Penalty Waiver Request Tax Iowa Gov for Expedited 2021

Understanding the Penalty Waiver Request for Iowa Form 78 629A

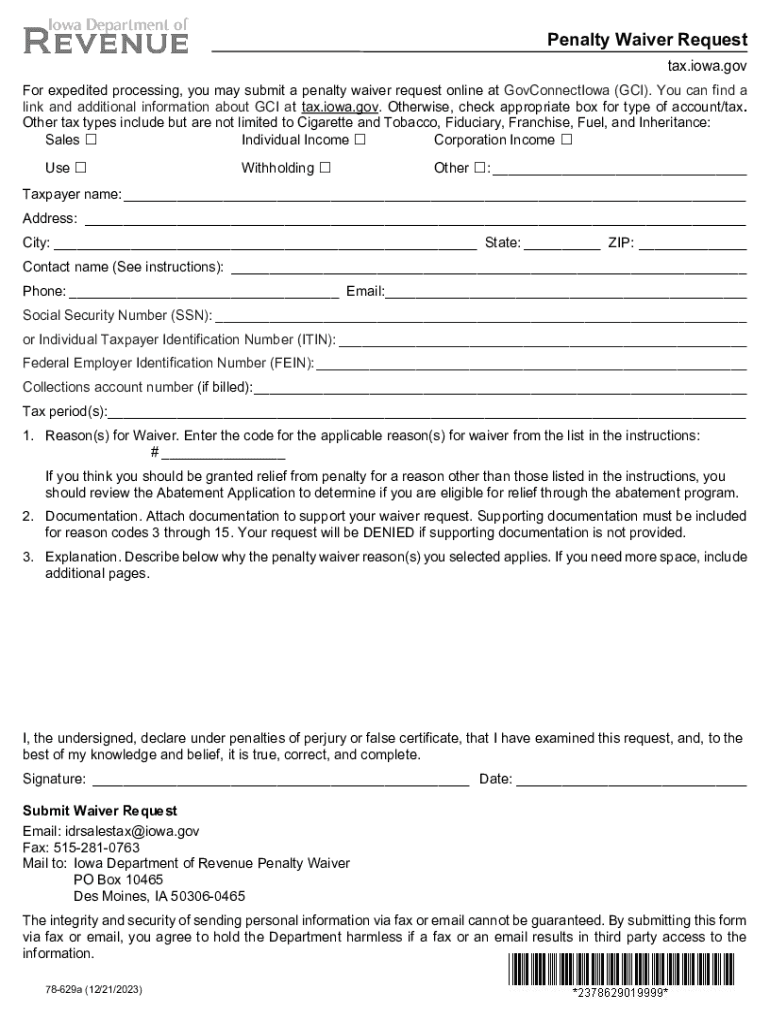

The Iowa Form 78 629A, known as the Penalty Waiver Request, is a crucial document for taxpayers seeking relief from penalties imposed by the Iowa Department of Revenue. This form allows individuals and businesses to formally request a waiver of penalties due to reasonable cause. Understanding the purpose and implications of this form can significantly impact your tax obligations and compliance.

Steps to Complete the Penalty Waiver Request for Iowa Form 78 629A

Completing the Iowa Form 78 629A involves several important steps:

- Gather necessary information: Collect all relevant details, including your tax identification number, the tax period in question, and the specific penalties you are contesting.

- Provide a detailed explanation: Clearly articulate the reasons for your request. This may include unforeseen circumstances, natural disasters, or other valid justifications that led to your inability to meet tax obligations.

- Review supporting documentation: Attach any documents that support your claim, such as medical records, correspondence from the IRS, or other relevant evidence.

- Submit the form: Ensure that you send the completed form to the appropriate address provided by the Iowa Department of Revenue, either electronically or via mail.

Eligibility Criteria for the Penalty Waiver Request

To qualify for a penalty waiver under Iowa Form 78 629A, taxpayers must meet certain eligibility criteria. These may include:

- Demonstrating reasonable cause for failing to comply with tax obligations.

- Providing evidence that the failure was not due to willful neglect.

- Ensuring that all tax returns and payments are current or filed.

Meeting these criteria is essential for a successful waiver request, as the Iowa Department of Revenue assesses each application based on the provided justification and evidence.

Required Documents for Submission

When submitting the Iowa Form 78 629A, it is important to include all required documents to support your request. Commonly needed documents may include:

- Copies of tax returns for the periods in question.

- Documentation of the circumstances leading to the penalty.

- Any correspondence with the Iowa Department of Revenue related to the penalties.

Providing thorough documentation can enhance the likelihood of approval for your penalty waiver request.

Form Submission Methods for Iowa Form 78 629A

Taxpayers have several options for submitting the Iowa Form 78 629A. These methods include:

- Online submission: Utilize the Iowa Department of Revenue's online portal for electronic filing.

- Mail: Send the completed form and supporting documents to the designated address for penalty waiver requests.

- In-person submission: Visit a local Iowa Department of Revenue office to deliver your request in person.

Choosing the appropriate submission method can streamline the process and ensure timely handling of your request.

Quick guide on how to complete penalty waiver request tax iowa gov for expedited

Effortlessly Prepare Penalty Waiver Request Tax iowa gov For Expedited on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an excellent environmentally friendly option to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Penalty Waiver Request Tax iowa gov For Expedited on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to Modify and eSign Penalty Waiver Request Tax iowa gov For Expedited with Ease

- Locate Penalty Waiver Request Tax iowa gov For Expedited and click Get Form to commence.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, time-consuming form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Penalty Waiver Request Tax iowa gov For Expedited and ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct penalty waiver request tax iowa gov for expedited

Create this form in 5 minutes!

How to create an eSignature for the penalty waiver request tax iowa gov for expedited

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Iowa Form 78 629A?

The Iowa Form 78 629A is a specific document used for certain legal and administrative purposes within the state of Iowa. Understanding its requirements and processes is essential for compliance. Using airSlate SignNow can streamline the completion and submission of the Iowa Form 78 629A, making it easier to manage.

-

How can airSlate SignNow help with filling out the Iowa Form 78 629A?

airSlate SignNow offers a user-friendly interface that simplifies the process of filling out the Iowa Form 78 629A. With our electronic signature capability, users can easily complete and sign the form digitally, ensuring accuracy and a faster turnaround time for submissions.

-

Is there a cost associated with using airSlate SignNow for Iowa Form 78 629A?

Yes, airSlate SignNow provides various subscription plans that can cater to your needs for managing documents like the Iowa Form 78 629A. Our pricing is competitive and offers great value for businesses looking to streamline their document workflows. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the Iowa Form 78 629A?

airSlate SignNow includes features such as document templates, electronic signatures, and real-time tracking for the Iowa Form 78 629A. These tools save time and ensure that your documents remain organized and accessible. Easy collaboration also means that team members can work on the form together efficiently.

-

Can I integrate airSlate SignNow with other tools while using the Iowa Form 78 629A?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage the Iowa Form 78 629A alongside other tools your business uses. Whether it's CRM systems or cloud storage platforms, our integrations provide a comprehensive solution for your document management needs.

-

What benefits can I expect from using airSlate SignNow for Iowa Form 78 629A?

Using airSlate SignNow for the Iowa Form 78 629A provides numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. Digital signatures enhance the security and validity of your documents. Additionally, our platform contributes to better compliance and organization for your business.

-

How secure is the information provided in the Iowa Form 78 629A using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you fill out and submit the Iowa Form 78 629A, your information is safeguarded with bank-level encryption and secure data storage. This ensures that sensitive information remains confidential and protected throughout the signing process.

Get more for Penalty Waiver Request Tax iowa gov For Expedited

Find out other Penalty Waiver Request Tax iowa gov For Expedited

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document