar year, this means the deadline is March fifteenth. It is important for partners to be aware of these deadlines to avoid late filing penalties.

Obtaining Instructions for Form IT 204 IP

Instructions for Form IT 204 IP can be obtained through the New York State Department of Taxation and Finance website. The instructions provide detailed guidance on how to complete the form accurately, including information on reporting requirements and common pitfalls to avoid. It is advisable for partners to review these instructions thoroughly to ensure compliance with state tax laws.

Quick guide on how to complete instructions for form it 204 ip new york partners schedule k 1 tax year

Prepare Instructions For Form IT 204 IP New York Partners Schedule K 1 Tax Year effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for standard printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources required to create, alter, and eSign your documents swiftly without delays. Handle Instructions For Form IT 204 IP New York Partners Schedule K 1 Tax Year on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Instructions For Form IT 204 IP New York Partners Schedule K 1 Tax Year with ease

- Locate Instructions For Form IT 204 IP New York Partners Schedule K 1 Tax Year and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, either by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes necessitating new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Instructions For Form IT 204 IP New York Partners Schedule K 1 Tax Year and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 204 ip new york partners schedule k 1 tax year

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 204 ip new york partners schedule k 1 tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to IT 204 IP instructions?

airSlate SignNow provides a comprehensive set of features designed for efficient document management and eSigning, which includes customizable templates, automatic reminders, and an intuitive interface. Specifically, the IT 204 IP instructions can be integrated seamlessly into your workflow, ensuring that all necessary details are captured and submitted correctly.

-

How can airSlate SignNow help with the IT 204 IP instructions process?

With airSlate SignNow, you can streamline the process of filling out and submitting your IT 204 IP instructions. The platform allows for collaborative editing, real-time status tracking, and secure cloud storage, ensuring that you can manage your documents effectively and efficiently.

-

What is the pricing structure for using airSlate SignNow for IT 204 IP instructions?

airSlate SignNow offers a flexible pricing structure tailored to suit different business needs, allowing you to choose a plan that best meets the volume of your IT 204 IP instructions. Pricing is competitive, and the features included in each plan provide excellent value, making it a cost-effective solution for eSigning documents.

-

Are there any integration options available for managing IT 204 IP instructions?

Yes, airSlate SignNow supports a wide range of integrations with popular applications, enabling you to manage your IT 204 IP instructions alongside other business tools. Whether it's connecting with CRM systems, cloud storage solutions, or productivity apps, these integrations enhance your overall workflow efficiency.

-

Is airSlate SignNow secure for handling sensitive IT 204 IP instructions?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and multi-factor authentication, to protect your sensitive IT 204 IP instructions. You can eSign and manage documents with confidence knowing that your data is secure and compliant with legal standards.

-

How long does it take to get started with airSlate SignNow for IT 204 IP instructions?

Getting started with airSlate SignNow is incredibly quick and easy. You can sign up for a free trial and begin managing your IT 204 IP instructions within minutes, with user-friendly resources and support available to assist you along the way.

-

What benefits does airSlate SignNow offer specifically for IT 204 IP instructions?

Using airSlate SignNow for your IT 204 IP instructions brings numerous benefits, including increased efficiency, reduced turnaround times, and real-time document tracking. By automating the workflow, you can enhance productivity and ensure that important deadlines are met without hassle.

Get more for Instructions For Form IT 204 IP New York Partners Schedule K 1 Tax Year

- Form w 8eci

- Cfe exam application form

- Au pair medical certificate form

- Property tax appeals when how ampamp why to submit plus a form

- Medical packag statement of work contract template form

- Medical receptionist contract template form

- Flea market vendor contract template form

- Fleet management contract template form

Find out other Instructions For Form IT 204 IP New York Partners Schedule K 1 Tax Year

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document