Rental Motor, Tour Vehicle, and Car Department of Taxation 2022-2026

Understanding the Hawaii income tax rate

The Hawaii income tax rate is structured progressively, meaning that higher income levels are taxed at higher rates. The rates range from one point four percent to eleven percent, depending on the taxpayer's income bracket. For individuals, the income tax brackets are divided into several categories, ensuring that those who earn less pay a smaller percentage of their income in taxes. This system aims to create a fair tax environment that considers the financial capabilities of each taxpayer.

Filing deadlines and important dates

Taxpayers in Hawaii must be aware of specific deadlines to ensure compliance with state tax regulations. The typical deadline for filing individual income tax returns is April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. For those who require additional time, an extension can be requested, but it is essential to pay any estimated taxes owed by the original deadline to avoid penalties.

Required documents for filing

To file a Hawaii income tax return successfully, taxpayers need to gather several key documents. These typically include W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income sources. Additionally, it is crucial to have documentation for any deductions or credits being claimed, such as receipts for medical expenses or educational costs. Organizing these documents ahead of time can streamline the filing process and help ensure accuracy.

Form submission methods

Hawaii offers various methods for submitting income tax returns, accommodating different preferences and situations. Taxpayers can file their returns online through the state’s tax portal, which provides a convenient and efficient way to complete the process. Alternatively, individuals may choose to mail their returns or submit them in person at designated tax offices. Each method has its own set of requirements and processing times, so it is advisable to choose the one that best fits individual circumstances.

Penalties for non-compliance

Failing to comply with Hawaii's tax regulations can result in significant penalties. Taxpayers who miss the filing deadline may incur late fees, which can accumulate over time. Additionally, if taxes owed are not paid, interest will accrue on the unpaid balance. In severe cases, non-compliance may lead to legal action or tax liens against property. Understanding these consequences can motivate timely and accurate filing, helping to avoid unnecessary financial strain.

Taxpayer scenarios

Different taxpayer scenarios can affect how individuals approach their Hawaii income tax obligations. For example, self-employed individuals may have additional considerations, such as estimated tax payments and business deductions. Retired individuals might benefit from specific exemptions or credits based on their income sources. Students may also have unique tax situations, particularly if they earn income while attending school. Recognizing these scenarios can help taxpayers navigate their obligations more effectively and maximize potential benefits.

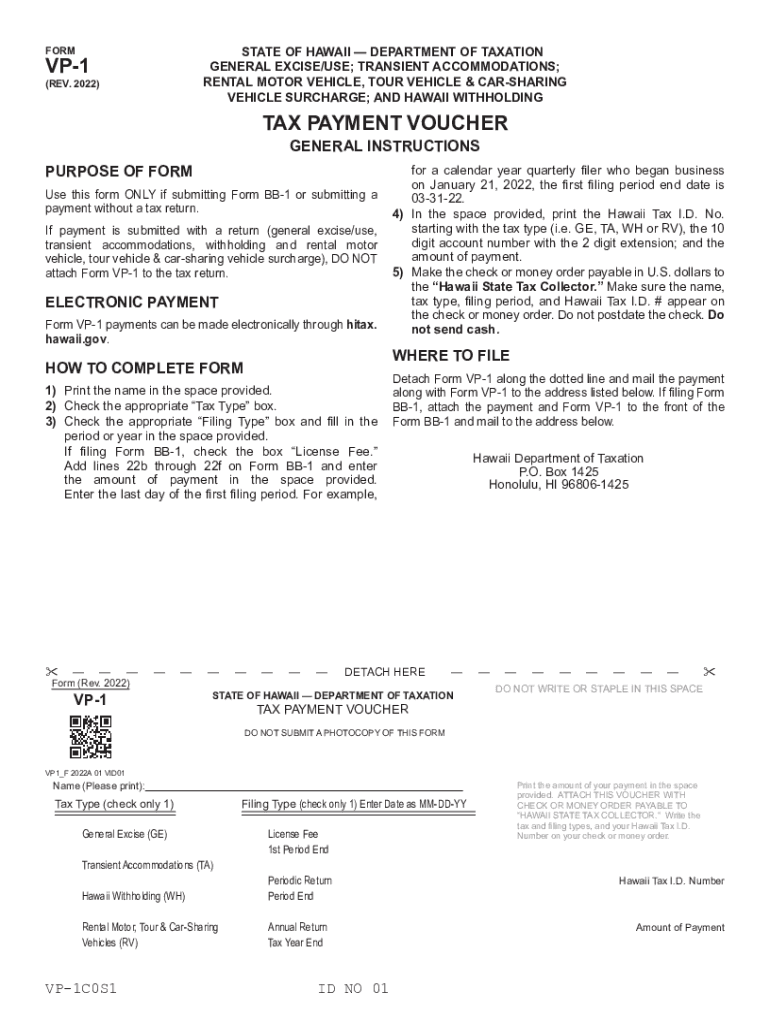

Quick guide on how to complete rental motor tour vehicle and car department of taxation

Complete Rental Motor, Tour Vehicle, And Car Department Of Taxation seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents promptly without any holdups. Manage Rental Motor, Tour Vehicle, And Car Department Of Taxation on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Rental Motor, Tour Vehicle, And Car Department Of Taxation effortlessly

- Obtain Rental Motor, Tour Vehicle, And Car Department Of Taxation and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Accentuate pertinent sections of your document or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Rental Motor, Tour Vehicle, And Car Department Of Taxation and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rental motor tour vehicle and car department of taxation

Create this form in 5 minutes!

How to create an eSignature for the rental motor tour vehicle and car department of taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the current Hawaii income tax rate for individuals?

The Hawaii income tax rate for individuals varies based on income levels, ranging from 1.4% to 11%. This progressive taxation means that higher earners will pay a higher percentage. It's important to check the latest rates to understand how they may affect your financial planning.

-

How does the Hawaii income tax rate affect my business?

The Hawaii income tax rate can signNowly impact businesses, particularly regarding profitability and planning. Businesses are subject to various tax rates depending on their structure and revenue. Understanding these rates can help optimize your tax strategy.

-

Are there any deductions available with the Hawaii income tax rate?

Yes, there are various deductions and credits available that can reduce your taxable income under the Hawaii income tax rate. Small businesses and individual taxpayers may qualify for specific tax credits that further reduce their tax burden. Consulting with a tax professional is advisable to explore available options.

-

How can airSlate SignNow help with tax-related document management?

airSlate SignNow simplifies document management related to taxes by allowing you to electronically sign and send necessary forms securely. This streamlined process can save time and ensure compliance with the Hawaii income tax rate filing requirements. It enhances organization and reduces the risk of misplacing important tax documents.

-

Does airSlate SignNow offer features for tax compliance?

Yes, airSlate SignNow includes features that aid in tax compliance, such as secure e-signatures and audit trails. These features ensure that all documents are signed and recorded properly, which is essential when navigating the Hawaii income tax rate regulations. Being compliant can protect your business from potential penalties.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing options tailored to meet diverse business needs. The costs vary depending on the features chosen and the size of your organization. By using airSlate SignNow, businesses can reduce costs associated with handling documents, which is beneficial when considering the Hawaii income tax rate.

-

Can airSlate SignNow integrate with accounting software for tax management?

Yes, airSlate SignNow can integrate seamlessly with popular accounting software, enhancing your tax management process. These integrations allow for efficient handling of documents necessary for calculating and filing under the Hawaii income tax rate. You can automate workflows between your e-signing needs and accounting tasks.

Get more for Rental Motor, Tour Vehicle, And Car Department Of Taxation

- Sc increase rent 497325670 form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant south carolina form

- South carolina tenant form

- South carolina tenant 497325673 form

- Temporary lease agreement to prospective buyer of residence prior to closing south carolina form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497325675 form

- Letter from landlord to tenant returning security deposit less deductions south carolina form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return south carolina form

Find out other Rental Motor, Tour Vehicle, And Car Department Of Taxation

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online