Instructions on Requirement to Mail or Retain This Form 2022

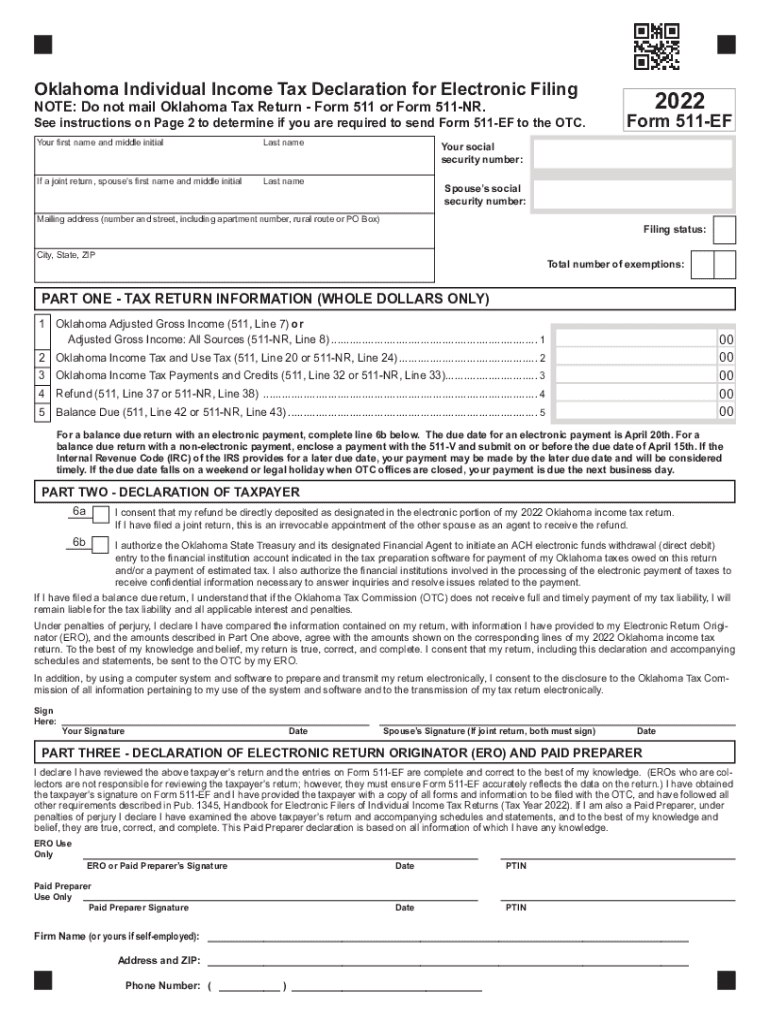

What is the oklahoma 511ef form?

The Oklahoma 511ef form is a crucial document used for individual income tax declarations in the state of Oklahoma. This form allows residents to report their income and calculate their tax obligations accurately. It is specifically designed for individuals who need to file their income taxes electronically, ensuring a streamlined process that aligns with modern filing requirements. Understanding the purpose and function of the 511ef form is essential for compliance with state tax laws.

Steps to complete the oklahoma 511ef form

Completing the Oklahoma 511ef form involves several straightforward steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring that you include any taxable income.

- Calculate your deductions and credits, which can help reduce your overall tax liability.

- Determine your total tax due or refund by following the instructions provided on the form.

- Review your entries for accuracy before submitting the form electronically.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for avoiding penalties and ensuring timely submission of the Oklahoma 511ef form. Typically, the deadline for filing individual income tax returns in Oklahoma aligns with the federal tax deadline, which is usually April fifteenth. However, if the deadline falls on a weekend or holiday, the due date may be adjusted. It is essential to verify any changes or extensions that may apply to your specific situation.

Form Submission Methods (Online / Mail / In-Person)

The Oklahoma 511ef form can be submitted through various methods, providing flexibility for taxpayers. The primary submission method is online, which allows for faster processing and confirmation of receipt. Alternatively, you can mail the completed form to the appropriate tax office. For those who prefer in-person submissions, visiting a local tax office is also an option. Each method has its own advantages, but online submission is often recommended for its efficiency.

Legal use of the oklahoma 511ef form

The Oklahoma 511ef form is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it is essential to provide accurate information and follow the guidelines set forth by the Oklahoma Tax Commission. The use of electronic signatures and secure submission methods further enhances the form's legal standing, making it a reliable option for fulfilling tax obligations.

Penalties for Non-Compliance

Failure to file the Oklahoma 511ef form on time or inaccuracies in reporting can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to understand the implications of non-compliance and to take proactive measures to ensure that the form is filed accurately and on time. Being informed about the potential consequences can help taxpayers avoid unnecessary complications.

Quick guide on how to complete instructions on requirement to mail or retain this form

Prepare Instructions On Requirement To Mail Or Retain This Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without unnecessary delays. Manage Instructions On Requirement To Mail Or Retain This Form on any platform with the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to alter and eSign Instructions On Requirement To Mail Or Retain This Form with ease

- Locate Instructions On Requirement To Mail Or Retain This Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for sharing the form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs within just a few clicks from a device of your choice. Alter and eSign Instructions On Requirement To Mail Or Retain This Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions on requirement to mail or retain this form

Create this form in 5 minutes!

How to create an eSignature for the instructions on requirement to mail or retain this form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Oklahoma 511ef?

Oklahoma 511ef is an electronic form of document management that simplifies the signing process. With airSlate SignNow, you can utilize Oklahoma 511ef to streamline your agreements efficiently. It’s designed to save time while ensuring legal compliance.

-

How does airSlate SignNow support Oklahoma 511ef?

airSlate SignNow fully supports Oklahoma 511ef by providing a seamless platform to electronically sign and manage documents. This integration ensures that your document workflows remain efficient and compliant with Oklahoma's legal standards. You’ll appreciate the simplicity and effectiveness of this feature.

-

What are the key features of airSlate SignNow related to Oklahoma 511ef?

The key features of airSlate SignNow concerning Oklahoma 511ef include customizable templates, automated workflows, and secure signature options. These tools help users ensure rapid document delivery and effective management, tailored specifically for the needs of Oklahoma businesses. Experience efficiency like never before!

-

Is there a cost associated with using Oklahoma 511ef on airSlate SignNow?

Yes, there is a cost associated with using Oklahoma 511ef features on airSlate SignNow, but we offer competitive pricing options. Our plans are designed to be budget-friendly while providing essential functionalities for document management. You can choose a plan that best suits your business needs.

-

What benefits do businesses gain from using Oklahoma 511ef with airSlate SignNow?

Using Oklahoma 511ef with airSlate SignNow provides businesses with increased efficiency, improved compliance, and enhanced security. This platform allows for quicker turnaround times on contracts and agreements, which can improve client relations. The overall effectiveness leads to greater productivity in document handling.

-

Can airSlate SignNow integrate with other tools while using Oklahoma 511ef?

Absolutely! airSlate SignNow allows for easy integration with popular CRM and document management systems while utilizing Oklahoma 511ef. This versatility ensures that you have a cohesive workflow and eliminates any disruptions in your business operations. Maximize your productivity with this integration!

-

Is the Oklahoma 511ef process legally binding with airSlate SignNow?

Yes, the Oklahoma 511ef process is legally binding when using airSlate SignNow, as it complies with all relevant eSignature laws. Our platform guarantees that all signed documents meet stringent legal requirements. Trust in airSlate SignNow for secure and enforceable electronic agreements.

Get more for Instructions On Requirement To Mail Or Retain This Form

- Letter tenant landlord rent 497311414 form

- Letter tenant about 497311415 form

- Mi tenant 497311416 form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase michigan form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant michigan form

- Notice rent increase 497311419 form

- Michigan letter services form

- Temporary lease agreement to prospective buyer of residence prior to closing michigan form

Find out other Instructions On Requirement To Mail Or Retain This Form

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple