Penalty Waiver Request 78 629 Iowa Department of Revenue 2022

What is the Penalty Waiver Request 78 629 Iowa Department Of Revenue

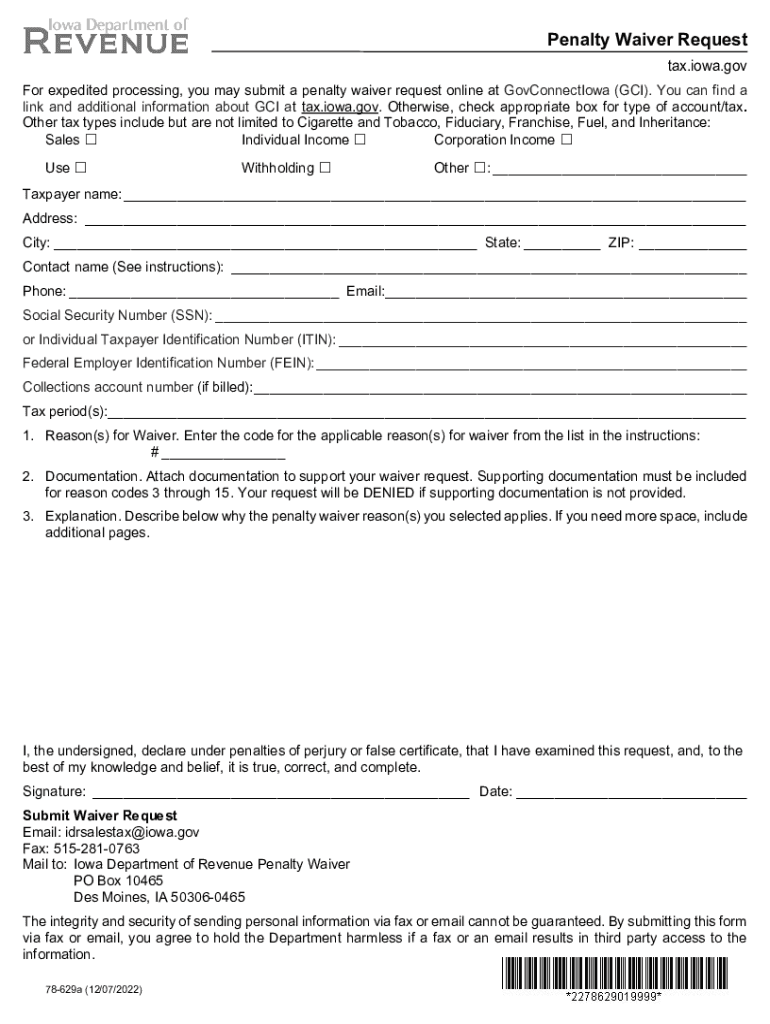

The Penalty Waiver Request 78 629 is a form issued by the Iowa Department of Revenue that allows taxpayers to request a waiver for penalties assessed on unpaid taxes. This form is particularly relevant for individuals and businesses who believe they have a valid reason for not meeting their tax obligations on time. The request must include specific details explaining the circumstances that led to the penalty, such as financial hardship or unforeseen events. Understanding the purpose of this form is essential for those looking to mitigate their tax liabilities in Iowa.

Steps to complete the Penalty Waiver Request 78 629 Iowa Department Of Revenue

Completing the Penalty Waiver Request 78 629 involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation that supports your request, such as proof of financial hardship or any relevant correspondence with the Iowa Department of Revenue. Next, fill out the form, ensuring that all sections are completed clearly and accurately. Be sure to provide a detailed explanation of the reasons for your penalty waiver request. After completing the form, review it for any errors before submitting it. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, as specified by the Iowa Department of Revenue.

Eligibility Criteria for the Penalty Waiver Request 78 629 Iowa Department Of Revenue

To qualify for a penalty waiver using the Iowa Form 78 629, taxpayers must meet specific eligibility criteria. Generally, the request is considered for those who have a valid reason for their failure to pay taxes on time, such as serious illness, natural disasters, or other extenuating circumstances. Additionally, taxpayers must demonstrate that they have taken steps to rectify their tax situation and have made efforts to comply with tax obligations in the future. It is crucial to provide supporting documentation that validates the claims made in the request to increase the chances of approval.

Legal use of the Penalty Waiver Request 78 629 Iowa Department Of Revenue

The legal use of the Penalty Waiver Request 78 629 is governed by Iowa tax laws and regulations. When submitted correctly, the form serves as a formal request to the Iowa Department of Revenue to reconsider penalties imposed on a taxpayer. It is important for taxpayers to understand that the submission of this form does not guarantee that penalties will be waived; rather, it initiates a review process. Compliance with all legal requirements is essential, including providing truthful information and supporting documents. Misrepresentation or failure to comply with the guidelines may result in denial of the request.

Form Submission Methods for the Penalty Waiver Request 78 629 Iowa Department Of Revenue

Taxpayers have several options for submitting the Penalty Waiver Request 78 629 to the Iowa Department of Revenue. The form can be submitted online through the department's official website, which offers a convenient and efficient way to process requests. Alternatively, taxpayers may choose to mail the completed form to the appropriate address provided by the department. In-person submissions are also an option for those who prefer direct interaction with department representatives. It is advisable to check the latest submission guidelines to ensure compliance with the department's requirements.

Key elements of the Penalty Waiver Request 78 629 Iowa Department Of Revenue

The Penalty Waiver Request 78 629 contains several key elements that must be addressed for the form to be processed effectively. These include the taxpayer's identification information, details of the penalties being contested, and a comprehensive explanation of the reasons for the waiver request. Additionally, it is important to include any supporting documentation that substantiates the claims made in the request. Clear and concise communication is vital, as this will help the Iowa Department of Revenue understand the taxpayer's situation and make an informed decision regarding the waiver.

Quick guide on how to complete penalty waiver request 78 629 iowa department of revenue

Effortlessly Prepare Penalty Waiver Request 78 629 Iowa Department Of Revenue on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Penalty Waiver Request 78 629 Iowa Department Of Revenue on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign Penalty Waiver Request 78 629 Iowa Department Of Revenue with Ease

- Obtain Penalty Waiver Request 78 629 Iowa Department Of Revenue and click on Get Form to begin.

- Take advantage of the tools at your disposal to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive details using the tools available specifically for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which requires only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign Penalty Waiver Request 78 629 Iowa Department Of Revenue while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct penalty waiver request 78 629 iowa department of revenue

Create this form in 5 minutes!

How to create an eSignature for the penalty waiver request 78 629 iowa department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Iowa Form 78 629A, and how can it be used?

The Iowa Form 78 629A is a document used for reporting specific tax-related information in the state of Iowa. Businesses can utilize this form to ensure compliance with state regulations. Using airSlate SignNow, you can easily complete, sign, and send the Iowa Form 78 629A securely and efficiently.

-

How does airSlate SignNow help with filling out the Iowa Form 78 629A?

airSlate SignNow simplifies the process of completing the Iowa Form 78 629A by providing an intuitive interface. Users can easily fill out the necessary fields, add signatures, and make edits as needed. Our platform ensures that the form is completed accurately and can be submitted electronically.

-

Is there a cost associated with using airSlate SignNow for the Iowa Form 78 629A?

Yes, airSlate SignNow offers various pricing plans to meet the needs of different users. Depending on your business requirements, you can choose a plan that provides features essential for handling the Iowa Form 78 629A and other important documents. We also offer a free trial to explore our services at no cost.

-

What features does airSlate SignNow provide for the Iowa Form 78 629A?

airSlate SignNow provides a comprehensive set of features for managing the Iowa Form 78 629A, including e-signatures, templates, and document sharing. Users can track the status of sent forms and receive notifications when they are signed. Our platform ensures a streamlined process from start to finish.

-

How can I integrate airSlate SignNow with my existing software for the Iowa Form 78 629A?

airSlate SignNow offers easy integrations with numerous software applications, allowing you to enhance your workflow with the Iowa Form 78 629A. Whether you use CRM systems, project management tools, or other software, our platform can seamlessly connect with them to streamline the signing process. Check our integration page for specific compatibility options.

-

What are the benefits of using airSlate SignNow for the Iowa Form 78 629A?

The key benefits of using airSlate SignNow for the Iowa Form 78 629A include increased efficiency, enhanced security, and convenience. By handling document signing electronically, businesses save time and reduce errors associated with manual processes. Additionally, our platform adheres to strict security standards to protect your sensitive information.

-

Can I send the Iowa Form 78 629A for signing to multiple recipients?

Yes, you can send the Iowa Form 78 629A to multiple recipients using airSlate SignNow’s bulk sending feature. This allows you to gather signatures efficiently from various stakeholders without the hassle of sending individual documents. You can also track who has signed and who is pending easily.

Get more for Penalty Waiver Request 78 629 Iowa Department Of Revenue

- South dakota lien form

- Quitclaim deed from individual to corporation south dakota form

- Warranty deed from individual to corporation south dakota form

- South dakota account form

- South dakota lien form

- Quitclaim deed from individual to llc south dakota form

- Warranty deed from individual to llc south dakota form

- South dakota lien 497326152 form

Find out other Penalty Waiver Request 78 629 Iowa Department Of Revenue

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document